Occidental(OXY) broke ground on their carbon capture plant last week in West Texas which is the first of five planned projects. This substack in the past covered, with scrutiny, the planned build with some details related to the lack of investment in the local community through Texas 313 tax abatements which allow OXY to essentially avoid a decade of property taxes on the facility that would go towards the local school district and hospitals. Unlike the solar and wind projects, this plant does not lose more than 50% of its property value after the ten year abatement expires and such a large plant does contribute to the interest and sinking (I&S) tax rate which provides funds for payments on the debt that finances a district's facilities. This could potentially be a net positive for the community after 10 years if the projects work out and aren’t abandoned. However, this may carry a big ‘if’ when looking at a similar project that carried a $1 billion construction cost but was recently abandoned by NRG Energy Inc where they sold their fifty percent stake for only $3.6 million.

If all six builds were to be constructed, OXY would be capable of capturing and permanently sequestering approximately 26 million tonnes per annum (Mtpa) of atmospheric CO2 where 35 billion tonnes of CO2 is emitted per year by humanity. The plant would be able to capture 0.00074% of yearly CO2 subsidized by tax dollars. The benefits written into US law seem endless for Oxy’s bottom line where the per-metric ton 45Q tax credit is substantially increased, now up to $85 for sequestered CO2 and $60 for CO2 that is reused. Oxy will essentially be awarded $60 per metric ton of carbon captured and reused even for enhanced oil recovery(EOR) to produce more oil and gas. Currently, OXY has a worldwide year-end proved reserves of 3.8 billion Barrel of Equivalent(BOE), with reserves replacement of 172% and finding and development costs of $6.60 per BOE. ‘Proved reserve additions were mainly driven by positive revisions associated to infill development projects of 335 million BOE, primarily in the Permian and DJ Basins, and extensions and discoveries of 176 million BOE, mostly in the Delaware Basin, along with improved recovery of 89 million BOE, mostly in the Permian EOR business.’ according to 2022 forth quarter earnings report by OXY.

'What Percent Of Our Atmosphere Is CO2?' was a question posed to a panel of House Transportation Committee on Infrastructure Investment and Jobs Act by Doug LaMalfa. ‘5%, 7%, 8%… I will take the high end’ where the answers by the panel but in reality the correct answer is 0.04%, essentially putting these guesses off by 17,400% from the actual amount. According to NASA, methane only makes up 0.00017% (1.7 parts per million by volume) of the the atmosphere, but methane traps a significant amount of heat, helping the planet remain warm and habitable. Methane currently accounts for around one-fifth of man-made global greenhouse gas emissions. Methane has a shorter lifetime bonding to the atmosphere versus carbon dioxide (CO2), but a greater near-term warming effect. In fact, methane has more than 80 times the warming power of CO2 over the first 20 years after it reaches the atmosphere. Taking the 80x power into account CO2 ( 0.04%) compared to Methane(0.00017%) brings the later to 0.013%.

