An update on Royalty Trusts monitored by Energy Crisis last published on April 16, 2023. Royalty Trusts are a quality strategy to hedge against inflation and energy prices have moved higher in the past few weeks along with continued pressure on supply with decisions by the Biden Administration Interior Department to slow growth in the Gulf of Mexico on the heels of a recent announcement of only three federal lease sales which is the lowest number in a five-year plan for offshore drilling since tracking began in 1980. The Gulf of Mexico accounts for nearly 15% of all U.S. production making it worth looking at these Royalty Trusts to qualify their value with a potential for higher oil prices for longer as the Strategic Petroleum Reserve cannot be leveraged to put heavy downward pressure on oil prices.

San Juan Basin Royalty Trust(SJT)

The principal asset of the San Juan Basin Royalty Trust consists of a 75% net overriding royalty interest that burdens certain oil and gas interests in properties located in the San Juan Basin of northwestern New Mexico

SJT equity price performance plotted against oil and gas prices and the strength in the dollar:

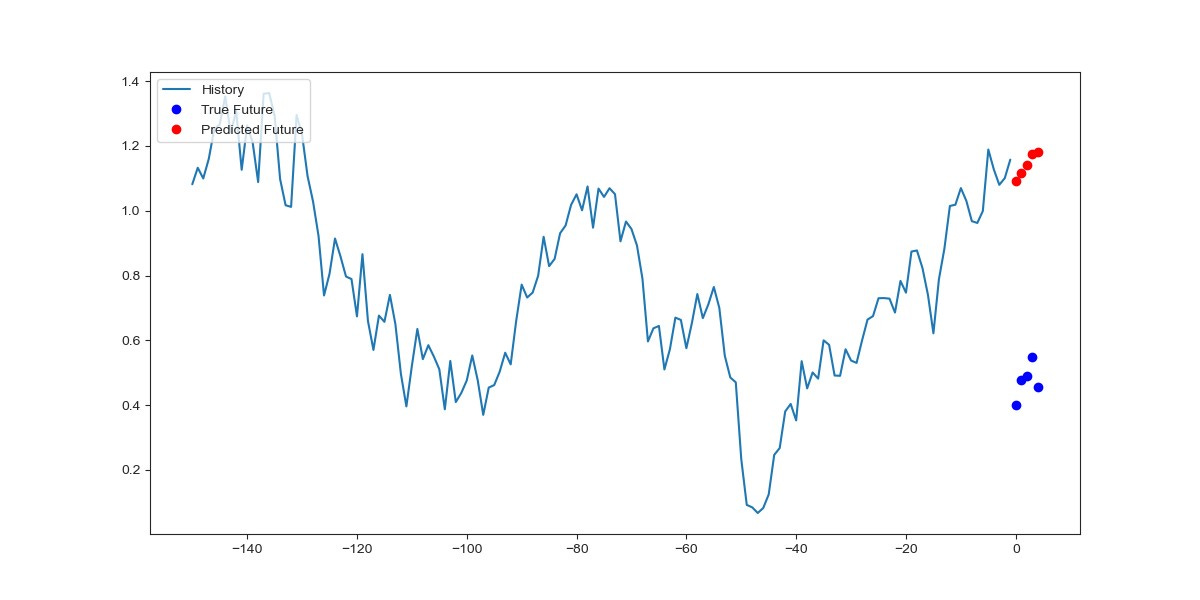

SJT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Permian Basin Royalty Trust(PBT)

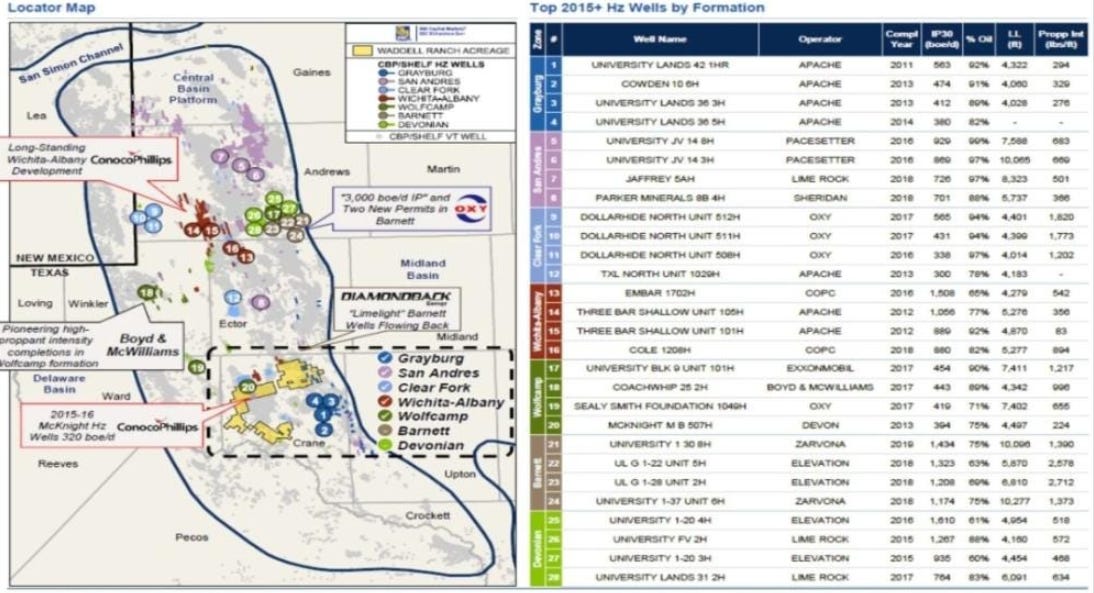

Permian Basin Royalty Trust’s principal assets are comprised of a 75% net overriding royalty interest carved out by Southland Royalty Company from its fee mineral interest in the Waddell Ranch properties in Crane County, Texas and a 95% net overriding royalty interest carved out by Southland from its major producing royalty properties in Texas.

