PBT has increased production of Oil on the Waddell Ranch by 1,044% in 24 months with quality allocation of capital.

All debt was recently paid off from drilling and completion activities and the monthly cash distribution is set to increase from Waddell Ranch contributions.

Recent monthly cash distribution jumped 166% with my current model's year end projections increasing another 450%.

Projected $0.25-$0.69 cash distribution through end of year gives PBT a projected exponential return potential.

The Permian Basin Royalty Trust(PBT) is now operating with zero debt as of May 2022 while heading into a multi-year cash distribution increase backed by two years of capital investments in new and recompleted wells adding many multiples of production capacity leading into high oil and gas price landscape. Current cash distribution yield is set to move above $0.25 per month(currently $0.0916) over the next two monthly reports and can continue to as much as $0.69 by December if Oil and Gas prices remain high.

This writing is intended to be a response to a recent article about the risk factors for the Permian Basin Royalty Trusts long term perspectives, I wanted to take the opportunity to correct the author and present actual data from the trust to support a bull thesis instead of a misinterpretation of the current oil cycle. I have decided to not go into detail trying to refute the points made by the author on ‘most countries are investing in renewable energy projects at full throttle’ and a ‘secular shift from fossil fuels’ because the energy crisis the world is in today is in my opinion a direct result of mishandling of these two positions against Oil and Gas bull thesis and since that theory hasn't fully played out I will just stick to the data.

Business overview

The Permian Basin Royalty Trust is a long standing royalty trust that pays a monthly cash distribution on the oil and gas it produces from leased properties in the Permian Basin. Unlike some of the major oil and gas companies such as Occidental Resources(OXY) and Exxon Mobil(XOM) the trust cannot add new properties to its asset base through merger and acquisitions. In the current market conditions where a focus on returning capital to shareholders through dividends has been a stated thesis by many analysts in the past year directed to the Oil and Gas sector, this should be considered as a net positive to the trust due to the poor history of mergers and acquisitions of the US Shale Fracing Revolution. Instead this trust relies on operator performance and capital investments for new and existing wells to be completed and worked over to increase production from the existing carved out leases in one of the most prolific oil and gas basins in North America.

The Permian Basin Royalty Trust’s principal assets are comprised of a 75% net overriding royalty interest carved out by Southland Royalty Company from its fee mineral interest in the Waddell Ranch properties in Crane County, Texas; and a 95% net overriding royalty interest carved out by Southland from its major producing royalty properties the Texas Royalty properties. The trust is set up as a grantor trust where the individual is held accountable for income for estate tax. Though a full proposal for the much talked about windfall profit tax on oil and gas companies, a grantor trust would most likely not be subject to these types of taxes.

The majority of PBT's leases are located west of Penwell, TX and have been drilled and developed for nearly 100 years before being incorporated into a trust in 1980 by Simmons Bank . The trust was operated and developed by Burlington Northern Inc. and through different mergers later became controlled by ConocoPhillips in March 2006. In May 2020 Balckbeard Operating took over as the operator on the leases for the trust of continued development of new and workover wells. PBT stock price has always been heavily correlated to the amount of the monthly cash distribution it produces to its shareholders. The royalty income recorded for a month is the amount computed and paid to the Trustee on behalf of the Trust by the interest owners. Trust expenses, consisting principally of routine general and administrative costs, recorded are based on liabilities paid and cash reserves established out of cash received or borrowed funds for liabilities and contingencies. If the Monthly Distribution Amount for any monthly period is a negative number, then the distribution will be zero for such month. To the extent the distribution amount is a negative number, that amount will be carried forward(NPI) and deducted from future monthly distributions until the cumulative distribution calculation becomes a positive number, at which time a distribution will be made.

Blackbeard after becoming the operator on lease for The Permian Basin Royalty Trust (PBT) taking over for ConocoPhillips (COP) looked to increase production through new well development by increasing their spending on capital expenditures and lease operating expenses in 2020-2021. Blackbeard through spending decreased the cash distribution in mid 2020 until the May 2022 report where the Waddell Ranch began contributing again. ConocoPhillips outlined in their sell sheet of the properties a very attractive decline curve off current production as well as quality returns on investment of new drilling on the Waddell Ranch located just West of Penwell, TX. The geology of this region has made this area an ideal target for growth in the Permian Basin being a large continuous block with centralized facilities and close proximity to some of the largest oilfield service companies in Odessa, TX located less than 5 miles from the properties. The performance of these fields dating back nearly 100 years with production increases realized after every major investment of capital into new exploration due to a multi-zone depth profile.

