An update on Royalty Trusts monitored by Energy Crisis last published on Oct 1, 2023. Royalty Trusts are a quality strategy to hedge against inflation and energy prices; with recent news about the Biden administration, in an effort to reduce gasoline prices this summer, is releasing approximately one million barrels of reserve gasoline supplies. The Gulf of Mexico accounts for nearly 15% of all U.S. production and the NOAA National Weather Service forecasters at the Climate Prediction Center predict above-normal hurricane activity in the Atlantic basin this year making it worth looking at these Royalty Trusts to qualify their value with a potential for higher oil prices for longer as the Strategic Petroleum Reserve cannot be leveraged to put heavy downward pressure on oil prices.

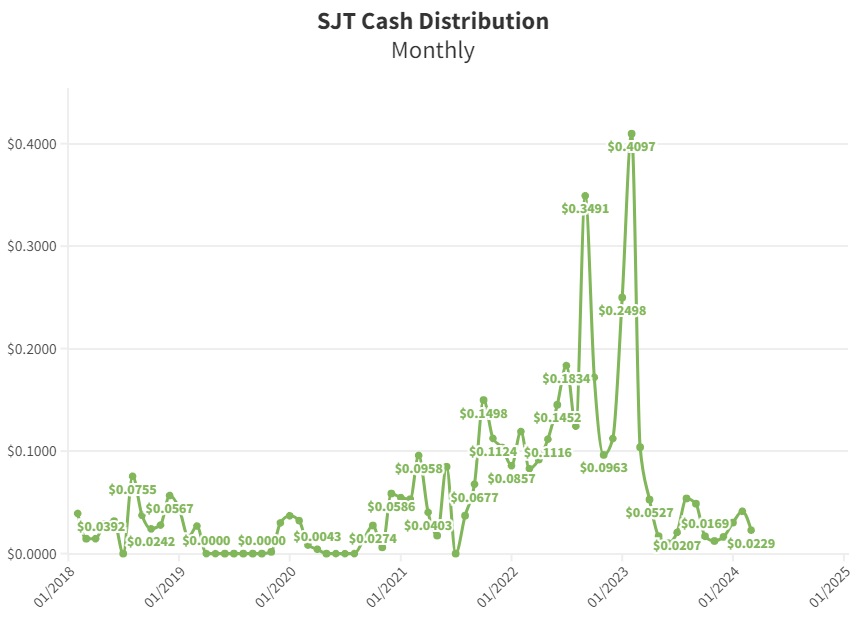

San Juan Basin Royalty Trust(SJT)

The principal asset of the San Juan Basin Royalty Trust consists of a 75% net overriding royalty interest that burdens certain oil and gas interests in properties located in the San Juan Basin of northwestern New Mexico

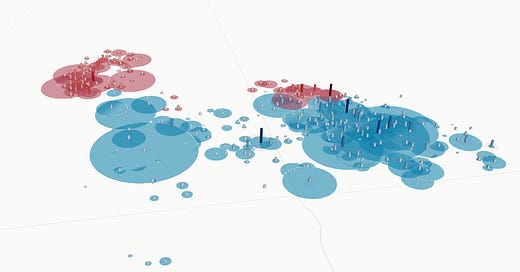

SJT equity price performance plotted against oil and gas prices and the strength in the dollar:

SJT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

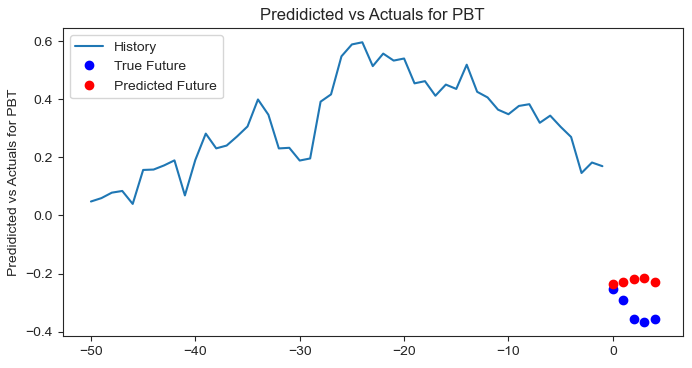

Permian Basin Royalty Trust(PBT)

