‘If I wanted bad analysis I would go to Seeking Alpha’ - Broncho

I originally started my substack after reading an article on Seeking Alpha(SA) that got nearly everything wrong about a holding that was researched heavily internally and decided to submit a rebuttal with correct information. Though the article that was being responded to was an opinion piece at best, the editors at SA required me to pile on more information with 5 different iterations of the original submission. The last request was to add context to the definition of ‘what a royalty trust is’ and in turn decided to utilize the specific language from this royalty trust’s conveyance since not all trusts are structured the same and included links to the document as a source. It was apparent why so many utilize substack in order to write their own way after personally participating in this exercise since the article was ultimately denied by the editor due to ‘plagiarism’ for sourcing the definition from the original documents of the trust, once again with links sourced, and to this day I am still dumbfounded by that decision. Recently, an article was sent over to us at Energy Crisis about that same royalty trust with some poor analysis including using wells operated by the same company in a completely different region to compare the mixture of conventional and unconventional wells currently being developed on the Permian Basin Royalty Trust(PBT) along with some glaring errors around production increase and CAPEX/OPEX. Though this article does a much better job at being data driven, it misses the mark on the most important piece which accounts for the production data off new completions and an eventual fully tapering of high cost drilling budget to maintain leases. Since we receive a ton of messages from funds, analysts, retail investors, and friends that are aware this is our largest holding we attempt to do an update on the current state of PBT every quarter to continue full transparency.

Property Recap

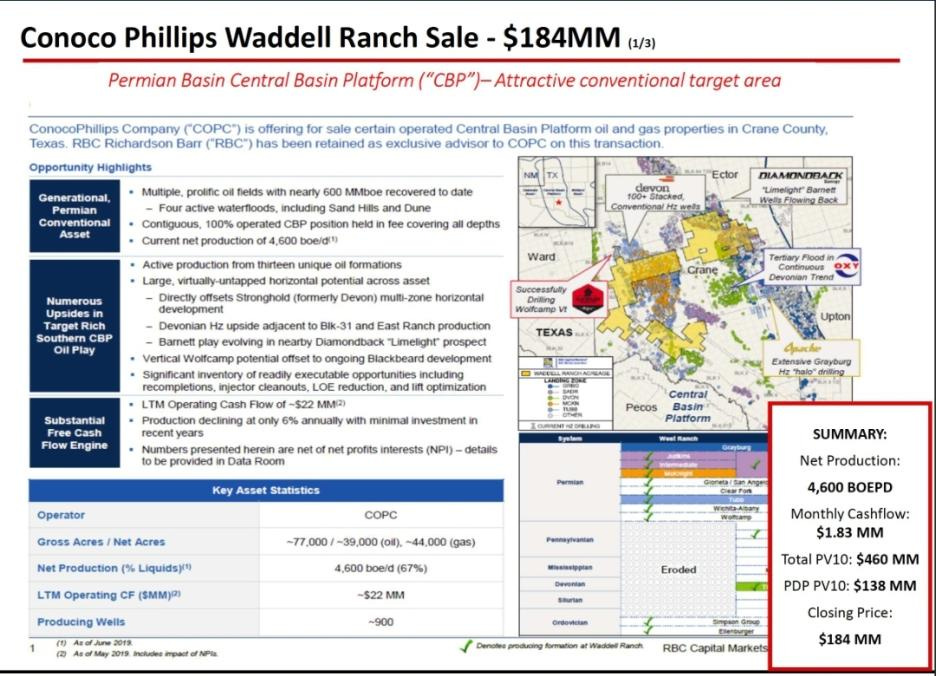

The Permian Basin Royalty Trust(PBT) is a long standing royalty trust that pays a monthly cash distribution on the oil and gas it produces from leased properties in the Permian Basin. PBT includes a 75% net overriding royalty carved out of the original Southlands fee mineral interest on the Waddell Ranch in Crane county comprised of 78,715 gross (34,205 net) producing acres and a 95% net overriding royalty interest from its major producing royalty properties in Texas.