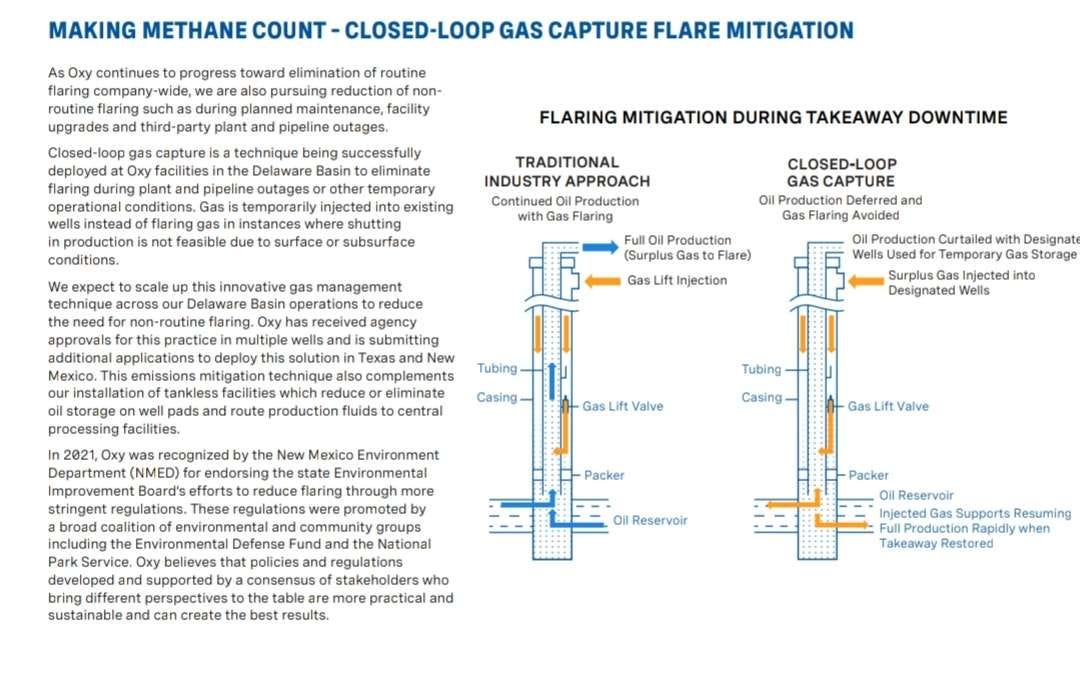

OXY has developed many technologies to position their ongoing effort towards a clean net zero corporation such as Closed-Loop Gas Capture. Keeping gas in pipeline based on facts presented above about Methane makes it seem like an easy choice and could dramatically reduce the rate of global warming short term but the allocation of capital by majors like OXY may lag when government subsidies do little to focus on those projects since CO2 ‘captures’ all current media buzz.

Oxy’s 2022 capital plan includes $200 to $400 million for our net-zero initiatives to develop and commercialize new technologies and lowcarbon business models. As construction of our DAC plant started in September, we anticipate spending in 2022 will be toward the lower end of this range. This plan includes approximately $80 million in emissions reduction projects at existing oil and gas, chemical and other midstream operations in 2022, such as retrofitting facilities to reduce CO2, methane and other air emissions.