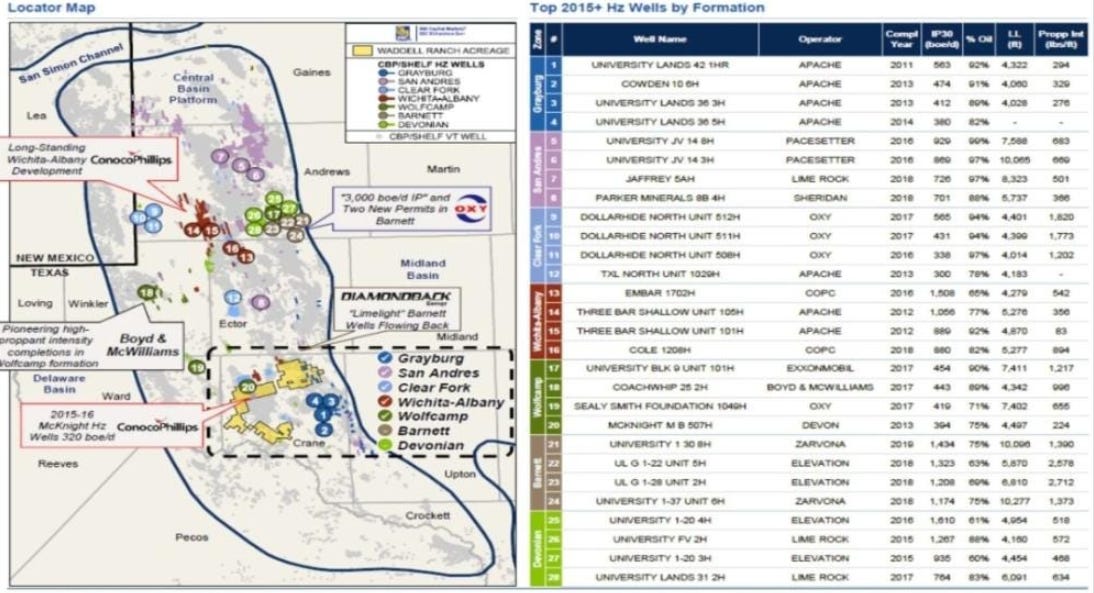

Permian Basin Royalty Trust’s principal assets are comprised of a 75% net overriding royalty interest carved out by Southland Royalty Company from its fee mineral interest in the Waddell Ranch properties in Crane County, Texas and a 95% net overriding royalty interest carved out by Southland from its major producing royalty properties in Texas.

PBT equity price performance plotted against oil and gas prices and the strength in the dollar:

PBT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Oil to Gas ratio for the new production on PBT is charted below to help represent gas increase on reworking of wells and unconventional additions through recent horizontals wells.

