If you follow my twitter ramblings, it would be no surprise to my readers that I am very short in theory MMTLP or originally TRCH even though I currently do not hold a position and haven’t in the past year nor do I know anyone currently short. That also may come as a surprise if you follow MMTLP, the soon to be private Oil and gas company that is a spinoff of assets from a reverse merger, because of my consistent posts at how the assets and the management do not seem to be of quality or a legitimate investment. My motives to continue to bash a company that so much retail is long and essentially trapped in has been constantly addressed on Twitter. Even though I don’t necessarily feel the need to justify my reasons of calling out a scam from Musk to another potential defaulting Oil and gas company, I will say that I believe retail traders are and have been a target by larger investors as exit liquidity for the past few years. If it’s oilfield related fraud, I tend to take it personally when misrepresentation is rampant because of my close ties to the industry.

So where to begin on my short thesis into Metamaterials spin off of their Oil and Gas assets? First this is obviously not financial advice and the goal is to break down the history and the misconceptions of the structure of these assets. This assessment should be viewed as a contrarian view to a very small but loud group trying to promote a position that even comes with a mascot of a lady dressed in a bird costume spouting some very suspect math for Oil and Gas acquisitions. Secondly let’s debunk a few things upfront that have been incorrectly stated about the assets and their location.

The Permian Basin

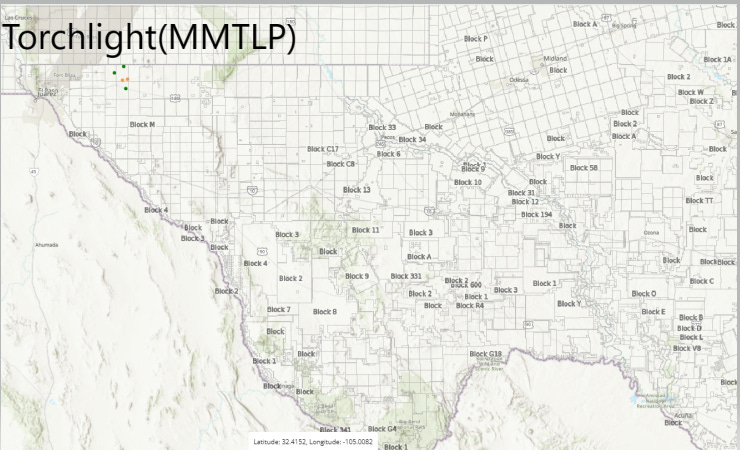

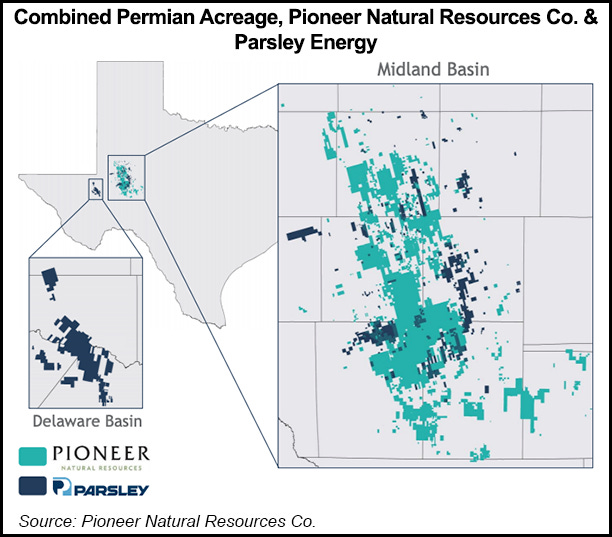

Recent headlines about mergers and acquisitions in the Oil and gas industry have been used to try and pin down a valuation on the Torchlight assets now under MMTLP. This included DoublePoint($6.4B) and Parsley Energy($4.5B) accusations in early 2021 and the recent Firebird Energy($1.6B) by Diamondback with the main viewpoint being that these ‘Permian Basin’ assets sold at a premium. The reference to the Permian is confusing because the assets being developed are in the Orogrande Basin a subset of the Permian, but far from these sales that they can physically be while still remaining in Texas.