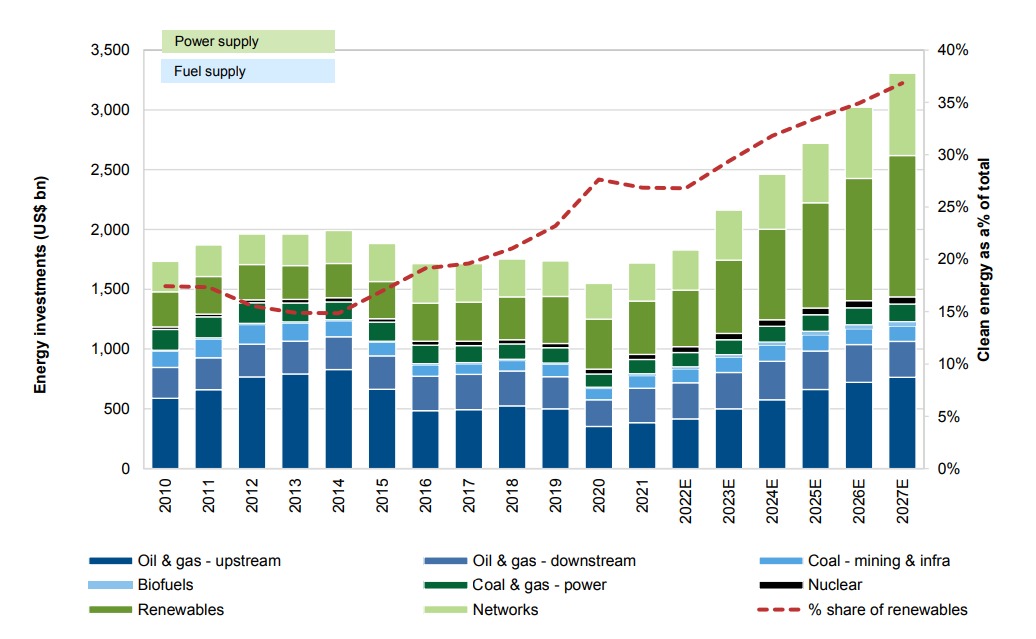

According to Goldman Sachs Carbonomics Affordability, Security and Innovation report, ‘The higher cost of capital for high carbon vs. low carbon investments is driving under-investment in energy, transport and heavy industries. More regulatory clarity could close this $0.5 Trillion pa missed investment opportunity and spur a $1 Trillion increase in annual energy spend by 2026 to provide reliable, affordable and cleaner energy supply, in line with the UN Sustainable Development Goals.’ The irony of using the made up word ‘Carbonomics’ is not lost on this writer as the report goes on to highlight the economics through the statement ‘the biggest policy breakthrough this year – the US Inflation Reduction Act – is transformational for the economics of hydrogen and carbon capture’. It most likely will take a decade to see the true effectiveness of these carbon capture projects and whether giving up near term benefits to communities much in need through tax abatements was the right choice.

We update our annual cost curve of de-carbonization (Carbonomics cost curve) for the fourth consecutive year... Carbonomics cost curve of de-carbonization for anthropogenic GHG emissions (GtCO2eq)

Hydrogen, carbon capture, energy efficiency and storage are the key technologies that have benefited from the strongest regulatory momentum Year to Date US IRA tax credits and incentives increase in coverage (vs prior legislation) of the total average cost by technology (%)

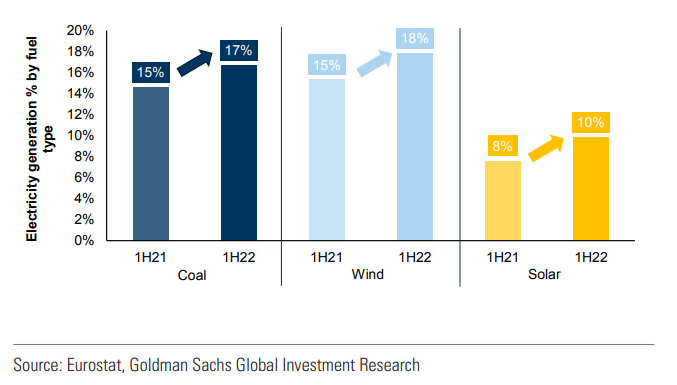

OXY alone expects its Permian production this year will average 560K-590K BOE/day and OXY expects U.S. oil production to grow by only 500k bbl/day this year which is well below the EIA and Whitehouse predictions a year ago. It can be argued that OXY is admitting they are partially the cause of CO2 in the atmosphere while also benefiting financially from the removal. While the demand for oil and gas continues another source of energy that carries double the emittance of CO2 has gained a new demand curve where coal markets have grown 1.2% past the all time high surpassing 8 billion tonnes for the first time.

This is leading to a dis-jointed energy transition, with both the most emitting (coal) and least emitting (renewables) fuels on a growth trajectory ytd Electricity generation % by fuel type, 1H22 vs 1H21, Europe

Total energy investments have fallen by >20% over the past decade, and we expect them to almost double by 2027E, reaching $3.3 Trillion (from $1.7 Trillion in 2021) Global energy investments (US$ Billion), split between power and fuel supply.

Ultimately a mixture of technologies will be needed to combat climate change and to reduce the overall impact that a growing population of the world has on Earth. Some oversight is essential in any capitalistic economy but running with blinders can create focus on only certain parts of the problem and lead to a path of partial answers. While OXY seems to have an approach that benefits the climate, it shouldn’t be lost on anyone that the subsidies provided to these corporations are the main driver behind investment and in many cases at the expense of local economies such as Ector County where OXY is currently erecting its carbon capture plant. As a proud resident in West Ector for the past 4 decades, a portion of the county that gets little love from the local government through developments in schools, hospitals, and zoning of new business and real-estate; having additional local hand outs to a corporation while resources are stripped from the ground and abandoned is hard to swallow. OXY is a giver and a taker of Ector County in many ways and it can be argued that they give back more than they take to the community but a lack of balance from region-to-region is the issue.

Any thoughts on NET Power (going public via RONI SPAC), gas-powered electricity technology with carbon capture? Oxy already owns a substantial stake in the private company and just announced that they are increasing their investment commitment in the SPAC to $350 million. The first commercial plant isn't due for completion until 2026, but it would appear that Oxy views this technology as an important part of their decarbonization plan.

https://netpower.com/net-power-and-rice-acquisition-corp-ii-announce-upsized-pipe-commitments-from-occidental-and-rice-family/