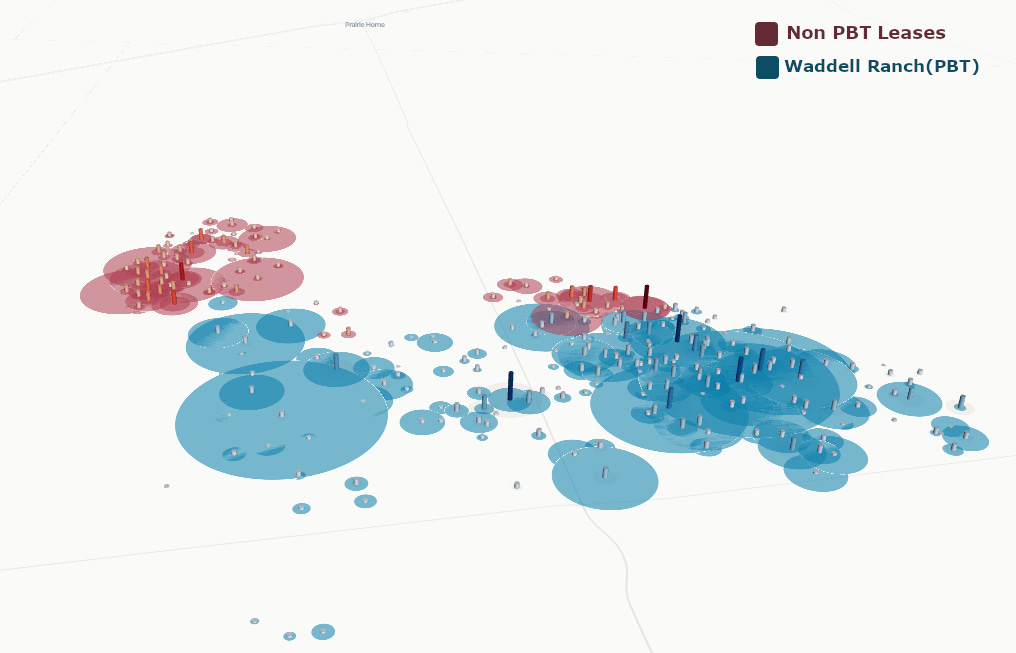

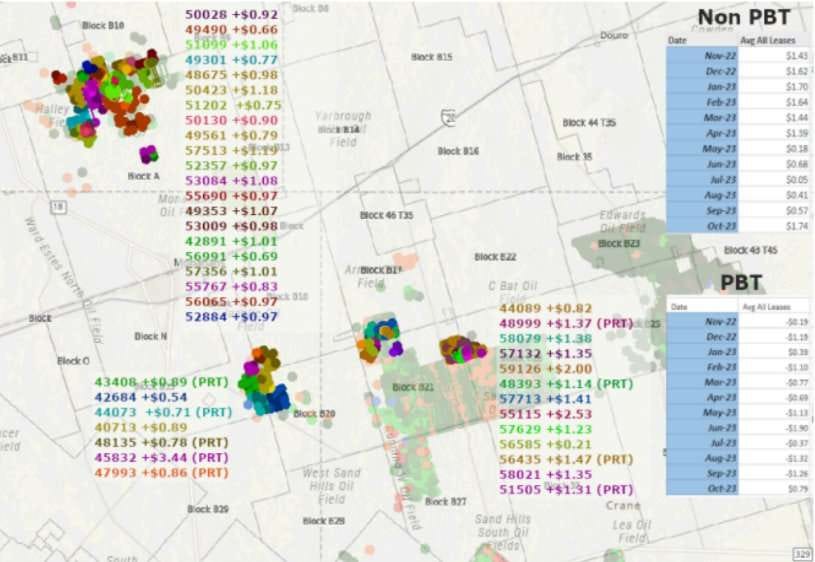

Map of 24 hour tests in Crane County of Operator Blackbeard:

