Monthly or quarterly dividends/cash distribution(also called royalties) are paid by Oil, Gas, and Coal Royalty Trusts based on the commodities pricing for their previously produced natural resources, Royalty Trusts offer dividends ranging from 6% to 12%. Separate operating companies are responsible for the production, marketing, and sale of the resources, meaning there is no or low exploration risk. The prospectus for these Royalty Trusts outlines "forecasted" revenues and earnings, but oil companies acknowledge that "proven reserves" involve some guesswork and that there may be less oil in the ground or it may be more difficult to extract than anticipated, making the 10% yield is not set in stone. As with all investments, a comprehensive analysis must be conducted before making a decision. The following article is meant to give reference to datasets for a few Royalty Trusts to help understand past performance versus future potential. Not all Royalty Trusts presented are built the same including varying regions, formations, capital expenditures, Net Royalty Interest, and many other factors. A more detailed analysis of a specific Royalty Trust listed below can be found here and here.

San Juan Basin Royalty Trust(SJT)

The principal asset of the San Juan Basin Royalty Trust consists of a 75% net overriding royalty interest that burdens certain oil and gas interests in properties located in the San Juan Basin of northwestern New Mexico.

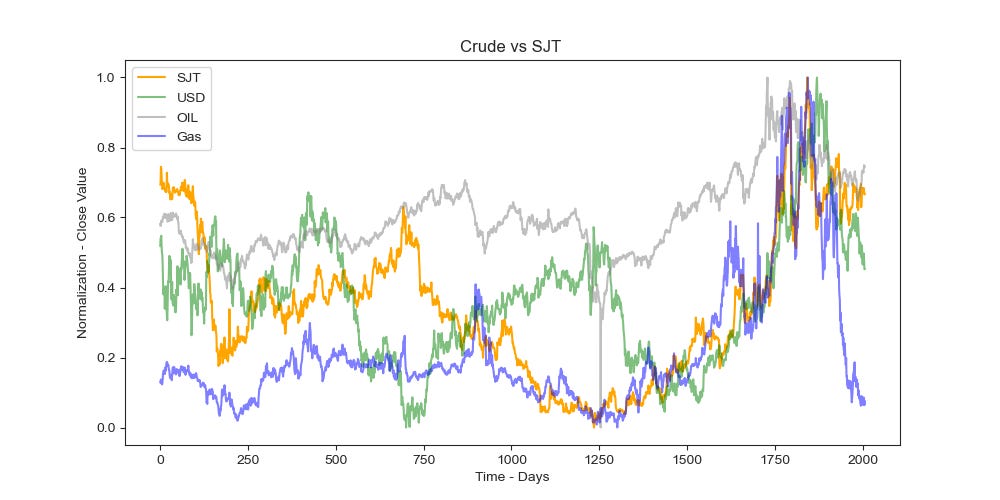

SJT equity price performance plotted against oil and gas prices and the strength in the dollar:

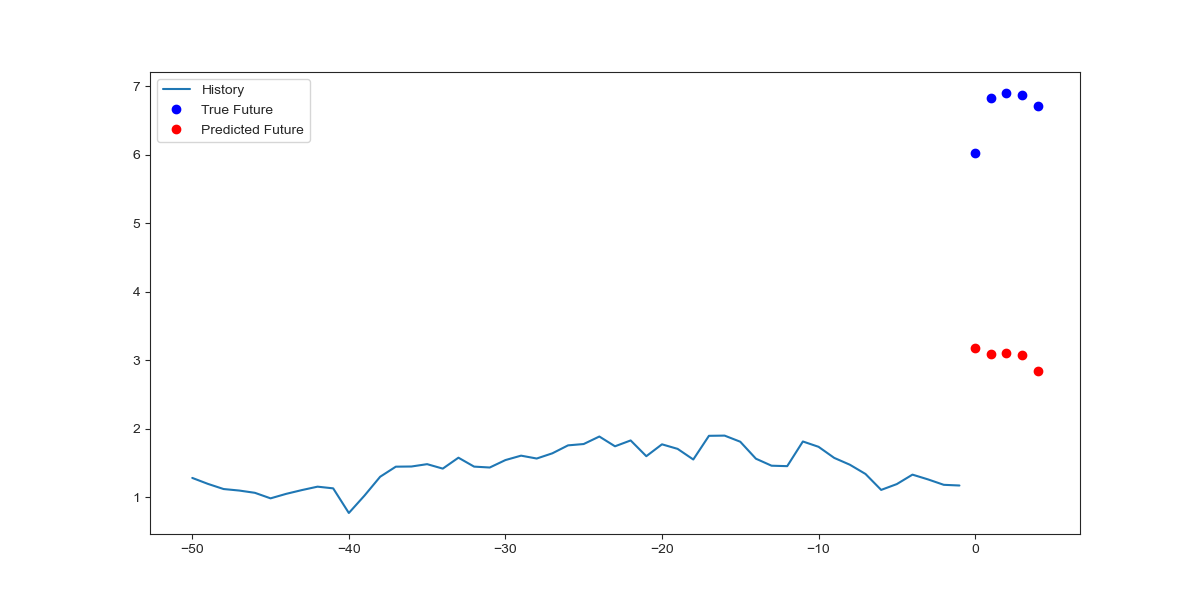

SJT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

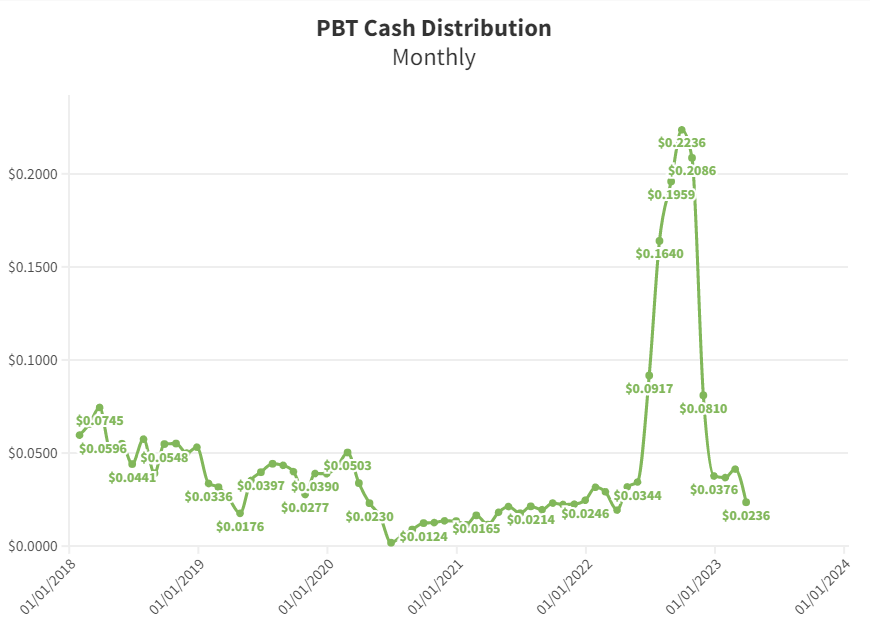

Permian Basin Royalty Trust(PBT)

