The Permian Basin

‘Our decision about energy will test the character of the American people and the ability of the President and the Congress to govern this Nation. This difficult effort will be the "moral equivalent of war," except that we will be uniting our efforts to build and not to destroy.’ - Jimmy Carter addressing the nation on the energy crisis on April 18, 1977

Understanding what goes into the final petroleum products consumed by the masses and their impact on the environment is no doubt a complex landscape filled with landmines. From the energy needed to bring molecules to surface, transport, refining process choice, carbon capture technologies in pipe, and the final delivery and combustion of those products all play a critical role in determining the best approach in mitigating those impacts during the multi-decade long energy transition. Hasty decisions based on politics over reality can lead to a crisis of epic proportions where a moral conundrum will be met with society looking to balance the haves and have nots. Yet many in the West as a collective ignore the simple fact that a large portion of the world lives in immensely deep poverty that can only be fixed by cheap and reliable energy sources.

Exploring the most economical sources should be at the forefront of concerns when attempting to raise billions out of poverty in the most cost effective way, but we can’t ignore the necessity to control the impact on the environment when utilizing these resources. Luckily, the United States has a source of energy in the Permian Basin that is lower emissions, economically viable, and relatively geopolitically secure as the U.S. becomes the largest oil and gas producer in the world.

Layers of Permian

The Permian is accepted as one of the most well known and and oldest oil and gas producing basins in the U.S. that stretches 86,000 square miles across 52 counties in New Mexico and Texas. Since 1920, the region has been drilled heavily across the sub basins of the Delaware, Midland and Central Platform where a unique pancake of 13 layers formed thanks to a perfectly aligned shift in plates dating back 325M years ago.

The main phase of the Delaware Basin differentiation occurred during Pennsylvanian and Wolfcampian time because of the rapid subsidence in the Delaware and Midland Basins and the uplift of the Central Basin Platform, as shown by sudden changes in thickness and lithology of Pennsylvanian to Permian strata.

https://www.eia.gov/maps/pdf/Permian-pI_Wolfcamp-Bonespring-Delaware.pdf

The Permian basin Royalty Trust(PBT) referenced in previous articles, is in Crane County where the operator is currently targeting multiple pay zones including the Wolfcamp. Much like the PBT operator on lease, many smaller independents are leading the growth of the Permian in recent years over the majors who have stressed return on capital to investors through buybacks and dividends over growth.

Since independent exploration companies don’t need to spend the extra energy of focusing on processing, refining or distribution, they have become more specialized in extraction and higher returns of much needed barrels to the world. As President Biden and the Department of Energy continue to call on the Permian to produce more oil and Gas for the world, the data shows that they are meeting those calls with higher production from these counties in the Delaware and Central Basins.

Crude Quality

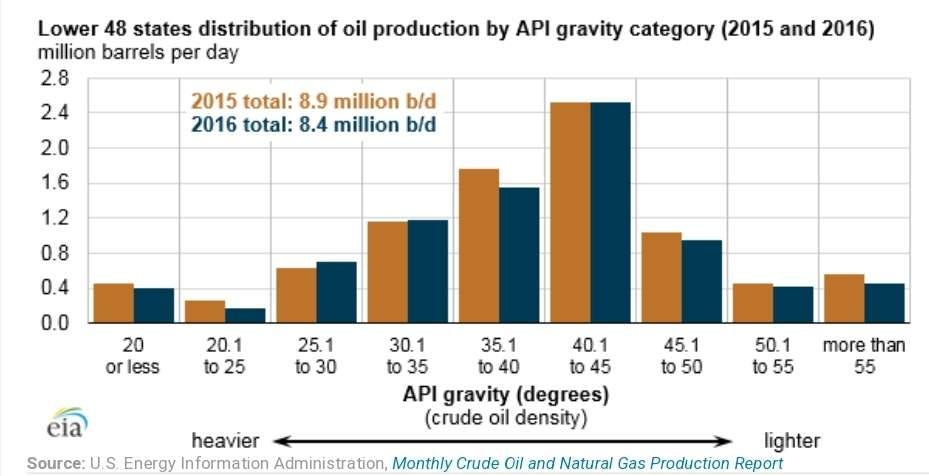

The quality of crude produced from a formation determines the final slate of refined products after processed through a refinery where an intermediate or true light barrel yields higher value middle distillates and less lower value naphtha and Liquefied Petroleum Gas(LPGs) than a condensate. According to the Energy Information Agency(EIA) the majority of the crude produced in the Lower 48 States have less dense oil with an API gravity of 40.1 or above.