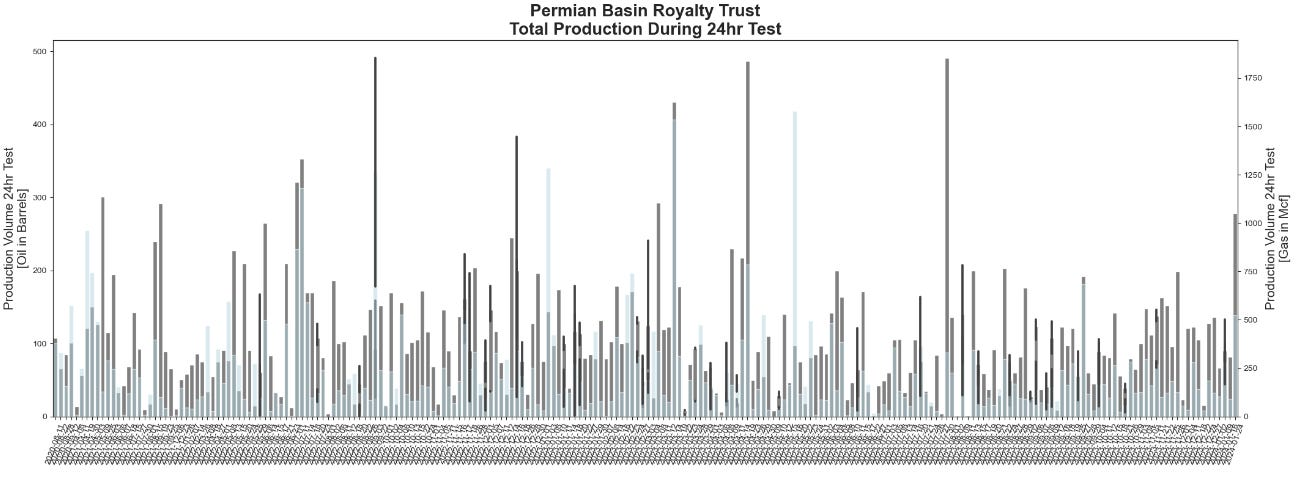

PBT 24hr test completion data:

PBT 24hr test completion data(Blackbeard Crane County):

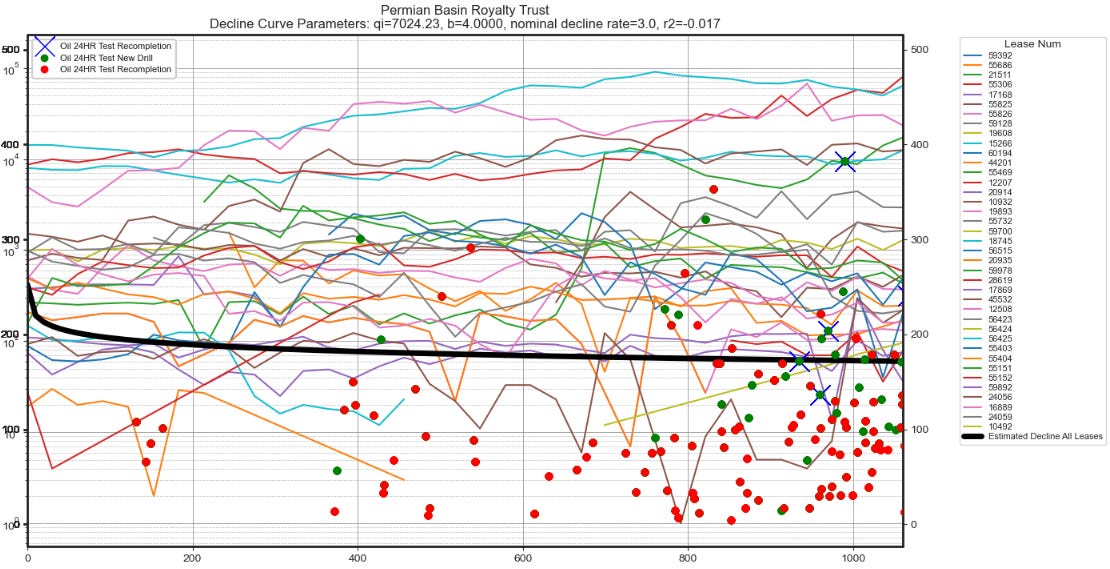

PBT lease declines and drilling historical:

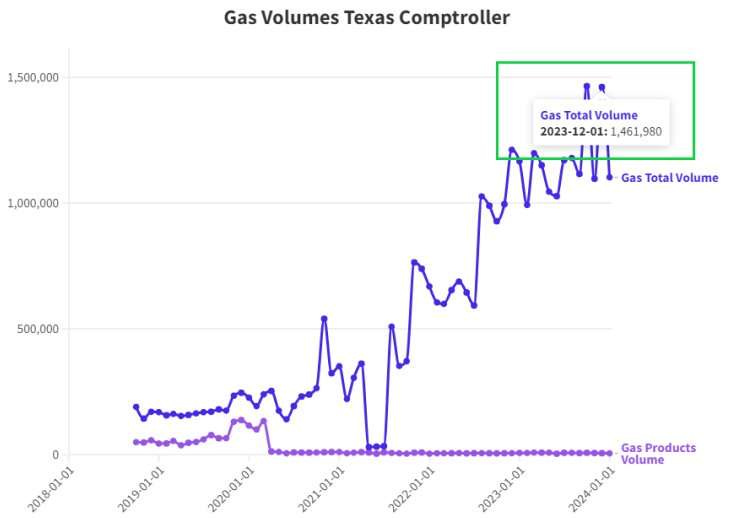

Gas Sales reported on the recent amendments finally match up well with Texas Comptroller data for December on total volume. Blackbeard NGPL reporting isn't consistent with the previous operator ConocoPhillips.

Total value of Gas sold has skewed drastically based on marketing costs where some months net out to $0.11. Blackbeard’s poor reporting controls across the Texas Comptroller and RRC result in huge revisions to the gas sales as well. For example, in Oct 2023 Gas Volume was reported to the Comptroller at 2,305,951 McF but was later revised down by half.

Blackbeard Operating controls the midstream pricing within an arms reach over the marketing price for gas in the area of Crane County. For many months in 2023 the Gas Total marketing Costs resulted in the sales no net out to basically worthless in value to the trust.

According to the Texas Comptroller data for wells operated in Crane County under Blackbeard, comparing Gas Sale value of PBT(greyed out) vs non-PBT(highlighted) shows a varying difference in value. +/- is based on average across all combined.

A large number of horizontals(17) where permitted through the Texas Railroad Commission(RRC) in November 2023.

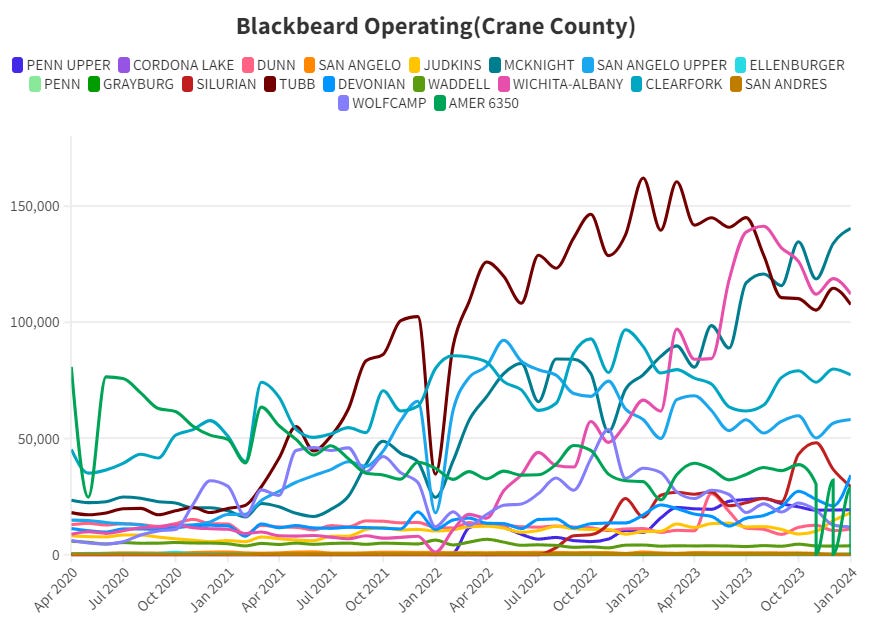

The Gas to Oil ratio for new production reported by Blackbeard to the Texas Railroad Commission follows an interesting linear path even though the drilling program has changed dramatically over the past 4.5 years where the first year was a majority of recompletions adding production through crude trapped behind pipe. More recent production is the result of heavy horizontal drilling which typically would show higher rates of gas during certain periods.