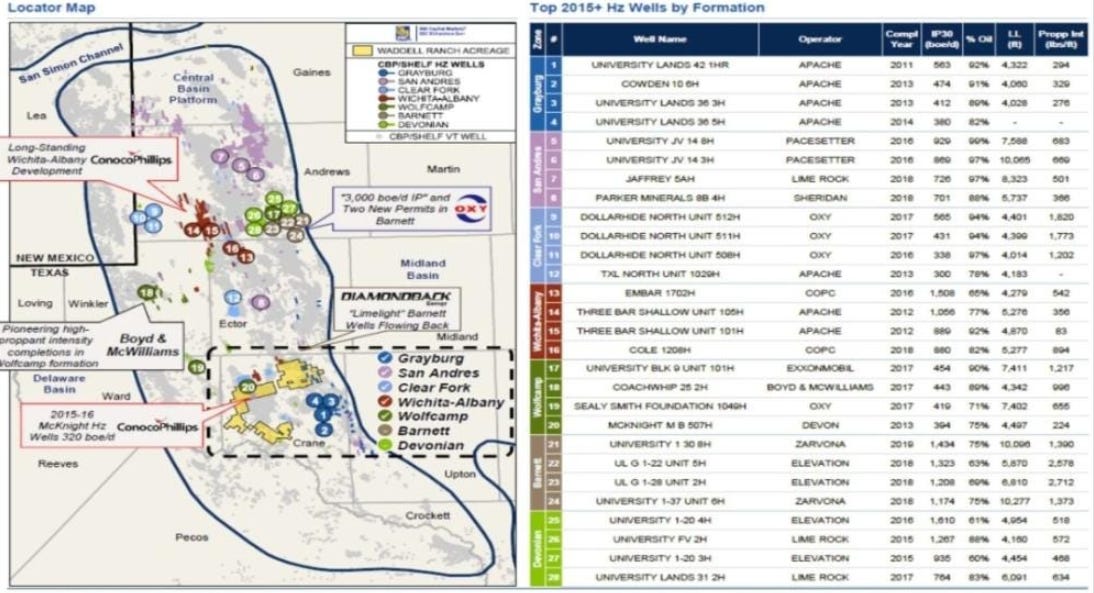

Permian Basin Royalty Trust’s principal assets are comprised of a 75% net overriding royalty interest carved out by Southland Royalty Company from its fee mineral interest in the Waddell Ranch properties in Crane County, Texas and a 95% net overriding royalty interest carved out by Southland from its major producing royalty properties in Texas.

ConocoPhillips sat idle developing new production from 2016 to 2020 spending only $17.95M in capital expenditures over 4 years prior to Blackbeard Operating taking over the trust and reworking capital during a down market dominated by news of lockdowns and COVID-19 restrictions that left most Oil and gas companies cutting back dramatically. Blackbeard however, ramped up drilling and completion of wells where in the first year spent $86.7M at a time where costs of all service in the Permian Basin were depressed and skilled workers were readily available. The increase in production on the Waddell properties is supported by recent test well data submitted to the Railroad Commission and compiled by me through different software scripts to track royalty trust performance by output. I am currently separating wells of +8,000’ depths and 6-7,999’ depths since new permits are more focused on the Devonian play. New investments on wells are creating on average additional barrels of 3,375-,4,052 of Oil per well each month.

Oil to Gas ratio for the new production on PBT is charted below to help represent gas increase on reworking of wells and unconventional additions through recent horizontals wells.

PBT equity price performance plotted against oil and gas prices and the strength in the dollar:

PBT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Horizon Kinetics adding +1M more shares since late February. INFL - Horizon Kinetics Inflation Beneficiaries added 1,186,250 shares to their already 3,744,689 shares in the HORIZON KINETICS ASSET MANAGEMENT LLC fund. Their Latest fund ENERGY AND REMEDIATION ETF launched last week with an initial investment of 1,904 shares. With the new fund launch and a recent disclosure of shares in INFL the new Energy Fund should continue buying PBT shares as inflows ramp up. Horizon now own 4,932,843 shares. Combine that with the 4,148,095 shares Softvest owns these partners now own 9.08M shares or 19.4% up from 16.9% a week ago. Total institutional ownership is up 14,022,714 shares or 30.09%. Adding to this Gideon Powell individual ownership of 4.6M shares or 10%.

‘Permian Basin Royalty Trust(PBT) is a trust that receives royalty payments for mineral rights that it owns in Texas. The most important of its assets are in the Permian Basin. We view the company as a mini Texas Pacific Land Corporation(TPL), another portfolio holding.’ - AMMF Annual Report 2022

TPL chart for reference:

A more detailed analysis of PBT can be found here and here.

MVO Royalty Trust

The principal asset of the MV Oil Basin Royalty Trust consists of a 80% net overriding royalty interest that burdens certain oil and gas interests in properties located in the Mid-Continent region in the states of Kansas and Colorado. As of December 31, 2017, the underlying properties produced predominantly oil (99% of production) from approximately 900 wells.

MVO equity price performance plotted against oil and gas prices and the strength in the dollar:

MOV equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Termination of MVO Royalty Trust

Unlike a traditional royalty interest that continues into perpetuity, a net profit interest in MV Oil Trust will terminate on the later of:

June 30, 2026

The time when 14.4 MMBoe have been produced and sold (equivalent to 11.5 MMBoe in respect of the trust’s right to receive 80% of the net proceeds from the underlying properties)

Sabine Royalty Trust(SBR)

Sabine Royalty Trust is an express trust formed to receive Sabine Corporation's royalty and mineral interests, including landowner's royalties, overriding royalty interests, minerals (other than executive rights, bonuses and delay rentals), production payments and any other similar, non-participatory interest, in certain producing and proved undeveloped oil and gas properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas.