Oil to Gas ratio for the new production on PBT is charted below to help represent gas increase on reworking of wells and unconventional additions through recent horizontals wells. (March data removed due some inconsistencies in Texas Railroad Commission data)

PBT equity price performance plotted against oil and gas prices and the strength in the dollar:

PBT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

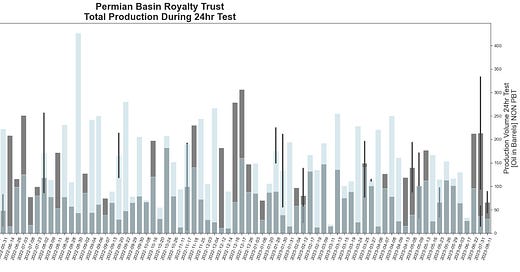

PBT 24hr test completion data:

PBT estimated decline:

PBT gather reports from Anchor Marketing, Plains Marketing, Enterprise Crude accusative barrels are still being reported at a higher production than what is reported by the operator on lease to both the Texas Railroad Commission(RRC) and the Trustee Argent.

A more detailed analysis of PBT can be found here and here.

Sabine Royalty Trust(SBR)

Sabine Royalty Trust is an express trust formed to receive Sabine Corporation's royalty and mineral interests, including landowner's royalties, overriding royalty interests, minerals (other than executive rights, bonuses and delay rentals), production payments and any other similar, non-participatory interest, in certain producing and proved undeveloped oil and gas properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas.

SBR equity price performance plotted against oil and gas prices and the strength in the dollar:

Permarock Royalty Trust(PRT)

PRT equity price performance plotted against oil and gas prices and the strength in the dollar:

PRT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

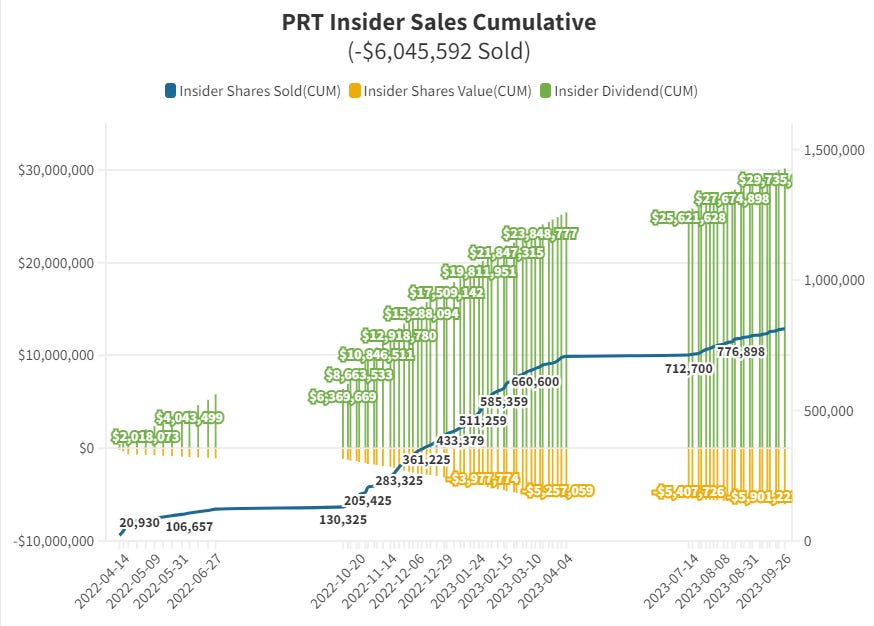

Insiders of PRT are husband and wife operating Boaz Energy. CEO of the operator on lease is the brother of the wife in couple duo selling shares heavily since April 2022, total shares sold 813k. It is usually not a good sign to see more FORM-4(insider trading reports) on a low production trust with no CAPEX allocation than production reports, especially when the trust reports monthly.

PRT capital expenditures have been low to insignificant since IPO in a move seemingly engineered to keep the monthly cash distribution high(average $0.061/month) on the low volume of Oil and Gas produced each month. The Insider couple owned roughly 50% of all chares at IPO and receive an average of $359k/month in cash distribution. It raises the question on why sell so heavily into a low volume equity when the monthly payout based on share count is so lucrative.

Thanks for the quick reply.

Greatly appreciate your update on the royalty trusts. Are you still long PBT? The 9/21 news release showed another high in production so I am still holding. Do you think the return on CAPEX in 2023 has been reasonable and do you think 2023 will be the end of the massive CAPEX. Have you revised your peak production since your 2022 articles? Your 2022 articles on PBT were fantastic and I bought more when the price dropped to $20-21. I sold all my SJT and VOC. I just started a position in SBR because of the recent oil uptrend. Looking at PVL, but production has not increased with increased CAPEX so something is not right with PVL. Thanks for all your articles!