Permian Basin Royalty Trust(PBT)

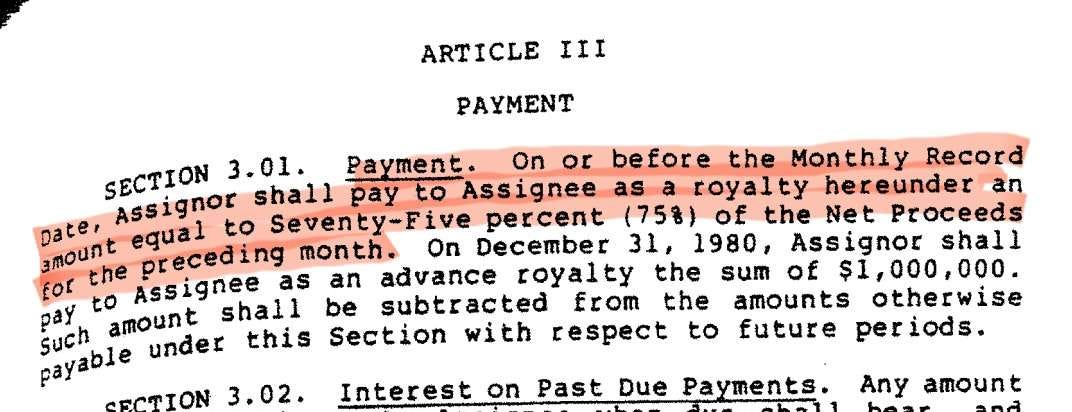

Permian Basin Royalty Trust’s principal assets are comprised of a 75% net overriding royalty interest carved out by Southland Royalty Company from its fee mineral interest in the Waddell Ranch properties in Crane County, Texas and a 95% net overriding royalty interest carved out by Southland from its major producing royalty properties in Texas.

Before getting into the current production and cash distribution of PBT there are a number of updates on the lawsuit of claims against the operator of the Waddell Ranch which is largest asset under the Permian Basin Royalty Trust in relation to value. The Waddell Ranch is a mixture of conventional and unconventional opportunity to bring on low decline barrels through Grayburg, San Andres, Clear Fork, Witchta-Albany, Wolfcamp, Barnett, and Devonian which has potential to payout long-term cash distributions for many years but for the majority of 2024 there has been an unnecessary overhang against the stock price due to the current operators seemingly lack of business ethics. Energy Crisis still believes that the Permian Basin Royalty Trust has some of the greatest potential of any royalty trust with an eventual $0.26-0.32 monthly cash distribution through increased production, true liquids/gas pricing, corrected capital expenditures, and adjusted lease operating expenses.

On May 8, 2024 Argent once again initiated the lawsuit that claims more than $15 million in damages to the Trust resulting from overhead costs and other expenses. The current claim does not cover any expenses that would have been miscalculated for 2023 and 2024 due to the timing of the initial audit being preformed throughout 2023. This is the same lawsuit that originated in December of 2023 in Federal Texas court that later on March 5, 2024, the lawsuit against Blackbeard was dismissed without prejudice. The lawsuit claims are based on a Joint Venture(JV) audit which is a process of examining the financial records and operations of a joint venture between two or more companies involved in oil and gas exploration, production, or related activities. These audits are important for several reasons:

Financial oversight: To ensure that costs and revenues are being accurately recorded and allocated among the JV partners according to their agreed-upon terms.

Compliance: To verify that the operator(Blackbeard), usually one of the JV partners responsible for day-to-day operations, is adhering to the Joint Operating Agreement (JOA) and industry regulations.

Cost control: To identify any excessive or unauthorized spending, and to ensure that costs charged to the JV are legitimate and reasonable.

Performance evaluation: To assess the efficiency and effectiveness of the JV's operations and management.

Risk management: To identify potential financial, operational, or compliance risks that could affect the JV partners.

Typical areas examined in a joint venture audit may include:

Capital expenditures

Operating expenses

Production and revenue accounting

Procurement and contracting processes

Overhead allocations

JV audits are almost always conducted by independent auditors or by the non-operating partners' internal audit teams to insure that the operator is being prudent in their operations and the results are rarely contested as a standard in the industry.