Texas is a big state and the leases above acquired by Pioneer are in the Permian Basin which consists of the Delaware, Central, and Midland Basins within the Permian Basin.

MMTLP assets are in the Orogrande Basin which hasn't produced the same results as similar geologies while located far West Texas near El Paso where there is little infrastructure currently. The area has a lack of oilfield service providers which adds to the costs associated with the drilling activity in the area since crews and equipment need to be transported and housed in the area for long periods of time. This was discussed by John Brda in an interview in 2018 and not much has changed since.

The majority of new permits since Jan 2020 are located near the Delaware, Central and Midland Basins in the Permian far from the Oragrande. Below it seems that the MMTLP properties are basically the only assets being explored.

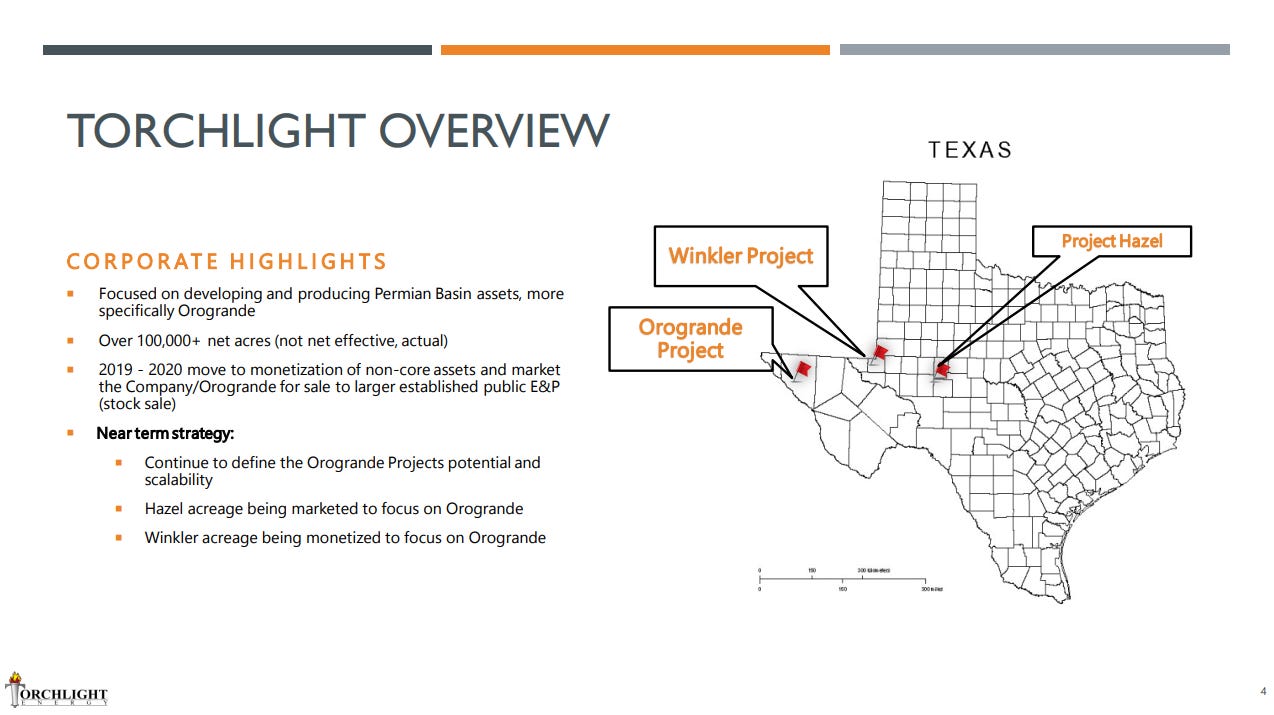

Prior to the reverse merger with Metamaterials the only producing leases that were under Torchlight control were sold off under the Winkler and Hazel project located in the Delaware and Centeral Basin and leaving only the Orogrande project in the Oragrande Basin.

