'All hope abandon, ye who enter here!' – Dante Alighieri, The Divine Comedy

Thousands of Oil and Gas wells were not plugged or were done improperly in accordance to current standards established in the 1950s where other items besides cement were used such as rock, wood, and sand. Texas Railroad Commission(RRC) regulations continued to evolve into 2000s laying out specific intervals for cementing and type of materials. The integrity of Oil and Gas wells has been brought into question in a 2014 whitepaper with an expanded emphasis on hydraulic fracking. In a technical sense, “well integrity” refers to the zonal isolation of liquids and gases from the target formation or from intermediate layers through which the well passes but in a practical sense it means that a well doesn’t leak. Extreme cases of a failure in well integrity can become expensive to repair and in the rarest of cases costs lives, as in the Deepwater Horizon disaster in the Gulf of Mexico.

In 1919, Article 3 of the RRC regulations laid out general requirements by stating that “dry or abandoned wells be plugged in such a way as to confine oil, gas, and water in the strata in which they are found and prevent them from escaping into other strata” (Texas RRC, 2000).

Like most regulations at the time, the rules were designed to protect the loss of oil and gas to other strata, not to protect the environment. As the oil and gas industry progressed, the RRC continued to update their plugging regulations by issuing specific cementing instructions in 1934 and then requiring the plugging of fresh water strata in 1957 (Texas RRC, 2000).

Plug and abandonment(P&A) of wells is meant to stop the potential leaking of chemicals into aquifers and potential methane leaks and other gases. In a recent article on Energy Crisis we looked into Methane leaks compared to the impact of CO2. According to NASA, methane only makes up 0.00017% (1.7 parts per million by volume) of the the atmosphere, but methane traps a significant amount of heat, helping the planet remain warm and habitable. Methane currently accounts for around one-fifth of man-made global greenhouse gas emissions. Methane has a shorter lifetime bonding to the atmosphere versus carbon dioxide (CO2), but a greater near-term warming effect. In fact, methane has more than 80 times the warming power of CO2 over the first 20 years after it reaches the atmosphere. Taking the 80x power into account CO2 ( 0.04%) compared to Methane(0.00017%) brings the latter to 0.013%.

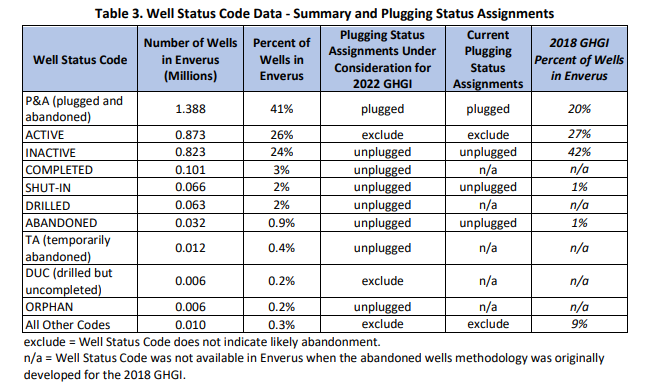

Table 2 compares the final count of abandoned oil and gas wells; these counts equal the Enverus abandoned well counts from Table 1 (with dry wells partitioned based on the relative oil/gas well counts) plus the 1.1 million historical abandoned wells.

Bonding requirement reform is a much needed change to hold companies accountable for retirement of assets that can fall onto the tax payers of those states to meet public safety standards. Previous requirements for P&A were established in 1960 at $10k and now increased to a minimum leasing bond of $150k; on federal lands the average amount the government held in bonds was just $2,122 per well in 2018 according to the Government Accountability Office. The Bureau of Land Management(BLM) oversees 245M acres of public lands which the Biden Administration has an opportunity to put pressure on Oil and Gas companies operating and developing these leases.

Texas will begin plugging about 800 abandoned oil and gas wells this fall, the state’s oil and gas agency said, after receiving an initial $25 million grant from a program included in President Joe Biden’s infrastructure plan.

It’s a fraction of the approximately 7,400 documented abandoned oil and gas wells that need to be plugged in the state — and industry observers believe the figure to be an undercount. Several more millions of dollars are expected to be disbursed to Texas through the newly created federal program.

The projected cost to plug and clean up the pollution from all 7,400 documented wells is approximately $482 million, according to the commission’s notice of intent to apply for federal funding obtained by The Texas Tribune.

$482 million is a large liability to carry even if its spread across many of the largest Oil and Gas companies. However, Texas law makes the landowner responsible for plugging abandoned wells and carries the added burden for injury or pollution related to the abandoned well. Within 180 days of learning the condition of a detreating well by the landowner, they must have the well plugged or capped under standards and procedures adopted by the commission. Within 30 days of plugging a report must be submitted to the RRC by a driller or licensed pump installer.