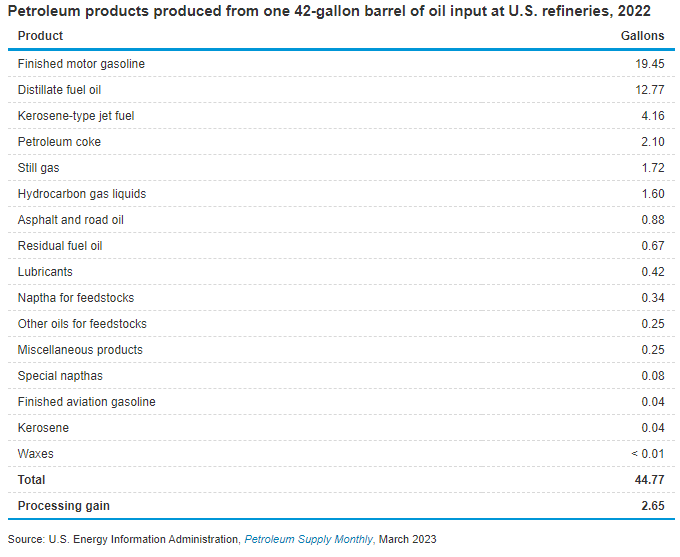

Crude oil refineries and blending facilities add other oils and liquids during processing to produce the finished products which are of a higher volume than the input volume of oil due to the products produced having a lower density. The average processing gain in volume at U.S. refineries was about 6.3% per barrel in 2022.

The total emissions in an average refinery by sources are the power station (29%), fluid catalytic cracking unit (19%), atmospheric distillation units (19%), and steam methane reformer for hydrogen production (11%). One key component in reducing the carbon footprint of these refineries is through Carbon Capture and Storage(CCS) which the oil and gas industry has deployed since the 1970s for enhanced oil recovery(EOR). A recent analysis by the International Energy Agency Greenhouse Gas R&D Program(IEAGHG, 2017) places the cost of CO2 avoidance using post-combustion CCS in refineries at US $166–185 per ton of CO2. CO2 avoidance is defined as the quantity of CO2 emissions avoided using abatement measures relative to a reference plant which uses a given mix of fuels and technologies.

70% of a refineries emissions are the result of fuel combustion according to the IEAGHG, 2017 report and fuel switching can be seen as another mitigation strategy. The corresponding CO2 abatement cost varies widely with the choice of replacement fuel, with estimates from Element Energy and Jacobs report in 2018 per metric tonne $30 for biomass, $110 for hydrogen, and $430 for electricity.

Operational costs are dominated by fuel costs. The relative fuel costs associated with biomass and waste, hydrogen and electricity compared to counterfactual fuels (i.e. gas or coal) depend on carbon prices as well as on the price of the fuels. Due to the significance of operational costs in industry, fuel and carbon prices will be a major driver of fuel switching technology choices. However, the fuel price at which fuel-switching technologies would become commercially viable also depends on the future cost premiums for these technologies, which are by no means certain (especially for those technologies which have yet to be implemented at scale).

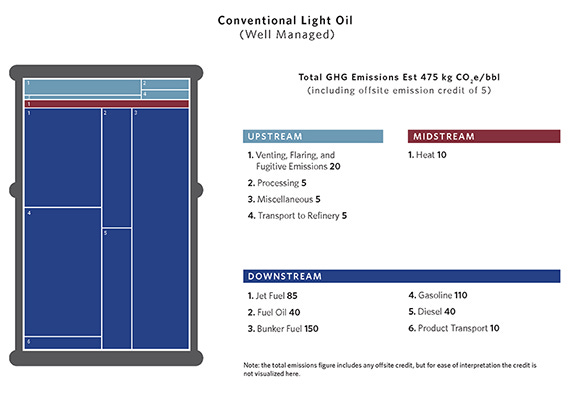

The steam methane reformer uses natural gas both as a feedstock and a fuel which produces two separate CO2 point sources adding to emissions. A well-managed conventional lighter oil such as that found in the Permian is overall much less emissions intensive than the other oils.

The first barrel offers a proportioned emissions breakdown of the supply chain for a well-managed, conventional light oil that produces relatively little GHG emissions upstream and midstream; most of its emissions arise from the combustion of products like gasoline and bunker fuel. As such, greater vehicle efficiency and clean fuel substitution are generally the most effective ways to reduce the negative climate impact of this type of oil.

Carbon Footprint

A barrel of light sweet oil, such as tight shale oil found in the Permian, contains less carbon than a barrel of heavy oil such as bitumen oil sands from Canadian producers. The extra heavier oils have a higher impact on the environment due to a higher carbon residue while lighter crudes carry the advantage of containing a mixture of various lighter hydrocarbons such as natural gas that can be used in the refining process as feedstock. OXY has a strong initiative in the Permian Basin to capture carbon directly from the air but have also implemented many technologies such as Closed-Loop Gas Capture to essentially eliminate unnecessary flaring of natural gases and utilize the excess hydrocarbons back into the pipeline.

Utilizing the lower carbon footprint of the Permian Basin hydrocarbons extracted while expanding on production could reduce a large portion of the industries impacts on the climate while compounding the results with higher level over government oversight by the Environmental Protection Agency(EPA) versus competing countries.

A new concept from Nacero is also being built in the Permian near Penwell, TX that will be fed light products with the same low carbon footprint producing 1 billion gallons of Sustainable Aviation Fuels(SAF) and Low Carbon Aviation Fuels(LCAF) using the same captured natural gas feedstock. The project is also slated to utilize 100% renewable energy for its operations where energy input is an often overlooked metric when calculating the impact a project has on the environment.

