After the most recent cash distribution of the Permian basin Royalty Trust(PBT) coming out flat month on month, I decided to write up a more in-depth explanation of how these fields are currently being drilled and reworked for new production volumes. The majority of this article is supplemental information to previous analysis and data dump that can be found here with some updated numbers off of fresh Railroad Commission permits and data.

Decline Curves

The most common question asked since the recent 8K for cash distribution surrounds the notion that wells may be declining faster than anticipated and new drilling isn’t supplementing the loss of barrels moving forward. Month on Month production declined slightly versus July report seen here:

Taking the last 10 months of production from new permits on PBT and removing the small number of wells that had any bad/missing data for the month due to a recompletion or a problem with the well(stuck road, flowback, ect.), the decline curves follow exponential instead of the feared harmonic declines previously discussed here.

Some declines look to be more dramatic at first but when digging into the actual permits for these outliers, they are shown to be completing the next stage in the commingling of fields(discussed more in depth in Recompletion section).

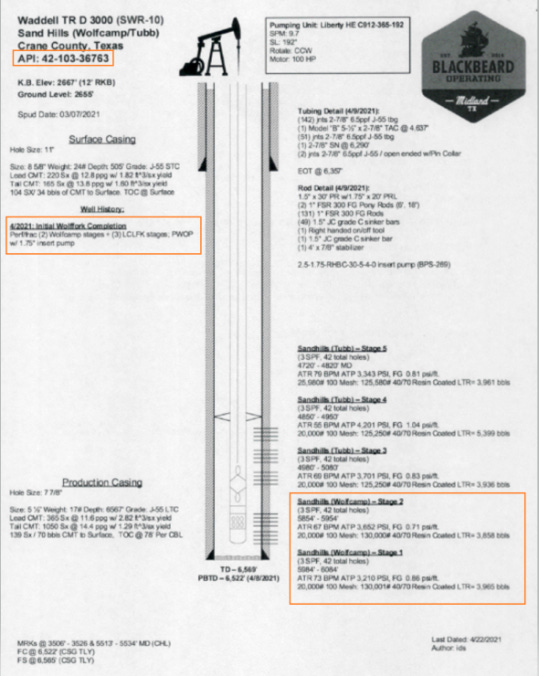

The example above for 42-103-36763 can be justified for recompletion of the Sand Hills(Clearfork) stage 3-5 where the new field and lower Sand Hills(Wolfcamp) fields will both supply oil and gas production simultaneously.

Recompletion

Latest report from August is for production in the month of June where 9 new drills spud date started and 16 completions where made. Completions seen here:

Many of the wells are similar to the permit mentioned previously where multiple zones are completed in multiple stages for hydraulic fracturing using perfs to target the different fields. A quality detailed explanation of this process can be found here but essentially Blackbeard is firing and fracturing these multiple zones by rotating equipment constantly across the different wells in order to utilize workforce and equipment as efficiently as possible.

A snippet of well 42-103-36727 can be seen below submitted to the Railroad Commission:

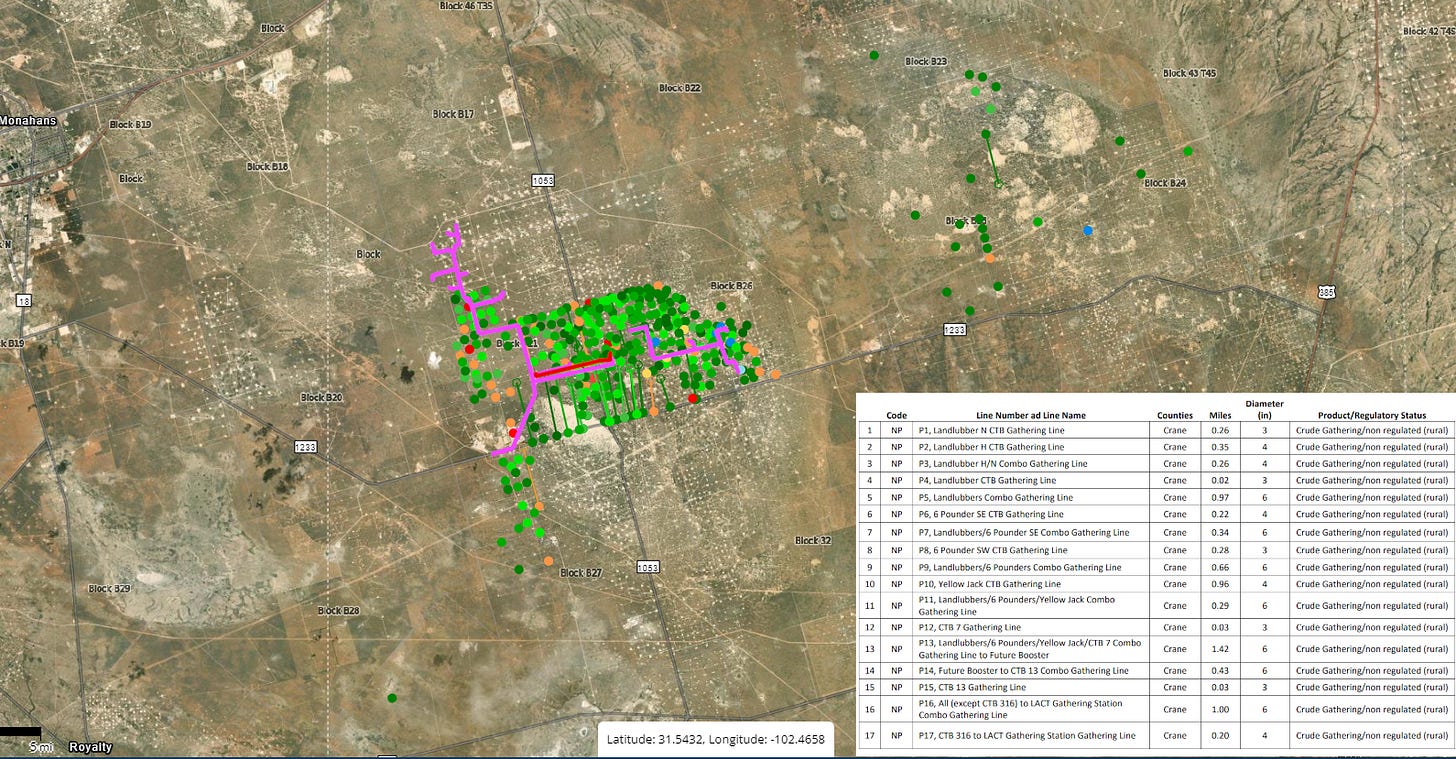

Pipeline and Plant

Production has increased over 600% on Waddell Ranch since Blackbeard has taken over as operator for the Permian Basin Royalty Trust in early 2020. Taking production from under 30k barrels per month(BPM) of oil to the recent 183,925 and roughly 600k Mcf of natural gas production. Part of the growing Lease Operating Expenses(LOE) required Blackbeard to run a significant amount of pipe and separation equipment to not only collect production output, but upgrade to a larger capacity for the increase. Seen here was the planned pipeline that has currently been completed along with their plant upgrades and tank battery storage:

Utilizing drone footage also verified that this pipe was completed across the highways and through the lease. A portion of the flyover video can be found here.

Accumulative Projection

Reworking the model this past week with better data from April recompletions and new wells, some adjustments for production growth were taken into account. These adjustments are related to the spud date(start of drilling) completion and recompletion of the wells as the work progress smooths out. An expected lag in the production and capital expenditures for the month of August reporting in October is also seen due to recent weather that washed out lease roads for roughly a week from heavy rains.

With the additional permit data, production can be plotted across a better range per month of completions with the additional fields commingled in production from the Sand Hills Tubb, Clearfork, San Angelo Upper, McKnight fields. Data was back-tested against this alteration in modeling to produce the recent results of the flat production month on month with an expected jump in September’s report for the month of July production. The biggest reason for the jump is recompletion along with pipe connection to new wells and repair to 4 previously producing wells.