Argent Trust Company(Trustee of the Permian Basin Royalty Trust) v. Blackbeard Operating, LLC Cause No. 342-352596-24

In Blackbeard’s counterclaim, they state that they should be allowed to pass all charges to the trust from their vendors such as Nile Midstream which is a Blackbeard owned and operated company. In fact the majority of services being provided on the Waddell Ranch are done by companies owned and operated by Blackbeard such as Post Recycling. Essentially Blackbeard is asking the court to allow them to invoice themselves for whatever they deem fair and pass those costs onto the trust. However, Blackbeard is also double billing for pipe and utilities while also utilizing equipment for other leases outside of the trust on nearby leases and should be an automatic recovery of funds by the trust from the operator.

The below ‘Oil RRC Adjusted’ and ‘Gather Oil Reported’ should match up as they did under the previous operator ConocoPhillips while the ‘Oil Reported 8k(Trustee)’ line should be 51% of the ‘Oil RRC Adjusted’, which was only the case after Blackbeard resubmitted their data to the RRC.

The gatherer Anchor Crude Marketing and West Texas Crude Transportation(owned and operated by the same group) have slowly gained more accumulative barrels reported for transportation under the Texas Railroad Commission(RRC) since Blackbeard has become the operator of the Waddell Ranch and Nile Midstream purchased 68.74mi of Natural Gas pipe from DCP pictured above. More information can be found about natural gas pricing and production reporting issues from last quarters update here.

Another lawsuit involving Anchor Crude Marketing(Harris County 202329448 - GIBSON ENERGY INFRASTRUCTURE LLC vs. ANCHOR CRUDE MARKETING LLC (Court 125)) claims the gatherer is trucking crude around pipe contracted to another gatherer in order to skip gathering fees.

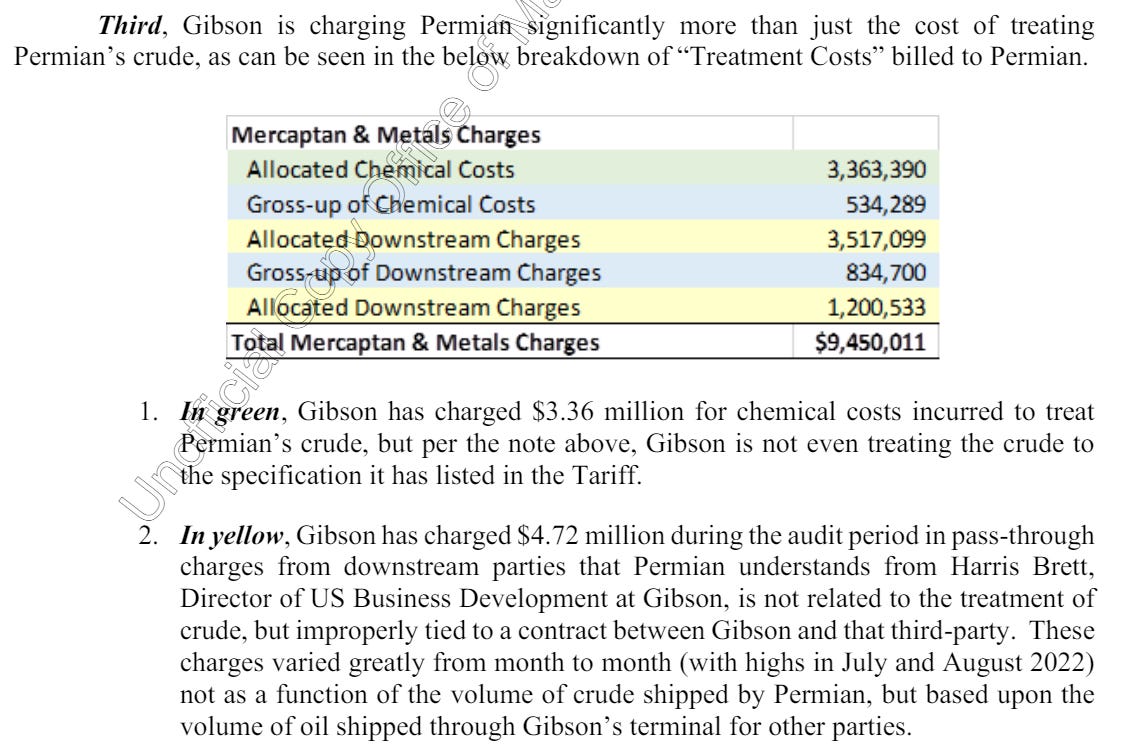

This lawsuit is in relation to another lawsuit in Harris County, 202275226 - GIBSON ENERGY INFRASTRUCTURE LLC vs. PERMIAN PRODUCTION PARTNERS LLC (Court 061), where Gibson has improperly charged Permian at least $9,986,830 during the audit period of July 2021 through July 2022.