Emerging Markets

Economic development will always remain king when put against any obstacle including the goals set forth to combat climate change. Imagine the priorities of a person in such extreme poverty that their daily budget is less than $10 per day. That's the reality of nearly half the world's population of 7.88 billion where 47% of the world lives on less than $6.85 per day. As a reference in the United States a person is counted as being in poverty if they live on less than roughly $24.55 per day. According to the World Bank Poverty and Inequality Platform India has 136.81M people living in extreme poverty on $2.15 per day.

Though down from its peak in 2004 of 450.83M, India has a long way to go before it can meet the needs of its poorest population. India is in a similar situation to China in the 1990’s where a move from farm to city by the population is creating opportunity for people to bring themselves out of the extreme poverty threshold and prosper through working in the cities and having access to healthcare, utilities, and jobs. Instead of exerting all ones energy on the farm of work-to-eat the government is attempting to provide access for people to work-to-live and one of the key points to this effort is energy security.

China and India currently purchase two thirds of the crude seaborn from Russia and at a heavy discount thanks to the price caps implemented by Western countries for Russian oil in response to the conflict with Ukraine. "Unless we survive the present, we will not be able to go into the world of clean and green energy," Oil Minister Hardeep Singh Puri said at India Energy Week. "While affordable traditional energy resources are essential for meeting the base load requirements, new sources of energy which are cleaner, sustainable, and innovative, are critical for combating the menace of climate change." If India plans to mimic the move China made for its people to add industry jobs for manufacturing where China and India now have almost identical population size, it will need a lot of crude, coal, and LNG.

Hiring Spree

Regardless of the potential of the Permian Basin, cities centered at the forefront of this region such as Odessa and Midland are already struggling to find qualified employees to chase the growth of the area.

“Our economic report shows by 2040 we’re going to need about 115,000 more workers in the Permian in order to keep producing the energy that the world, the country and our region needs,” said Tracee Bentley, chief executive officer of the Permian Strategic Partnership, an organization of local energy companies formed in 2019 to improve the region’s roads, schools, health care, housing and workforce training. “We’re all struggling with that aspect: trying to attract, retain families.”

The U.S. was the major supplier during World War II for itself and Western allies but in just a few decades after the war, the U.S. was beginning to shed its dominance as the world's leader. Oil supply peaked in 1970 and did not return to those levels until nearly 50 years later. The surplus of oil shifted against rising demand and saw a fall in supply as low investment began to take hold, a similar situation seen nearly a century later in today's U.S. shale fields. By March 1971 the Texas Railroad Commission(RRC) for the first time in 25 years allowed all production at 100% capacity and still fell short to meeting world demand needs. 'We feel this to be a historic occasion' declared the chairman of the RRC. 'Damned historic, and a sad one. Texas oil fields have been like a reliable old warrior that could rise to the task when needed. That old warrior can’t rise anymore.' In turn the U.S. looked to the global oil supply to meet its energy needs that fueled many decades of prosperous growth and luxury.

As the term ‘energy crisis’ found its way into the country’s vocabulary and to the top of the political agenda, the wisdom of oil import quotas came into question. Although the IOCC argued strenuously against the creation of a import tariff , just such a system replaced quotas in 1973.

Recently Dr. Ray Perryman, President and CEO of the Perryman Group, spoke to the needs of the local community during a school bond committee meeting in Odessa, TX about the importance of the areas workforce and the need to educate students in the area. Many important metrics were mention by Dr. Perryman such as:

World poverty levels of emerging markets

Growth of Texas through a younger population that tends to have more kids

How each dollar spent on education is a return on the investment by state

Oil demand forecasts based on DOE estimates though 2050

The shortfall in workers in the Permian to meet the industry growth demand

‘If you torture the data enough, nature will always confess.’ - Ronald Coase, "How should economists choose?" Warren Nutter Lecture, 1981.

Dr. Perryman’s address to the committee had plenty of data but more heart behind the sentiment towards the needs of the population of Ector County. Possibly lead by his wife Lorraine Perryman, first female and youngest mayor of Odessa in 1990, from which she has since donated much of her personal time to the city’s education efforts and has served on past school bond committees. While Dr. Perryman dropped data, he regurgitated to the DOE for years, he used no charts or notes while skillfully implanting quips and light hearted jokes keeping the audience entertained. Yet ultimately the take away from many members listening in on this final meeting for the ECISD 2023 Bond Committee is while the average state in the U.S. gets a return of $56.76 for every dollar invested in education, Texas receives nearly double that return at $108.29 and yet the Permian Basin will be massively short their workforce to meet global energy demands. All this under the assumptions put forth by the DOE that renewable energy will increase supply by 350% and oil demand in lock-step at an increase of 30%, leading to natures confession that we are and will be in an energy crisis lead by supply and demand. Once again the phrase ‘energy crisis’ will be reintroduced to everyone’s vocabulary replacing the phrase ‘climate change’ as energy policy by politicians to transition too quickly reverses while the most vulnerable population was ignored.