On the heels of a flash crash in crude prices that sent a commodity with physical volume demand of more than 100 million barrels per day(BPD) down 6.69%(roughly -20% from a week prior) the President of the United States(POTUS) is back to throwing blame at the oil and gas industry for their ‘huge profits and failed to invest those back into production.’ A quick phone call to the Secretary of the Department of Energy to pull some data on what U.S. production actually looks like for the trailing 12 months would of resulted in a contradiction of this statement where US Oil production for the month of February at 12.48M BPD up from 11.316M BPD a year prior and nearly inline with all time high productions of 13M BPD achieved in 2019.

What did it take to add these barrels? According to Baker Hughes which tracks the rig count and frac spread internationally to gauge the productivity and new drilling activity has shown a steady increase in the rig count. Current March 2023 level is inline with the rate of rigs in operation pre COVID.

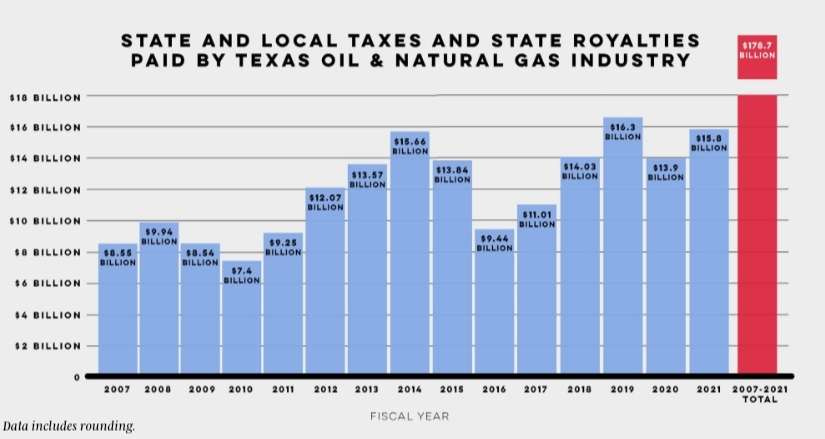

The federal and State government has benefited for many years from the revenues generated by Oil and Gas companies operating in the United States. The U.S. currently taxes petroleum production through income tax and an ad valorem royalty of 18.5 percent for oil pumped on federal lands but effective income tax is lower for the industry for both corporate and pass-through oil producers. Revenue from Oil and Natural Gas on Federal lands hit its highest in history in 2019 at $4.202B ‘composed of royalties, $2.931 billion; bonuses, $1.181 billion; other revenue(including settlement agreements, interest payments, Application for Permit to Drill fees), $67 million; and rents, $22 million. Disbursements of these revenues include $2.002 billion to states; $1.539billion to the Reclamation Fund; $39 million to the Permit Processing Improvement Fund; $172 million to other accounts; and $444 million to the Treasury General Fund.’ according to a report on September, 2020 by Congressional Research Services.