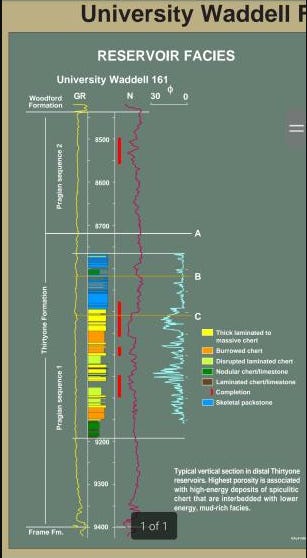

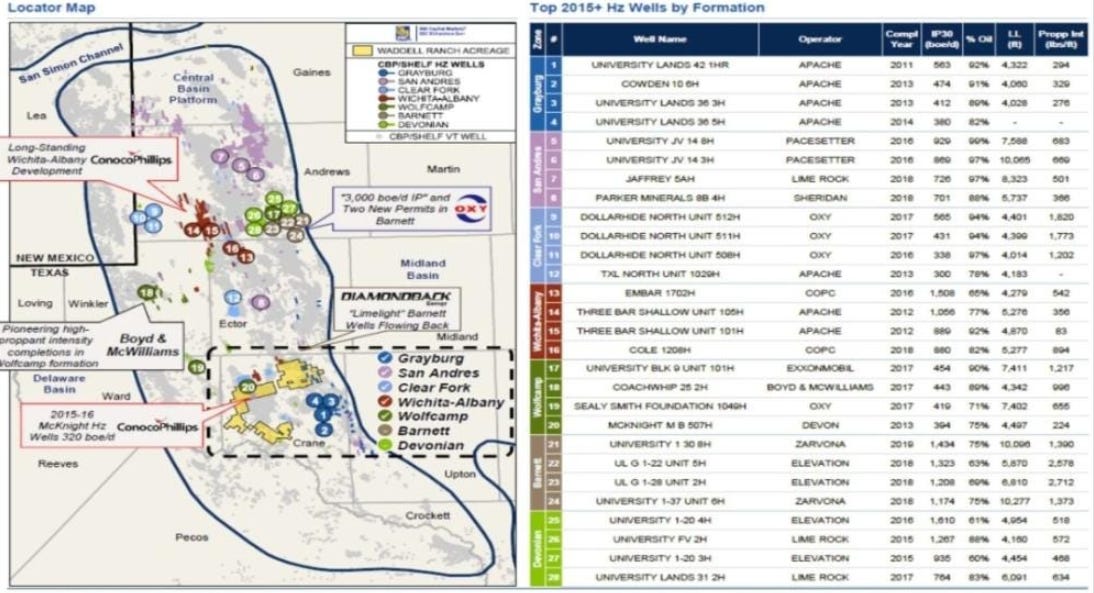

More info about the targeted fields can be found here but I also wanted to attach relative information before for quick reference below.

Below is some material from XTO Energy which explored these same fields and the current CEO of Blackbeard worked as an engineer during the time of these developments.

Current Sentiment

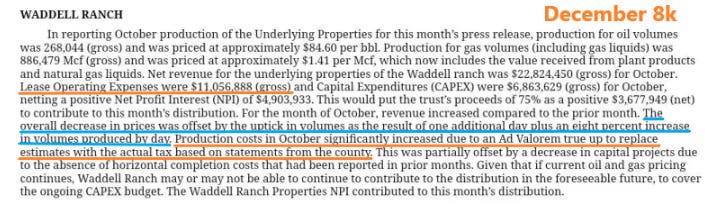

Most Oil and Gas equities have had a significant reversal from the highs in the second half of 2023. PBT in recent weeks has taken a bigger hit in relation to the price of oil and gas while producing higher cash distribution for the past 2 months of lagging oil prices that averaged $84.60 for the month of October and $88.56 in September according to 8K filings by the trustee. These slightly higher prices produced a monthly cash distribution for those 2 months of $0.15717 and $0.106232 per share.

We use a proprietary solution to calculate the current Predicted Future of the royalty trust. Seen in charts below factoring many weighted points such as 3 month cash distribution, CAPEX/OPEX, production growth, oil & natural gas price, and the current share price to determine if the equity has been priced wrong in either direction. PBT is currently underperforming the Predicted Future price target significantly based on oil and gas prices and production levels relative to the cash distribution. This was flipped in early October of this year where the price action of the stock was overshooting to the upside and overvalued at the current production rate and cash distribution. The opposite is now true with the recent selloff below $15 and the overshoot to the negative side making it a prime buy at these levels.

Depending on the yield chosen to calculate, which will be discussed in depth in the conclusion, would put the fair value range of PBT $18-23 based on a 8-10% yield and zeroing out this past month’s one time excess Lease Operating Expense on the assumption that the recent ‘true up’ is a one off. This is a fair assumption since the trustee attributes the large increase to Ad Valorem tax.

Monthly Cash Distribution

Current monthly payments are suppressed with continued capital going towards new drilling since early 2020. These investments added substantial production growth to the leases over the past 2.5 years taking production before Blackbeard became the operator from sub 100k BPM to a current +500k BPM gross based on production reports. Production could possibly be much higher in the range of 650-680k BPM which is outlined below.