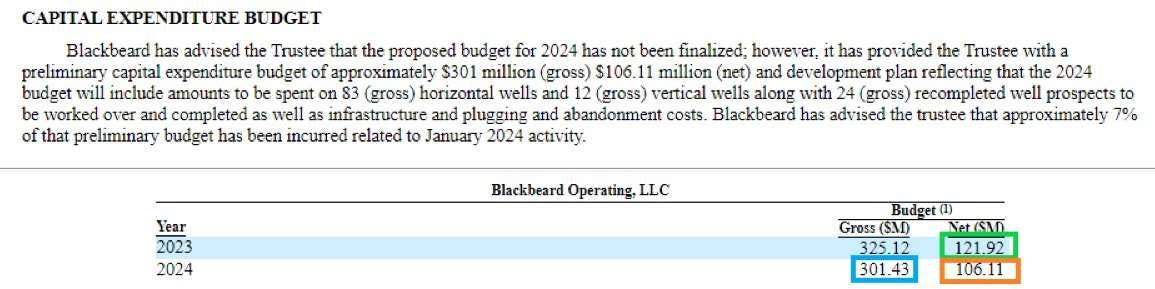

Confusion occurred for many investors when a report by the trustee on Net vs Gross budget in the 10K made many assume the budget had skyrocketed for 2024 instead of a net decrease. This was only clarified in a later 8K where the trustee shared a table representing the correct Net to trust budget that was previously referred to in past years’ filings with different language.

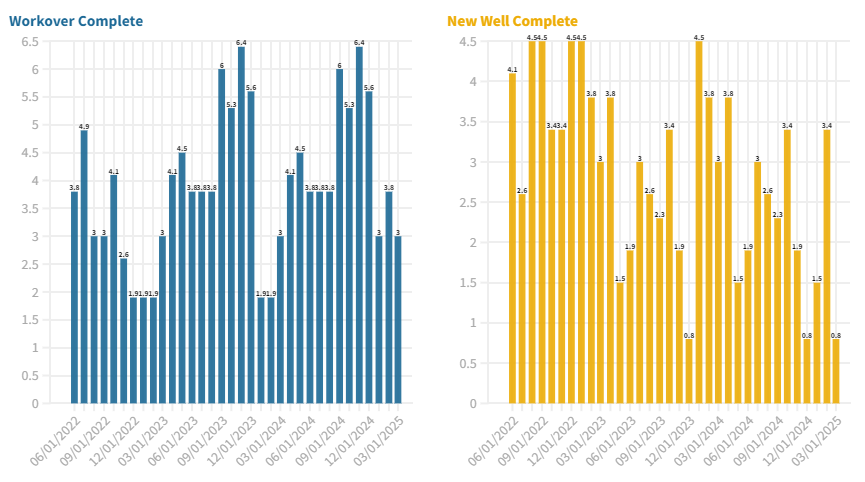

Blackbeard projected the 2024 capital expenditure budget(CAPEX) for the Waddell Ranch properties, which has not been finalized, estimated at $106.11 million (net to the Trust) on 95 new drill wells and 24 recompletions in 2024 as compared to 77 new drill wells (gross) and 142 recompletion (gross) with continued retirement of assets through plug & abandoned wells. The accumulative completions from June 2022 to February 2024 from 8K reports show 97.7 new vertical wells, 28.25 Horizontal wells, 133.3 recompletions, and 76.8 plug & abandoned wells were completed overshooting the current return of wells versus the budget spent. With continued decrease in oilfield service costs, the budget is currently trending in favor of more wells able to be completed with less capital allocation.