Production Growth

ConocoPhillips sat idle developing new production from 2016 to 2020 spending only $17.95M in capital expenditures over 4 years prior to Blackbeard Operating taking over the trust and reworking capital during a down market dominated by news of lockdowns and COVID-19 restrictions that left most Oil and gas companies cutting back dramatically. Blackbeard however, ramped up drilling and completion of wells where in the first year spent $86.7M at a time where costs of all service in the Permian Basin were depressed and skilled workers were readily available. Below I charted all New Wells and Workover Wells completed and in progress during the last 15 years of the trust to help visualize how new capital is being deployed.

If you follow Oil and Gas companies then you probably already know that new investment does not necessarily result in returns of production of barrels to the market but in the case of PBT all investments have resulted in an increase in production volumes since there is no speculative drilling being done. Looking at the most recent quarterly filing, the first quarter of 2021 production came in at 181k barrels of oil whereas just the last monthly report from June had a combined total of 195k barrels in a single month of oil produced showing a more than three times production volume off of new investments in one year. With the high rate of capital spending Blackbeard racked up $18.2M debt net to trust as of October 2021 reporting. In just 6 months time the language of the filings changed from "Since the Waddell Ranch is in current deficit for the foreseeable future, any increase or decrease of the distribution by revenues received, will only be reflective of the activity of the Texas Royalty Properties."(October 2021 Report) to "This would put the Trust’s proceeds of 75% as a positive $4,881,643 net to trust for the month of March, therefore paying off the excess cost deficit entirely with a remaining $34,000 to contribute to this month’s distribution. Given that if current oil and gas pricing continues, Waddell Ranch could continue to contribute to the distribution in the foreseeable future."(May 2022 Report).

The addition of Waddell Ranch properties contributing back to the monthly cash distribution is the most significant part to the strong buy rating of PBT because the trust has shown ongoing growth in barrels and an ability to support high continued capital expenditures to add to a baseline of production each month.

Production from early 2020 to the most recent 8-k filed on June 17, 2022 has shown quality growth month on month from the new wells being drilled. Total production growth since new investments has risen 1,044% in production of oil on the Waddell Ranch properties since March 2020. Production growth grew at a faster pace near the end of 2021 as wells were being completed faster with surface equipment that was in short supply for the majority of the year. Blackbeard also did an upgrade to the Natural Gas processing plant in order to add more capacity and upgrades to tank batteries for storage of crude which affected the lease operating expenses. Gas production increased approximately 46% from 2020 to 2021 primarily due to the new drilling and updated gas plant facility.

The increase in production on the Waddell properties is supported by recent test well data submitted to the Railroad Commission and compiled by me through different software scripts to track royalty trust performance by output. I am currently separating wells of +8,000’ depths and 6-7,999’ depths since new permits are more focused on the Devonian play. New investments on wells are creating on average additional barrels of 3,375-,4,052 of Oil per well each month. With a current budget of $92M net to trust to bring on 47 new drill wells, one can assume that production volume will continue to increase into year end to meet estimated targets of 225k(net) barrels of oil per month for Waddell Ranch properties.

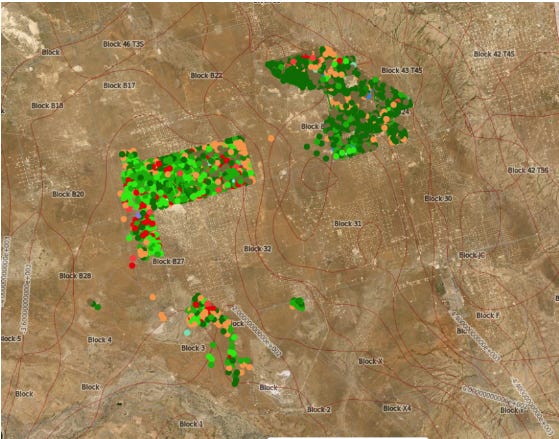

Here are wells permitted since Oct 2021 with production already online shown below for reference. Heavy concentration of vertical wells in this area being completed at a faster rate than earlier in the year but there are still many bottlenecks in the Permian.