All CAPEX goes towards the Waddell Ranch properties operated in Crane, TX while the Texas Royalty Properties under the trust contribute to the cash distribution every month and are not subject to the debt taken on by drilling which guarantee a monthly cash distribution payment baseline. These properties have at a 95% net overriding royalty interest and average volumes of 18,000 barrels per month(BPM) of oil and 23,000 Mcf of gas putting a floor in on $0.03 monthly with oil above $80.

Once Waddell Ranch’s new production capacity is fully developed and CAPEX is slowed the additions of revenue generated to the monthly cash distribution brings in a much higher potential where 268k BPM of oil flowed through those fields in October.

Current Drilling(2023)

New Permits vs. Spud Dates

Blackbeard projected 2023 capital expenditure budget(CAPEX) for the Waddell Ranch properties was estimated at $96.8 million (net to the Trust) after a decrease in the original statement with a projection of 30.75 new drill wells and 45 recompletions along with 37.5 plug & abandoned wells. ConocoPhillips sat idle developing new production from 2016 to 2020 spending only $17.95M in capital expenditures over 4 years prior to Blackbeard Operating taking over the trust. According to the most recent filings approximately 76% of that budget has been incurred. The accumulative completions from March 2023 to December 2023 from 8K reports show 24.2 new vertical wells, 7.175 Horizontal wells, 46.3 recompletions, and 42.4 plug & abandoned wells were completed overshooting the current return of wells versus the budget spent. With continued decrease in oilfield service costs, the budget is currently trending in favor of more wells able to be completed with less capital allocation.

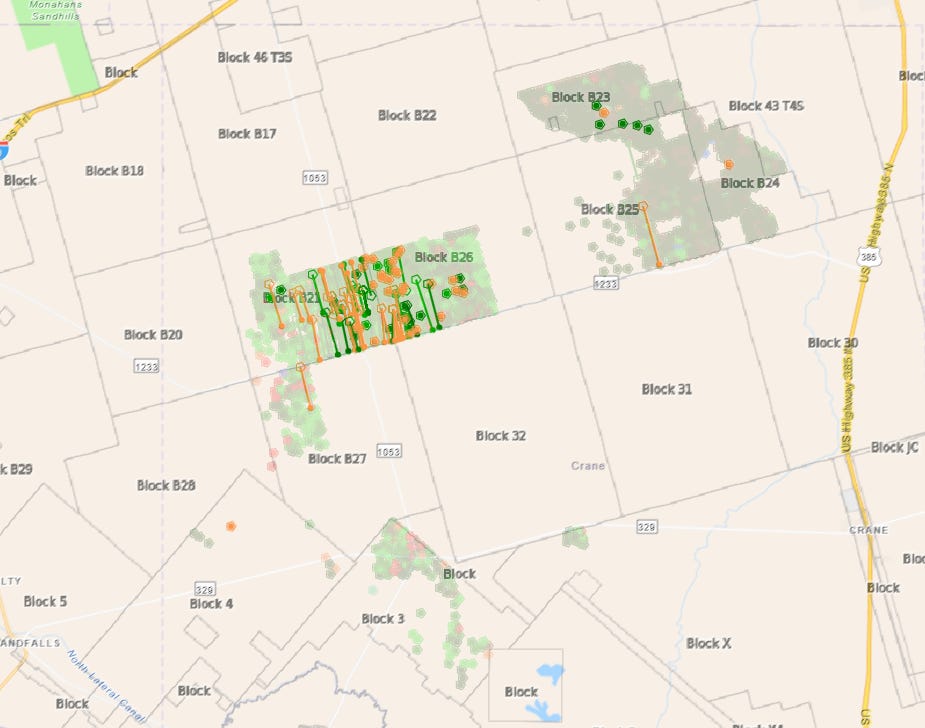

Infrastructure Additions

Anchor Crude Marketing LLC had pipe permitted through both Permarock and Permian Basin Royalty Trusts in 2020 that Blackbeard operates in the area under permit #10239 for 2.1 miles of 6.625” pipe. Purple pipeline in the map above indicates the total pipeline installed at the time. At the time the leases tied to this were permitted under 4030 surface commingling leases and into a gathering station on Waddell. Pipe size and upgrades to the gathering station in this region are not things that are typically done without the expectation to use the capacity of the lines moving barrels.

Targa Resources Corp. is expanding its cryogenic natural gas processing and fractionation capacities as part of the operator’s broader strategy to further extend its Permian basin gathering and processing position amid heightened demand from producers. This includes upgrades to the Sandhills plant current capacity of 165MMcf/d to 275MMcf/d what is to be fully operational in 2023.