In the 41 years since the inception, the SBR Royalty Trust has produced approximately 23.5M barrels of oil and 298B cubic feet of gas. As a result of this production, the Trust has paid out approximately $1.589 billion to Unit holders over the years. This year’s reserve estimate of 6.0 million barrels of oil and 47.4 billion cubic feet of gas remaining, it could be estimated that the Trust still has a life span of 8 to 10 years.

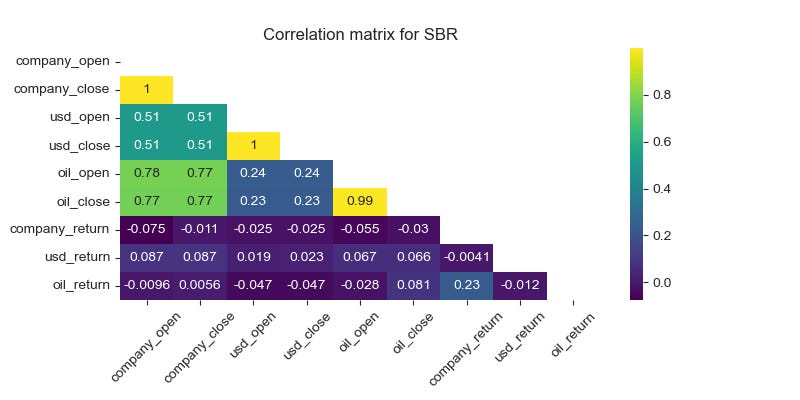

SBR equity price performance plotted against oil and gas prices and the strength in the dollar:

SBR equity predicted matrix based on past performance and current market conditions of oil and gas prices:

Permarock Royalty Trust(PRT)

PRT equity price performance plotted against oil and gas prices and the strength in the dollar:

PRT equity predicted matrix based on past performance and current market conditions of oil and gas prices:

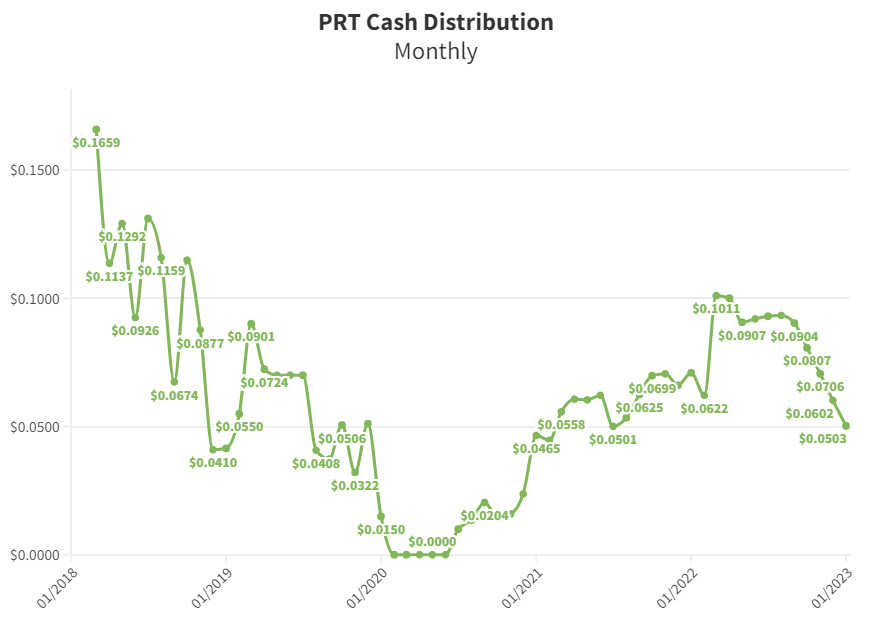

Insiders of PRT are husband and wife operating Boaz Energy. CEO of the operator on lease is the brother of the wife in couple duo selling shares heavily since April 2022, total shares sold 707k for $25.4M.

PRT is affiliated with NGP and the operator is also an NGP controlled entity. NGP announced recently they would be selling $7B in Permian assets but Permarock(PRT) was not mentioned in this announcement. Underlying Properties had approximately 15.25 MMBoe of proved reserves at IPO(2017).

PRT capital expenditures have been low to insignificant since IPO in a move seemingly engineered to keep the monthly cash distribution high(average $0.061/month) on the low volume of Oil and Gas produced each month. The Insider couple owned roughly 50% of all chares at IPO and receive an average of $359k/month in cash distribution. It raises the question on why sell so heavily into a low volume equity when the monthly payout based on share count is so lucrative.