Distribution

The previous author of the article in reference is quoted in saying ‘the impact of the natural decline of production on the performance of PBT is clearly reflected in its distribution record… the distribution of PBT has dramatically decreased over the last decade, from $1.16 in 2012 to $0.27 in the last 12 months.’, but the data above supports the complete opposite of the decline thesis. What is really happening with this trust is that a large amount of debt was taken on in 2020-2021 by the new operator at a time when service costs were low and that debt needed to be paid down before the properties of the Waddell Ranch could contribute to the cash distribution of the trust. What the author also failed to realize is that this debt was fully paid down in May and Waddell Ranch is once again contributing to the payout of investors and that this past week's most recent report of cash distribution resulted in an increase of 166% month on month or $0.034445 to $0.091662. In 2008 PBT had a cash distribution ranging from $0.1104-$0.2789 where the underlying stock price traded as high as $27.50 in April 2008 with only production of 62,716 bbls oil and 315,480 Mcf of gas(during this time Waddell and Texas properties volumes were combined in reporting).

Looking closer on a month to month growth basis we can see that PBT has had consistent forward potential in returns to shareholders through cash distribution. My modeling of the current production output potential from the 2022 budget of PBT below puts the Waddell Ranch Oil production net to trust at 225k bbls of oil(5x 2008 levels) and 701k Mcf of natural Gas per month by year end reporting in December of 2022. This production growth, even with continued capital expenditures, would position the trust's monthly distribution at more than $0.50/share(+$6/year). Currently I operate on the thesis that the trust's underlying equity price will trade at a 7% yield for the year once these investments are fully realized leaving an exponential upside potential for investors.

Included in the above model is a breakdown of all continuing expenses for Blackbeard to operate such as Admin, Taxes, Capital Expenditures, and Lease Operating Expenditures. The model is designed around the reporting month date but data for each report is from the prior 2 months of sales to the market for the cash distribution.

Price Target

The 7% yearly yield translates into a very attractive price target for the equity. By end of year with the current production growth and oil at $120/barrel, PBT monthly cash distribution could reach +$0.48 per month or a underlying price target of $85 per share. Though PBT is sensitive to oil and gas prices creating exponential cash distribution potential oil sales make up the majority of the revenue for the Waddell Ranch and can easily be calculated based on the current structure of the oil market.

Risk Factors

Even with a steep decrease in WTI oil price to $65, PBT would still be producing a monthly cash distribution of roughly $0.25 or an 18% yearly yield at current price. I have tracked a number of royalty trusts for years and the majority of these trusts do have declining production only being held up by the current oil prices but this is definitely not the case for PBT as the data shows. With a tight market expected to continue for Oil and Gas for multiple decades and a lack of investment to grow production, I personally see oil trading above $100 for the foreseeable future.

Final Thoughts

The Permian basin Royalty Trust is one of the few well positioned small cap equities in the Oil and Gas sector that is positioned to return high monthly yields to its investors off of quality past investments during the down cycles of COVID-19. With many investors looking for safe and reliable returns on their capital allocation in an inflationary market, PBT seems to be a quality equity to add to any type of portfolio.

**Disclosure

I have a beneficial long position of shares of PBT that I have been holding since mid 2020

This is an extraordinary well-reasoned analysis of PBT. I own units and I will likely buy more pending cash availability. Absolutely correct that the chronic underinvestment in energy is likely going to keep crude prices high (as compared to recent years) for the forseeable future. It is also incredibly insightful to highlight the operators favorable business decisions. In the oil/gas trust sector, the operator is key. As happy as I am with my PBT I have a huge loss on my lrt (ll&e) that is not listed anymore "0". That trust was great paid out monthly until new operator took it over quantum and breitbern and suddenly no distributions because of escrow reserve requirements. The lrt trust has a 15 percent interest in wells in Florida's Jay Field and production is strong. Yet no distributions... A shareholder replaced the Trustee and there's a case pending in Texas for fraud against the operator for fraud I can only hope there's a favorable judgement and recovery for unitholders. It shows how important the operator is. No distributions for the last 10 years after decades of monthly payouts just incredulous. My financial loss is staggering as the units currently have no value. And the list income is obvious. Oil and gas production is a rough business and there are corrupt fraudsters out there. Fortunately, PBT seems to be in very good and honest hands. Thank you Broncho for this excellent analysis.

Thank you for the write up on PBT. My question- how long will it take for the market to "wake up" to the potential of PBT and increase the price? It seems like the market doesnt really care/follow this potential blockbuster stock.