Chevron owns 12,647 acres of ranchland in Crane County, home to Antina Ranch, and 34,411 acres next door in Upton County. Most of that is the former McElroy Ranch, which Chevron bought in 1990 and closed to quail hunters. “We could make our operations more efficient by buying the surface and making sure there were no trespassers on the ranch,” a Chevron spokesperson told the Odessa American a few days after the sale.

Also in Upton County, SM Energy, Pioneer Natural Resources, ConocoPhillips, and Apache Oil each own more than 7,000 acres apiece. In Crane, ExxonMobil owns 14,410 acres. Late last year, a company with the generic name US Land Guild bought the 13,600-acre Doodle Bug Ranch, in Crane. The company’s address is the same as that of Blackbeard Operating, a private Fort Worth oil company that already owns 8,368 acres in the county.

Oil and Gas companies are buying the surface of their leases to essentially own and lockout anyone that may have direct negative effects from environmental factors of blowouts or leaking wells not adequately plugged and abandoned. More than 370k acres are currently owned by producers of Oil and Gas in Texas, an inverse of the past were ranchers owned the surface and the companies operated with a stewardship of the land.

The Gulf of Mexico is estimated to have 53k oil and gas wells with less than 10% of those wells currently producing, with the industry estimating total plugged wells at between 29-30k in 2021. Plugging of wells can range up to $10 million for deep-water and $500k for shallow-water wells. OCS Lands ACT of federal decommissioning obligations of wells require exploration and production companies to provide ‘lessees and owners of operating rights are jointly and severally responsible for meeting decommissioning obligations for facilities on leases as the obligations accrue and until each obligation is met.’(30 C.F.R. § 250.1701) ‘All holders of a right-of-way are jointly and severally liable for meeting decommissioning obligations for facilities on their right-of-way, including right-of-way pipelines, as the obligations accrue and until each obligation is met.’ Contractual obligations can hold the former interest owner liable for decommissioning costs associated with the wells even when an interest is no longer held because the obligations are subject to the owners when the well was actually drilled.

With the much needed death of 313 abetments in Texas coming to an end many projects for solar and wind farms will need to be reassessed for their long-term profitability potential without subsidies. While the costs of decommissioning an Oil and Gas wells have a long history of data points to rely on for the impact attributed to the state if a company or individual cannot meet their obligations, the same cannot be said for the renewable sector. In a story from the Associated Press in in 2021 an owner of a dilapidated Oklahoma Panhandle wind farm has presented plans to clean up the most dangerous of the wind turbine towers. Owner Olympia Renewable Platform LLC has hired a contractor to remove broken blades from seven towers and topple a couple of others topped with burned-out generator nacelles.

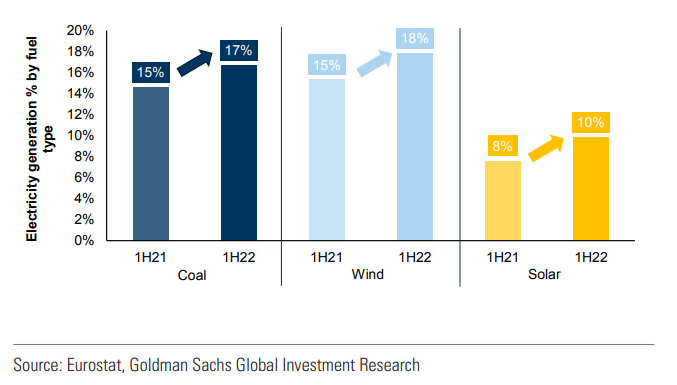

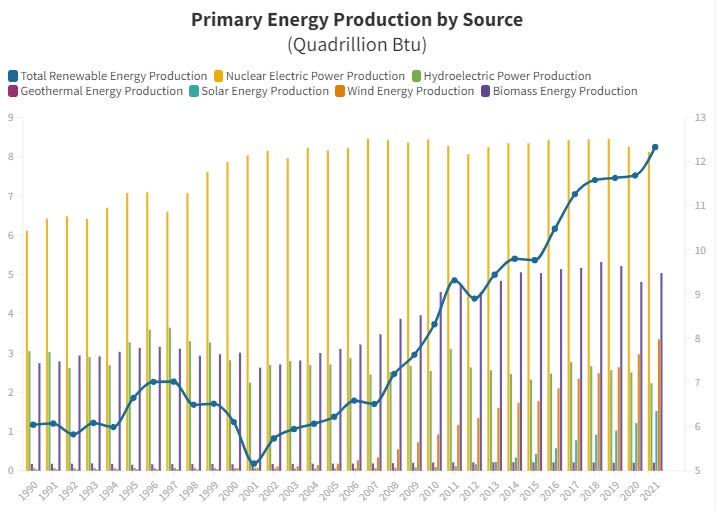

Estimated U.S energy consumption for 2021 came in at a total of 97.3 Quads but the more interesting metric is two thirds of power generated is lost energy rejected through thermodynamic heat loss in transmission lines and sub generation stations. Currently, the Secretary of Transportation has been quoted many times on his pro-view of electric vehicles but one thing that is never truly answered is what additional capacity the grid needs in order to offset petroleum products for transportation that currently sits at 26.9 Quads of power generation before efficiency loss. With solar and wind making up only 4.83 Quads of energy input, roughly 50 times of renewables will need to be added to the grid to power the electric vehicle revolution and offset the fossil fuel density of power currently being used.