Delayed Data

Cash distribution and production reports are always reported for the two months previous production of oil and gas for the leases under the royalty trust. The same goes for data submitted to the Railroad Commission(RRC) which is starting to have a wider than normal gap for fresh data. In order to combat this, the utilization of a drone and 5 flights over the properties up to 3km inland, was done to verify as many wells as possible for the above data. Videos of the flyovers can be viewed here(video 1), here(video 2) and here(video 3). This gives more up-to-date idea of what stage the completion is at and since the targeted depths and fields for completion are known, estimates can easily be made for when these wells will produce. An example of a well complete with no updated data that was permitted in June:

Institutional Ownership

Horizon Kinetics added the largest amount on a percentage basis to their position($34.6M) in PBT while Eric Oliver of SoftVest Advisors LLC continued to add to his position. Eric lobbied to become trustee of Texas Pacific Land Trust(TLP) and was later awarded a board seat for the trust after a compromise following a post proxy vote and is also founder of Geological Research Centers and Caprock Title Co., Inc. in Midland TX; located in the same Permian Basin that the operator of PBT(Blackbeard) is currently located. Eric’s SoftVest has the largest institutional position in PBT at $67.99M and if history serves for his picks on land trusts, TPL is up 73,900% since his 2004 purchase. Yes you read that right, a 739X return from $12 to Friday closing of $1,888.

Budget

Completion of pipe and other facilities should allow the Lease Operating Expenses(LOE) to come back down towards the $3.2-3.5 million range soon but capital expenditures(CAPEX) are still set to continue through the rest of the year. Currently the budget is set for $92M with a projection of about 47 new drill wells and 45 recompletions along with about 19 plug and abandoned wells. Current total CAPEX spent as of last report for this budget is $59,357,878 or $30.6M remaining for the next 5-6 of the fiscal year. Based on all new data the CAPEX will most likely remain high for the next 2 reports before tapering significantly into the holiday season where all drilling and production should slow. With the target of 300K BPM of Oil and 930k Mcf Natural Gas from Waddell Ranch for the December report, this could be set for some fireworks on the cash distribution. This holds true to previous analysis of PBT where the equities trading price will reflect a 7% yearly yield of the last 3 months cash distribution with a risk premium added based on current oil prices.

Final Thoughts

All current data available through the Railroad Commission along with additional drone data still leaves the production increases to target +300k barrels per month for Waddell Ranch around the January 2023 report or about 67% increase from the August report. Being a big voice across many outlets that an energy crisis was on the horizon since September 2021, all the research and work to understand how it plays out is beginning to pay off. Oil and Gas should continue to have a floor of $85 defended by OPEC+ and a ceiling of $155 that isn’t sustainable for more than a few months. Leaving previous price predictions for PBT stock the same but slightly delayed. The first due diligence on PBT that I posted was when it was trading at $2.68 an 558% upside at Friday’s close and 761% when it topped out at $23.08 during the Russia/Ukraine price premium pushed oil to +$120 in May/June.

We owe a large amount of gratitude to Mr Broncho this update is extraordinary both in its comprehensive detail as well as superb analysis. I am very grateful for his update on PBT. I agree with the oil price overview. For what its worth, I do not believe oil will crash or that the U.S. is headed for a crash. IMHO there is excessive pessimism and if you look at the news so many are predicting deep recession, crash, etc. Keep in mind that the purveyors of doom folks like Celente, Kioysaki, etc have been peddling these conspiracy theories for years about hoe these unnamed "they" want to cause a U.S. depression. why on earth would "they" (whoever they are but presumably welathy elites and corporations) would want to destroy their wealth? It is absurd. It has been about 20 years straight that Celente has claimed the U.S. was entering a depression "this year". The greatest danger to the U.S. is the reduction in critical thinking and increased belief in these absurd claims (crisis actors, tracking chips in vaccines, etc.). BTW - if so many analysts are predicting a severe recession/depression odds are this will NOT occur. Economically...my 2 cents is that the U.S. is in far better shape overall with large energy resouces, food security and a peerless military. Texas crude is a good bet. The world is not going to implode and big oil consumers like India and China will continue to grow even if the China slow down rmains a bit longer. The 0 Covid policies in China will be lifted at some point and demand will surge. But as Broncho wisely states, the range 85 plus if fine as too high a price will cause demand destruction. We should be happy with crude 90 - 110 lets say high 90s low 100s. I thank Broncho once again for his excellent analysis and evaluation of PBT. We are incredibly fortunate thta he is kind enough to share his analysis with us.

thanks so much for all the DD research you do - big fan