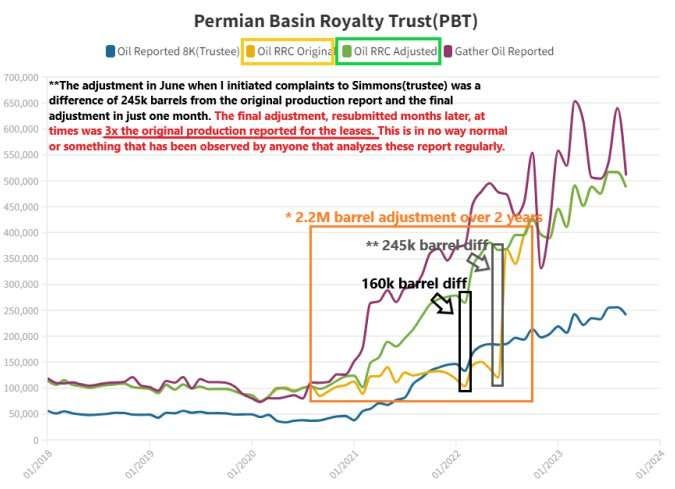

Reporting to RRC by Blackbeard compared to Transportation reports by third party gathers are still wildly off. The largest and highly egregious error in reporting came from the moment Blackbeard became operator of the Waddell Ranch in 2020 and for 22 months continued misreporting to RRC. Blackbeard only needed to resubmit the Waddell Ranch in Crane data and no other leases nearby. This data was shared with the trustee many times and based on limited communication flowing in this direction the consensus from the consultant is the RRC data now matches the reported data to the trust and transportation reports are not as reliable. While that statement is valid and true, the original issue with massive under-reporting in RRC data for such a long period that was later reverse engineered to match makes that statement false. The below ‘Oil RRC Adjusted’ and ‘Gather Oil Reported’ should match up as they did under the previous operator ConocoPhillips while the ‘Oil Reported 8k(Trustee)’ line should be 51% of the ‘Oil RRC Adjusted’, which was only the case after Blackbeard resubmitted their data to the RRC.

A lawsuit against Blackbeard Operating by Argent Trust Company(Trustee) was refiled on May 8th in Tarrant County. Based on the first sentence, it seems Blackbeard feels that the rules apply to them a bit differently as they hold to their namesake. Usually, an operator does not fight the trustee when these overcharges are assessed by a third party auditor.

'charging the Trust for overhead on wells that did not produce or have volumes injected' was not in the original complaint.

'charging the Trust for services performed and equipment installed on property unrelated to the Conveyance.'

How much production was created for other properties operated by Blackbeard off of the backs of PBT unit holders here?

'Fraudulent concealment', but trust the rest of my numbers submitted to the trustee even though those numbers were completely different than RRC data for 22 months and had to resubmit 2.2M barrels of production and errors as large as 60% under-reported to RRC. To reiterate, Blackbeard made large errors in reporting to the Texas Railroad Commission for 22 months straight on only the Waddell Ranch which had to be resubmitted in its entirety but not a single adjustment was made by the trustee for production on prior months which is common practice due to month on month errors if an operator is doing a large drilling program like Blackbeard has since mid 2020.

Typically, a large discrepancy by an operator of this size would spark a site audit to guarantee that all infrastructure is in place to correctly account for all production towards the correct locations. Even with a Joint Venture Audit currently in place the operator continues to make large errors reporting to both the RRC and Texas Comptroller, making it easy to assume that a site audit would result in uncovering common errors through tighter controls and recover any costs associated with the audit. It is not uncommon for operators to bypass meters in the field which can only be discovered by visiting the site. Many key findings according to Malone Petroleum Consulting that are a result of an audit are detailed here:

Blackbeard has lost much of its credibility under the lawsuit brought against them for mischarging the trust for personal gain and in turn it would not be far fetched for the operator to utilize other practices on production that resulted in padding the other side of their operations.