Nile Midstream(owned by Blackbeard) is tied into leases in Winkler and Ward County that happen to touch these blocks described in the lawsuit above which attaches to a small portion of pipe owned by Anchor Crude Marketing.

Argent has now filed three monthly cash distribution reports without disclosure of production for those months due to Blackbeard's refusal to offer the required data. From SECTION 2.01 Books and Records of the document it seems pretty clear that the data is owed.

Texas Natural Resource Code(TNRC Section 91.402) would make Blackbeard forfeit their rights as the operator if they do not make payment within 60 days of oil monthly sales and 90 days for gas. Though it is apparent that the recent payments by Blackbeard were sent in an attempt to avoid forfeiture of leases, though a day late on the 60 days for at least one, it is not clear by the press release and monthly reports if gas sales were included in the amount without the calculations since that amount is not due until day 90. It may be safe to assume that even Argent does not know what is included and are only provided a net cash balance to distribute to unit holders based on lack of communication from Blackbeard. The most recent delayed payment puts unnecessary pressure on Argent and their SEC auditors tasked with providing reporting and cash distribution to investors but Blackbeard could(should) eventually receive pressure from the SEC for taking purposeful actions that harm investors of a publicly traded equity as retaliation for the Trustee following their fiduciary duties to ensure that the operator is correctly issuing the correct payments and charges. This also seems to go against the Reputable Prudent Operator standards that most quality professionals in the industry follow regardless of the law.

Blackbeard makes the claim that the trust conveyance only requires Blackbeard to report quarterly for ‘computation of Net Proceeds attributable to such quarter’.

According to the recent 10Q filed by Argent, Blackbeard did not provide the data that they said they were only required to provide within time to process the quarterly filing. In our opinion Blackbeard is not confident in the data they are providing and are attempting to withhold in order to not show intent to misinform moving forward once made aware of potential miscalculations.

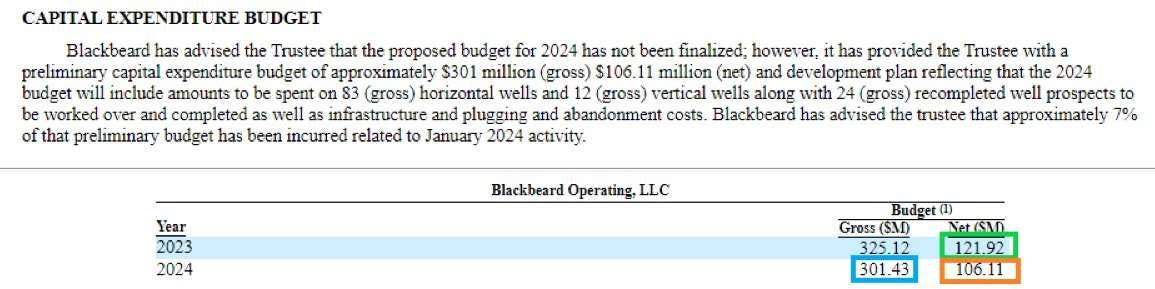

Also notable from the quarterly filing that the capital expenditures are running behind on the budget based on their past spending methods. In the prior 3 years the spending was front loaded into the first 6 months of the year and tapered around November. We have the same opinion of the capital spending as the production numbers above, that they have decided to not provide the information and adjust moving forward post claims. Ignore the incorrect usage of NET and GROSS when comparing 6 month and full year as Argent screwed up the definition of the NET term in a filing earlier in the year that caused a 16% stock crash in a day and have refused to correct it since.