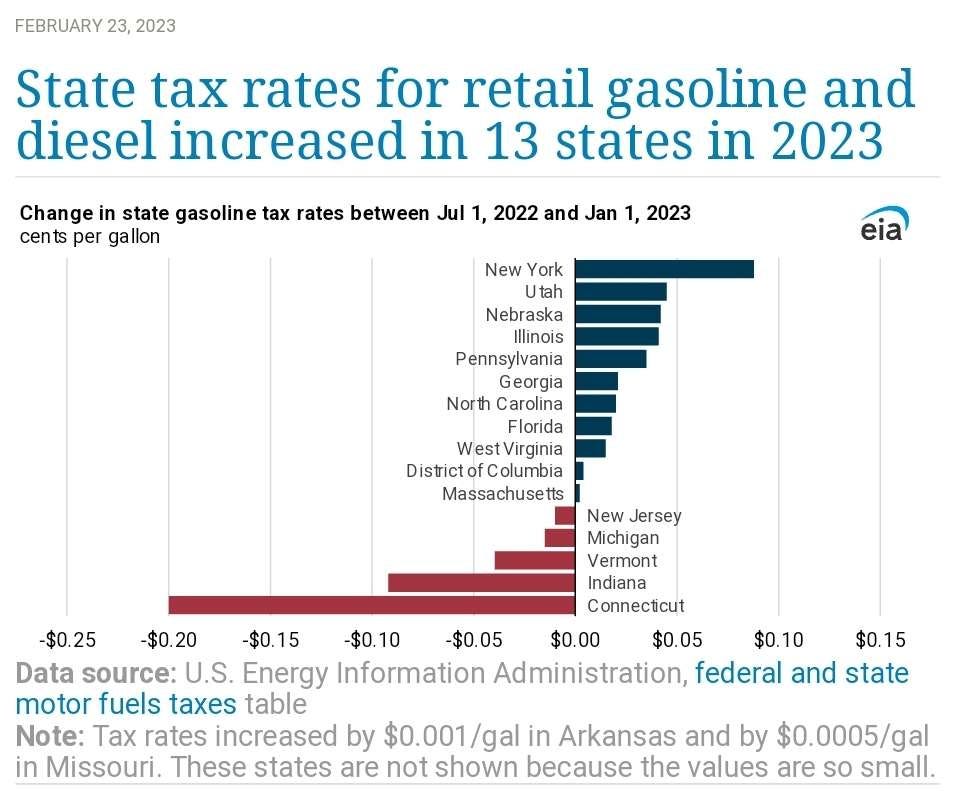

State tax at the pump also plays a critical role in the final price of products consumed by families. According to a report by the EIA in February 2023 the tax rate for retail gasoline and diesel increased in 13 states. Less than a year ago President Biden called for a three-month Federal Gas Tax Holiday:

Right now, the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel. Those taxes fund critical highways and public transportation, through the Highway Trust Fund. But in this unique moment, with gas prices near $5 a gallon on average across the country, President Biden is calling on Congress to suspend the gas tax for three months – until the end of September – to give Americans a little extra breathing room as they deal with the effects of Putin’s war in Ukraine.

In the statement Biden is said to have called on State and Local governments to also assist in bringing down prices at the pump to consumers for a bit of relief in a very heavy inflationary landscape.

In addition to federal gas tax relief, the President is calling on state and local governments to provide additional consumer relief. Already, some states and local governments have acted: for example, in Connecticut and New York, governors temporarily suspended their gas taxes, and in Illinois and Colorado, governors delayed planned tax and fee increases. And, around the country, in states like Michigan and Minnesota, states and local leaders are considering a number of forms of consumer relief – from temporary suspensions and pauses on state sales tax on gas to consumer rebates and relief payments. The President believes more states and local governments should do so.

In a recent Bloomberg article the towns of Odessa and Midland were featured as an example of how poor living conditions arise despite recent high tax profits for the region. The residents of these towns that rely so heavily on the Oil and Gas industry constantly live in a fear that another bust is on the horizon and a considerable amount of effort is spent by groups of fiscally conservative members of the community to suppress any current or future spending on local needs. A conflict of interest in respect to the fact that these communities need a well trained workforce as they contribute the most to the extreme and ever growing energy demands of the world.

“Our economic report shows by 2040 we’re going to need about 115,000 more workers in the Permian in order to keep producing the energy that the world, the country and our region needs,” said Tracee Bentley, chief executive officer of the Permian Strategic Partnership, an organization of local energy companies formed in 2019 to improve the region’s roads, schools, health care, housing and workforce training. “We’re all struggling with that aspect: trying to attract, retain families.”

The Permian is growing and will continue to do so regardless of short-term hurdles of stagflation and material costs. This may not always fit into the current agenda of climate but it does fit perfectly in the needs of human prosperity as the world starts the long multi-decade journey of energy transition. In order to meet demand of these fuels requires a workforce that under current circumstances looks to fall short by 2030 as access to quality education and rhetoric by political figures detracts interested parties that plays a key role in feeding the industry. There are positive initiatives such as Odessa working towards a potential new Career Technical Education (CTE) building, partially funded by Permian Strategic Partnership, in an upcoming bond proposal but selling the community on these needs while POTUS and the Department of Energy(DOE) continue to put an expiration date on the industry becomes a difficult sell for the local school district at vote time.