Undeveloped vs Developed

Developed Oil and Gas leases have had some traction over the past few years as the sector has become bullish again with a shortage of oil. However many of the major producers are still sitting on their growth plans in order to not continue the sins of the past chasing growth. A recent acquisition of Firebird Energy by Diamondback that has assets near and around Odessa/Midland TX is currently producing 22k Barrels of Oil Equivalent(BOE) per day and a projected 25k BOED later this year for a purchase price of $1.6B.

"With over 350 locations adjacent to our current Midland Basin portion, this asset adds more than a decade of inventory at our anticipated development pace," Travis Stice, CEO of Diamondback, said in a statement.

Even though the structural landscape of oil supply sets up the sector for a multi year bull market the focus of all acquisitions is to buy producing wells that fit into the current lease structure by distance and geology. Other similar deals done by Pioneer in the past year can also be easily assessed for their strategic location to current assets under the companies management.

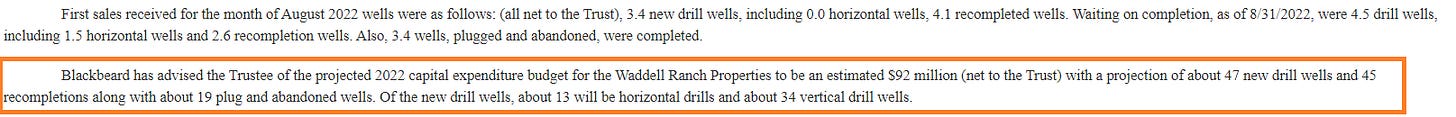

Looking back at Firebird, it’s interesting to note that the 22KBOED of production matches up nicely with the Permian Basin Royalty Trust(PBT) that has been featured many times on this substack(our due diligence even included drones) and is in fact located in the Permian Basin. PBT is currently producing 653K BOE/month or 21.7K BOE/day but is expected to reach 850K BOE/month (28K BOE/day) by the end of the year.

The PBT operator has been investing and chasing new growth in a time when costs were suppressed but it’s also important to note the capital required to bring on this new production was no small amount and MMTLP assets will need to give up some significant interest in order to entice an operator to do wildcat exploration compared to traditional drilling done in the Permian were there is a low chance of coming up empty.

The point is that a large amount of capital is required in extracting hydrocarbons regardless of the potential and the shift of focus to certain parts of the Permian Basin make more financial sense for investors looking for a return on their capital.

Past to Present

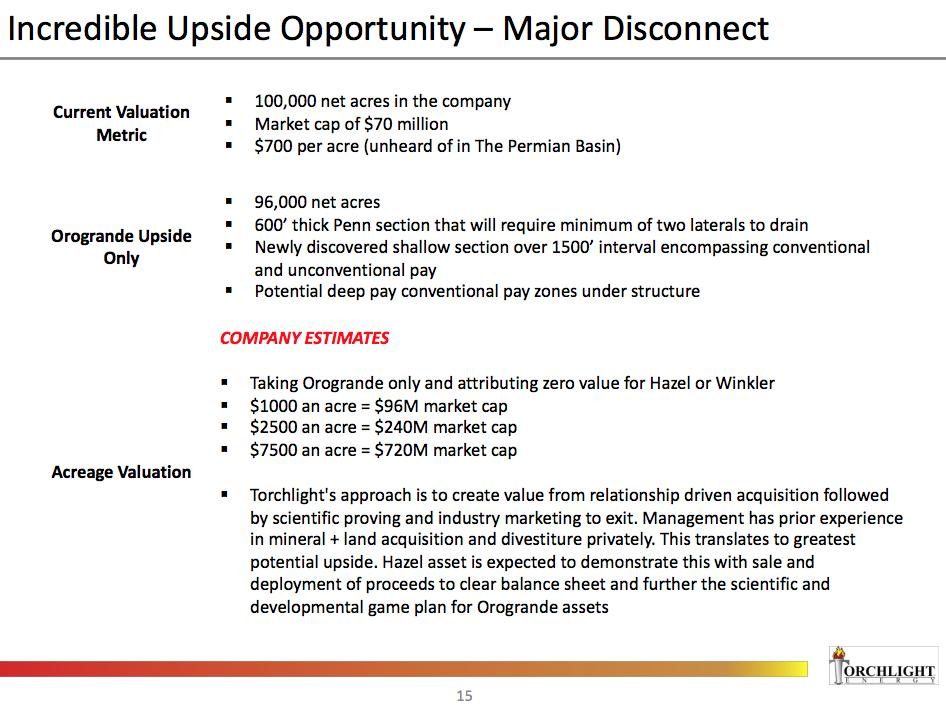

Some of the math presented on the Oil and gas assets under MMTLP seems bullish at first glance since it doesn’t take into account a lot of factors related to the industry such as the cost needed to extract these unproven barrels.