With wind and solar generation to the grid’s needs growing rapidly thanks to past subsidies, there is also an added knock on effect to the expanding costs to decommission aging structures. Data from a limited review of eight decommissioning estimates for wind energy projects proposed in 2019–2021 showed per-turbine decommissioning costs (total decommissioning costs divided by number of turbines) of $114,000–$195,000 according to the Department of Energy. The agency also outlines waste contribution of 146.1 million tons of municipal solid waste and 145 million tons of construction and demolition waste managed at U.S. landfills. As of 2022 landfilling remains the most cost-effective option to process blades and other composite components and according to the Electric Power Research Institute(EPRI) study conducted in 2020 the average lifespan for these wind components is 15-25 years.

Wind turbine hub heights have increased over time because turbine blades have gotten longer. Turbines with longer blades and a greater rotor diameter typically have higher nameplate capacity. Older turbines, such as those in California or Tennessee, generally are shorter and have shorter blades than newer turbines, which have higher hub heights to accommodate longer blades.

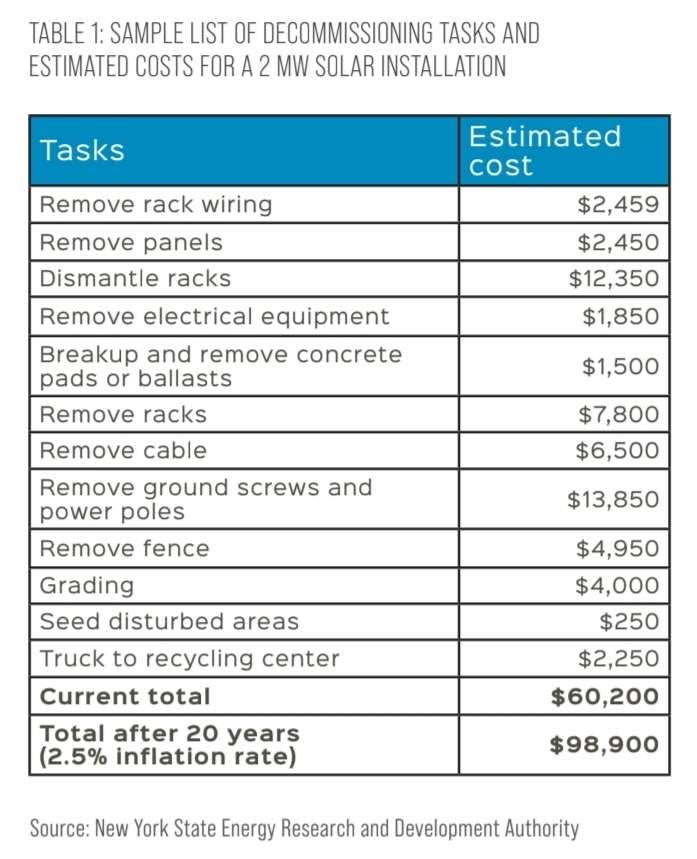

Solar carries a burden of decommission expenses where the New York State Energy Research and Development Authority (NYSERDA) estimates $30,000 per megawatt in present day costs. The addition of bonding has been suggested as a possible bottleneck to the high growth of solar development according to a study by NYSERDA because it adds additional development costs that have been attributed to renewable projects in the past.

Much like Oil and Gas P&A, landowners and developers installing renewables that could becomes potential obligations to the state should be required to maintain good stance in respect to decommissioning at the projects end of life cycle or replacement through bonding and escrow accounts. Government agencies should hold every sector accountable from fossil fuels to renewables on abandonment costs associated with the development of any project regardless of its designation and eliminate the capital burden on tax payers and future generations.

Texas has 2 decommissioning laws - one for solar (SB 760) and one for wind (HB 2845). Both require a 10 year period before a bond is put up by the corporations with the landowners. This then puts the onus onto the owners of the leased land to ensure the decommissioning is done. A dept of 3 ft is the most they have to remove wiring, concrete, metal etc.

I think the estimate on the Google search is under value. (no surprise)

NREL cost were $386,000 for 1 MW fixed tilt solar - Feb 2021. see Best Practices at the End of the Photovoltaic System Performance Period. This could even be low now.

My worst fear is that these facilities will be left behind by the single entity LLC's, who own them when their useful life expires. Texas has about 300,000 acres (30GW) under solar currently operating, not including the 155 GW in the ERCOT queue. If subsidies go away so will the operators! The law of unintended consequences could leave us acres of superfund sites to clean up.