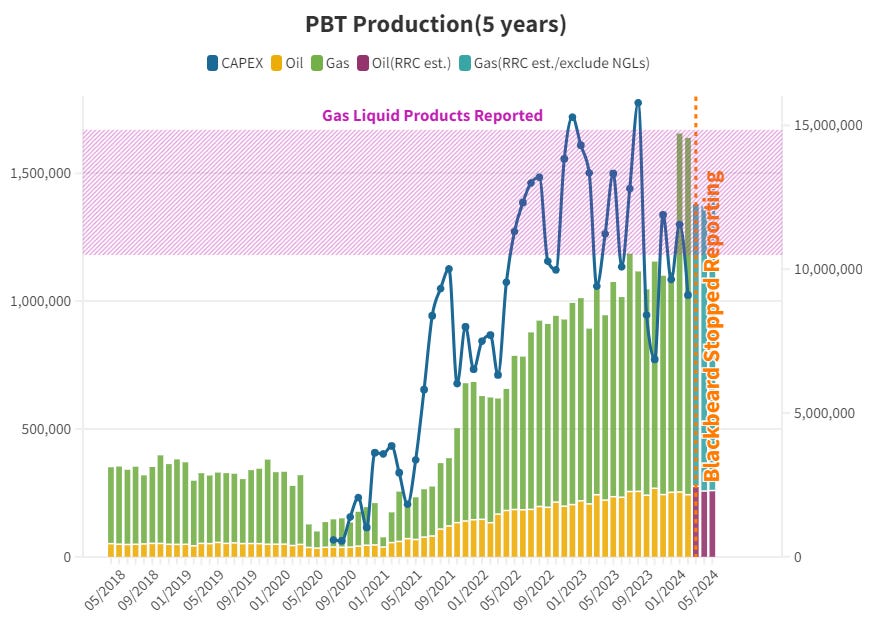

Luckily for investors Texas Railroad Commission(RRC) still requires Blackbeard to report their production. Gas Sales reported on the recent amendments finally match up well with Texas Comptroller data for December on total volume but have not been reported since. Blackbeard NGPL reporting isn't consistent with the previous operator ConocoPhillips or Texas Comptroller. This alone would normally spark an on-site measurement audit where there will be a high possibility that Blackbeard is not correctly allocating volumes to the trustee. Add in the claims in the Gibson lawsuit that the gatherer Anchor Crude marketing willingness to move barrels outside of normal operations and contracts and Blackbeard’s close ties to this operation, including in other counties where the lawsuit was claimed, and boots on the ground to hold Blackbeard’s hand and guarantee quality controls seem like the obvious move.

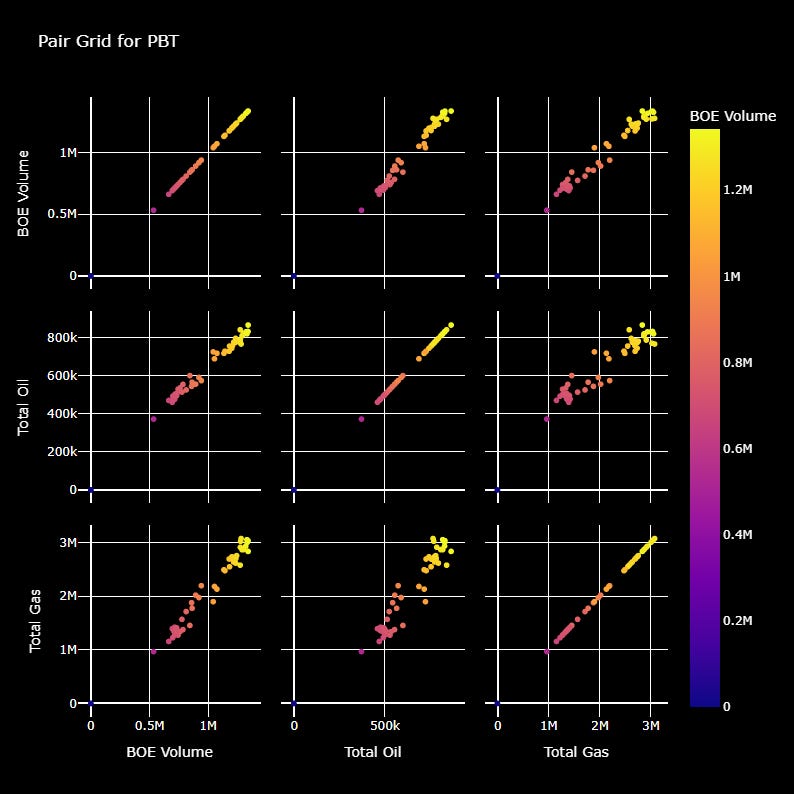

PBT and non-PBT 24hr completion tests for the region:

PBT equity price performance plotted against oil and gas prices and the strength in the dollar:

PBT 24hr test completion data:

PBT 24hr test completion data(Blackbeard Crane County):