CEO Matt Meloy said ‘oil and gas volumes are ramping up across both basins and the Midway plant will allow more flexibility to flow volumes between the two systems, improving efficiency across the board. The addition of Midway will allow Targa to idle one old Sand Hills processing plant that had operational problems, higher maintenance costs and limited capacity’. The Targa Sandhills plant and new Midway sits directly in the middle of PBT leases shown below.

Below you can see additional capacity added for natural gas pipeline to the upgraded Targa plant leading off the PBT leases. With the change over to the new plant there was noticeable loss of production for natural gas recently. This same loss in production would also be seen in the oil sales for the leases as production would be choked back some to mitigate the need for excess flaring from a planned project compared to an unforeseen event.

CAPEX/OPEX

Budget for 2024 should be in the next report in January. Last year the original budget had a decrease of $135M in Jan 2023 to $122M in Feb 2023 and settled at $96.8M in Mar 2023. This was partially attributed to the costs in late 2022 in the Permian Basin for oilfield services(OFS) being projected higher but have since come down dramatically.

CAPEX is expected to decrease due to Blackbeard’s needs to return capital of the last 3 years of investment to their stake holders. The reduction in spending can already be seen over the last few months’ reports from the trustee.

Service costs, pipe, and day rates have also been much better compared to the pop in 2022 which is why we saw a decrease in budget beginning of the year. Blackbeard is an NGP backed exploration company and will need to start seeing their investments returned and there are still massive production gaps on the leases based on public data submitted the the Texas Railroad Commission(RRC). One possibility is Blackbeard is chocking back production to ramp into a sale of their assets as fully developed and we see a pop off the production increase. Typically royalty trusts are leveraged by investors for the monthly cash distribution and though capital was well spent on production growth, the negative Net Profit Interest(NPI) for the Waddell Ranch isn’t sustainable for investors or Blackbeard long-term.

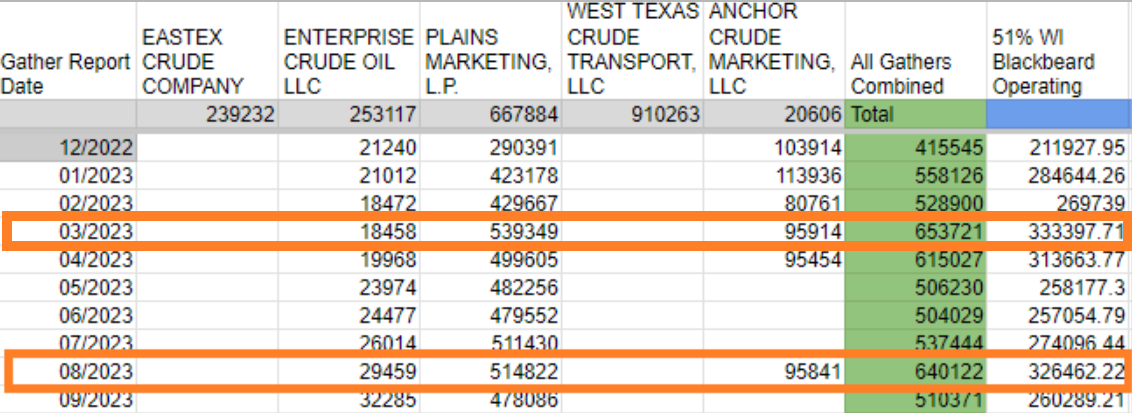

Missing Production

The same gather(Anchor Marketing) that permitted the new pipeline for crude through the commingling leases and into the Waddell gathering station has had some major gaps in reporting in the past but all gathers reporting crude for the PBT leases show a +300k barrels per month(BPM) production rate that is not being accurately reflected in the current production reports for both the Railroad Commission(RRC) and the trustee 8K filed with the SEC.

This same scenario happened last year where the gather eventually reported barrels for the missing months and the trend was held to be accurate. One worry when missing reports is that a certain month may have more barrels on the report that was shifted from another month due to battery tank storage but this hasn’t been the case in the past and the current August report doesn’t suggest that it is over inflated in any way.

A ‘true up’ on the operator to explain these gaps in relation to the RRC reports submitted for production of oil will need to be resolved and understood better. This is a potential catalyst for shareholders but the story still lies in the current production output of the leases and the stability of the price for a barrel of oil to stay above the $65 on average.

Completion Reports

Tracking all completions on the leases since Blackbeard took over as the operator show very few wells with low operational results. Mostly all wells drilled are within a reasonable range of initial production to guarantee a quality return on capital spent. With Blackbeard operating multiple rigs simultaneously on long-term contracts along with the region of the Permian that is highly accessible allows for total lower cost per well.