The current lawsuit is for $15M or more but only covers 2020-2022 since the audit was initiated in early 2023 and did not complete until sometime in the forth quarter. The 2023 JV audit should be due soon from the consultants hired by Argent and an amendment filed with the courts. Budgets by year: 2020 $10.6M, 2021 $51M, 2022 $92M, 2023 $121.92M should result in the current lawsuit against the capital expenditures of more than double the $15M based on current findings outlined by the trustee. The communication between the operator and trustee is so poor that Blackbeard decided in the most recent cash distribution that they ‘refused’ to provide the revenue cash or the Net Profit Interest(NPI) calculations for the cash distribution owed to unit holders to be properly distributed by the trustee. An unexpected path from what many investors are use to when dealing with a company in the Permian backed by NGP.

Sabine Royalty Trust(SBR)

Sabine Royalty Trust is an express trust formed to receive Sabine Corporation's royalty and mineral interests, including landowner's royalties, overriding royalty interests, minerals (other than executive rights, bonuses and delay rentals), production payments and any other similar, non-participatory interest, in certain producing and proved undeveloped oil and gas properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas.

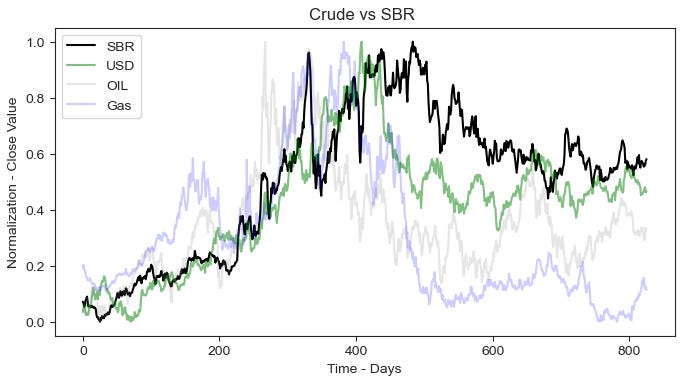

SBR equity price performance plotted against oil and gas prices and the strength in the dollar:

SBR equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Permarock Royalty Trust(PRT)

PRT equity price performance plotted against oil and gas prices and the strength in the dollar:

PRT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Insiders of PRT are a husband and wife operating Boaz Energy. CEO of the operator on lease is the brother of the wife in couple duo selling shares heavily since April 2022, total shares sold 873k. It is usually not a good sign to see more FORM-4(insider trading reports) on a low production trust with no CAPEX allocation than production reports, especially when the trust reports monthly.

PRT capital expenditures have been low to insignificant since IPO in a move seemingly engineered to keep the monthly cash distribution high(average $0.061/month) on the low volume of Oil and Gas produced each month. The Insider couple owned roughly 50% of all shares at IPO and receive an average of $359k/month in cash distribution. It raises the question on why sell so heavily into a low volume equity when the monthly payout based on share count is so lucrative?

MVO Royalty Trust

The principal asset of the MV Oil Basin Royalty Trust consists of a 80% net overriding royalty interest that burdens certain oil and gas interests in properties located in the Mid-Continent region in the states of Kansas and Colorado. As of December 31, 2017, the underlying properties produced predominantly oil (99% of production) from approximately 900 wells.

MVO equity price performance plotted against oil and gas prices and the strength in the dollar:

MOV equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Termination of MVO Royalty Trust

Unlike a traditional royalty interest that continues into perpetuity, a net profit interest in MV Oil Trust will terminate on the later of:

June 30, 2026

The time when 14.4 MMBoe have been produced and sold (equivalent to 11.5 MMBoe in respect of the trust’s right to receive 80% of the net proceeds from the underlying properties).

Do you know if Blackbeard was given a deadline to add the monthly payment by tonight at midnight?Saw that on a blog.

Did you ever see the work STJ did on SBR. They had a web site with tons of work done but it has been taken down. Bottom line in their view there is much revenue that is falling through the cracks because of lack of audit and there are amazing assets not being properly managed.

https://www.businesswire.com/news/home/20220426006202/en/STJ-Ventures-Launches-Website-with-Information-on-Sabine-Royalty-Trust-Assets-and-Reiterates-Support-for-Proposed-Change-in-Trustee