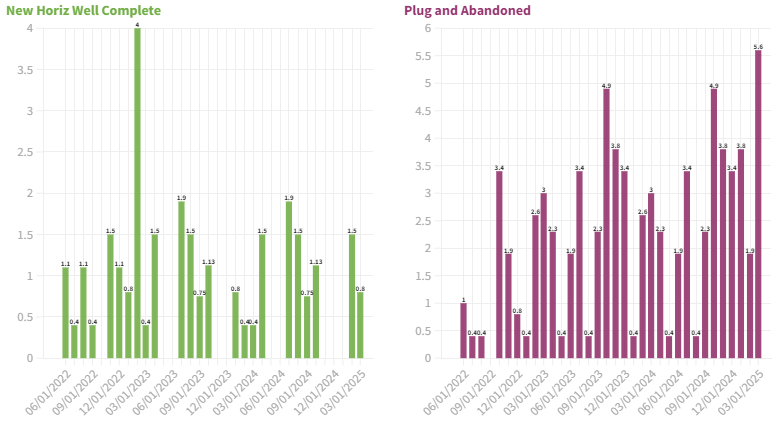

Blackbeard projected the 2024 capital expenditure budget(CAPEX) for the Waddell Ranch properties, which has not been finalized, estimated at $106.11 million (net to the Trust) on 95 new drill wells and 24 recompletions in 2024 as compared to 77 new drill wells (gross) and 142 recompletions (gross) with continued retirement of assets through plug & abandoned wells. Blackbeard no longer updates the trustee of the drilling program process since May production.

Sabine Royalty Trust(SBR)

Sabine Royalty Trust is an express trust formed to receive Sabine Corporation's royalty and mineral interests, including landowner's royalties, overriding royalty interests, minerals (other than executive rights, bonuses and delay rentals), production payments and any other similar, non-participatory interest, in certain producing and proved undeveloped oil and gas properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas.

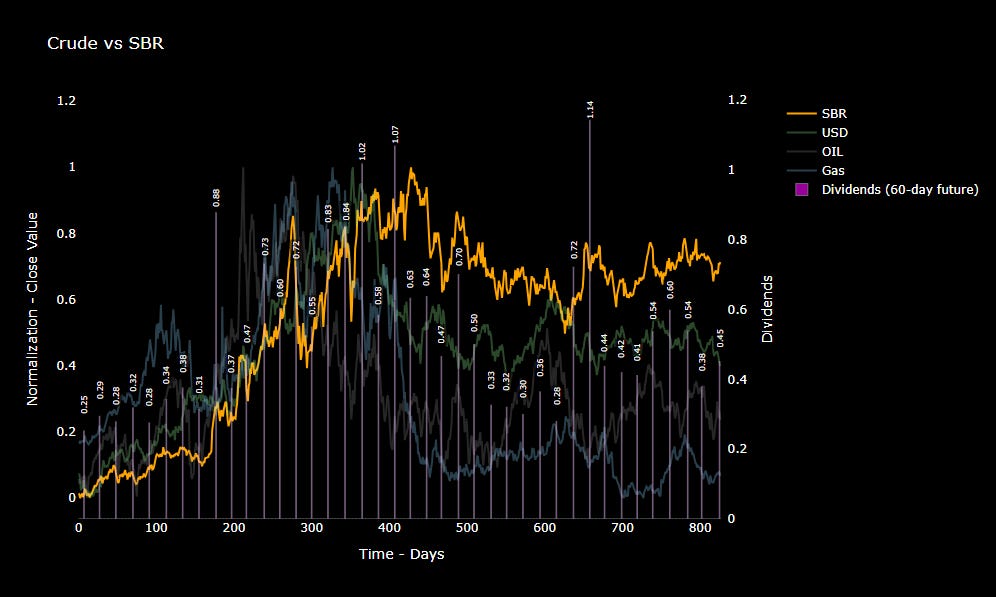

SBR equity price performance plotted against oil and gas prices and the strength in the dollar:

San Juan Basin Royalty Trust(SJT)

The principal asset of the San Juan Basin Royalty Trust consists of a 75% net overriding royalty interest that burdens certain oil and gas interests in properties located in the San Juan Basin of northwestern New Mexico.

The average natural gas price decreased from $3.69 per Mcf for the three months ended June 30, 2023, to $1.92 per Mcf for the three months ended June 30, 2024. With the 2024 CAPEX and lower pricing for natural gas, SJT will continue to trade at a discount in the near future. The cash distribution at a three month no distribution makes for a clearer bottom on the equity for an opportunity to begin accumulating again.

SJT equity price performance plotted against oil and gas prices and the strength in the dollar:

Permarock Royalty Trust(PRT)

PRT equity price performance plotted against oil and gas prices and the strength in the dollar:

Any truth that the lawsuit isn’t being heard until 04/25?