Surface equipment surveyed by drone shows a continued investment in higher production runs. Since PBT leases are not wildcat drilling the risk is extremely low and with a cut in CAPEX a return on capital would be instant.

Gas to Oil Ratio

Continued monitoring of new wells production rates on oil vs. gas still aligns with the original thesis that this is a strong oil play with gas capacity being a nice to have when prices are high such as the events in 2022. With the transport into Waha hub that brings the spot price of the gas off these leases to a much lower price over Henry hub, continued growth on the basis of oil production is necessary.

The projected volume of natural gas from the current wells in the first quarter of 2024 is currently set at 1.4M Mcf which is substantially higher than the current 886k Mcf reported in December 2023 for production measured in October.

Other additional projects are also helping to alleviate bottlenecks for gas flows in the area that suppress prices towards the Waha Hub:

Targa Greenwood Plant in the Permian Midland 275 Mmcf/d

Targa Wildcat II 275 Mmcf/d

Targa Roadrunner II 230 Mmcf/d

Targa Bull Moose Plant 275 Mmcf/d

Saguaro Connector dependent on Mexican LNG export terminal 2.8 Bcf/d

Whistler Pipeline increase capacity by 0.5 Bcf/d

The Permian Highway Pipeline increase capacity by 550 MMcf/d

The El Paso Natural Gas Line 2000 500 MMcf/d

Nacero Natural Gas to jet fuel plant**

** Recent article published by Energy Crisis explaining this project and currently do not believe it will ever be completed.

The Permian gas production has been a problem for some operators needing to move volumes which tend to get lower rates than are desirable but as new relief is added with the projects above the price paring of this area with the spot price of Henry Hub should set a desirable return on the additional gas.

Declines

Decline rates across the new production in relation to new drills and recompletions shows a long term quality trend. PBT’s major focus is on lower cost vertical wells with lighter production but lower decline rates means the upfront costs are not washed out quickly with high production rates but can be easier to project out long-term since the wells’ production shouldn’t drop significantly after the initial production of 90 days.

The geology of this region has made this area an ideal target for growth in the Permian Basin being a large continuous block with centralized facilities and close proximity to some of the largest oilfield service companies in Odessa, TX, located less than 5 miles from the properties. The performance of these fields dating back nearly 100 years with production increases realized after every major investment of capital into new exploration due to a multi-zone depth profile.

From the recent Seeking Alpha article, the statement is made that they do not have insight to the drilling productivity due to no longer subscribing to various services that often provide future drilling data. With CAPEX being the largest overhang on the trust and a long term need for investment that ConocoPhillips also outlined in their prospectus for the sale of the leases this seems like a point that should of been investigated further before making any financial assumptions.

Even without these tools the trustee reports new sales volume of production off of new drills and recompletions showing that new wells are adding to production with low declines and that many of the recent wells drilled, especially the horizontal wells that attribute to a larger cost of capital, have not had the time for production to be shown. Those larger cost horizontal wells have also decreased recently helping to cut the CAPEX budget towards the end of the year.

Projected Production/Strategy

Current production is at 335k BPM according to the gather reports submitted to the RRC by third parties contracted to transport crude for Blackbeard. With lowered CAPEX($20-25M/year) into maintenance and plug/abandonment obligation and high Lease Operating Expenses, even with $60 oil, would put the cash distribution at $0.18 per month to bring PBT well back into the high $20s range on a basis of a 8-10% yield. Though, its hard to imagine $60 oil even in the short term and higher oil prices change that price target dramatically. Target to divest is much higher than current prices but tighter controls from the trustee on Blackbeard to understand their total strategy would be helpful as the cash distribution ramp into lower budget will allow for a long-term hold on the current reserves.

At Energy Crisis our long-term strategy is to hold for monthly cash distribution payouts and are not as overly affected by the price of the underlying equity trading. We enjoy our cash distribution and monthly dividends that help keep the lights on and our content forever free. Regardless of our investment strategy the equity has well overshot in the selloff and due for a rebound if all the above even holds partially true. Using a yield between 8-10% to calculate would put PBT $18-23 and zeroing out this past month’s one time excess Lease Operating Expense on the assumption that the recent ‘true up’ is a one off. With energy prices more stable in 2023, the yield expected should be calculated higher when paring the price of PBT trading compared to the past 7% average yield used for our analysis but disruption in the oil market seems inevitable with consent threats to the supply side where 500K-1M BPD loss in production globally can force prices up dramatically.

Thank you for the detailed update on PBT and sharing your expert analysis.

What is your thoughts on the recent lawsuit between the Trust and Blackbeard? Is this about production or expenses or both?