According to recently released data from the Texas Oil & Gas Association (TXOGA), the Texas oil and natural gas industry paid $15.8 billion in state and local taxes and state royalties in fiscal year 2021 or $43M per day. Production taxes in 2021 exceeded $5B for only the third time in history while supporting education, transportation, healthcare and infrastructure, both locally in communities across Texas. More than $979M when to the Texas Permanent University Fund(27% increase from 2020) and +$1.1 billion towards the Texas Permanent School Fund(17% increase from 2020) while additional funds from property taxes on mineral properties producing oil and natural gas, pipelines and gas utilities contributed another $1.84B. Specifically Independent school districts in the Permian basin received $887.7M in oil and gas property taxes in 2021.

In testament to the industry after a multi year long campaign of hatred and dismissal towards their future, it shows guts to continue to invest billions towards what some experts feel will be obsolete in a decade. That is how feelings work, they are driven by emotion instead of data and typically the end conclusion is a false narrative that has to be backed up and in this day that usually entails angry tweets poised as coming from POTUS himself. It’s hard to fathom how a political war of conjecture can be repeatedly spewed while ignoring so many important data points that drive our next generation and local economies.

There is a dictum that "generals always fight the last war", preparation from learned experience opposed to forward looking resolutions. Politics is no different where looking into the past to direct policy of the future leads to a misunderstanding and gauging of the current problems. Technology, life-span, population growth have hit levels unfathomable pre 1950s and that translates from the battlefield to the dinner table. A generation of generalists that can't see the forest through trees when analyzing the gaps between the society they live in and the world as a whole. Using energy as a weapon is nothing new from harnessing the power of an atom to cutting off the supply of essential fuel supply lines but recent developments are met with exuberance and disregard for the long-term ramifications. Disruption was a term that raised eyebrows from venture capitalists for decades but that term attached to energy markets have a different connotation and the world is seeing it play out in real time as long standing agreements dissolve and the disruption of energy flows is forever changed. But it’s a wild thought to wage war on oneself and disrupt the future of whole local economies that in essence feel shunned for wanting to keep a workable economy in their hometowns while providing energy density that literally fuels the world just feels plain evil.

In a past article titled, Chasing Growth, the Energy Crisis Substack covered the overhang of bankruptcies that plague the oil patch and add to the reasoning of hesitancy to invest in the future of the communities.

Bankruptcies piling up on the US Shale players grew to extreme heights of nearly 300 companies from 2016 on as shown by Haynes Boone who track these events. Between 2007-2018 roughly $700B was lost on chasing high growth wells in the US which led to a decade long abundance of cheap energy for the world. A mistake repeated over these short cycles that has finally come to a head where investors are demanding a return on capital instead of subsidizing the world. Emerging markets with high population continue to look towards energy as a way to bring their economic structure to the forefront of modern society and in the growth of these nations leads to more growth for all energy, but at what cost? J.P. Morgan estimated that a need of $600B more than previous decade just to maintain supply vs demand.

The psychology behind the oil and gas industry is undoubtedly complex where you would be hard bent to find a single natural occurring material on planet earth that's hated more universally than oil. POTUS may need a bogeyman to push blame onto as campaigning begins, but this continued effort to wage war leaves the industry and local communities in fear of what is next. An investment is always seen as an initial contribution that returns a better result, whether that be through monetary means or other forms of social prosperity, it’s always in the respect of trying to better the environment around us. Those investments cannot continue to be seen as a zero sum game where winners and losers are picked and chose based on the regions they live in. Much like war waged across the globe, many of us cannot help where we live and we certainly did not choose where we were born. Yet children across Texas are being conditioned to hate the very molecules that provide security, income, and even an education to them daily.

Very astute observations about the rather insane and counter-productive "soak the rich oil industry" mantra of the current U.S. administration. I dont like it and I think Biden is an ineefective "leader" whose policies on a wide range of issues I object to. Plus, look at the news reports about Comey asking about the whistleblower claims when Biden was VP. The only positive is that if oil is driven down and it stays "lower for longer" it will only create supply problems in the future.