As many were quick to point out in these threads, University of Texas lands has a stake in these assets as a Mineral Owner of 20%.

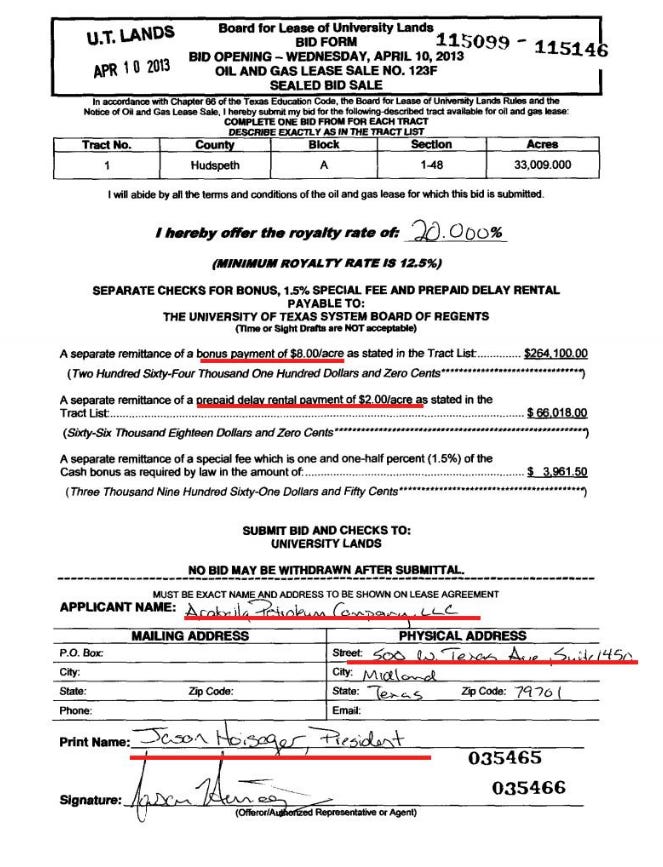

Some of the leases were originally bought in 2013 when oil was above $90 in a boom with massive money coming into E&P companies. Arabella bought from UT lands against no bidders and paid a fee in order to not develop the land.

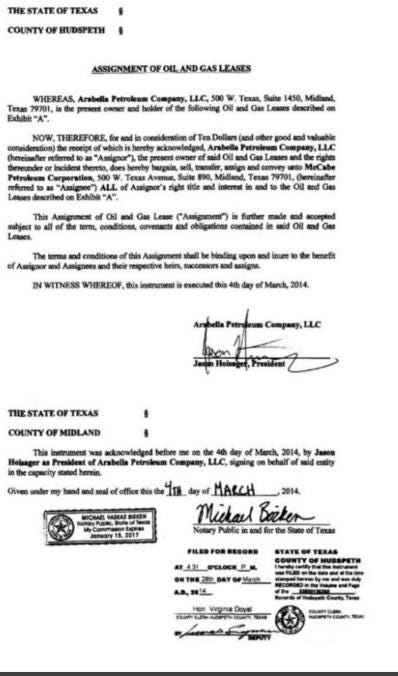

Arabella then sold to McCabe the Orogrande land. Arabella was a single person ran by Hoisager and later filed bankruptcy 7/15/2015. Filings by trustee paint Hoisager poorly:

The Trustee believes that Jason Hoisager, Arabella Exploration Inc. and Arabella Exploration, LLC were the beneficiaries of actual and constructive fraudulent transfers of cash and oil and gas properties belonging to APC, and that such transfers were made with the actual intent to hinder, delay, or defraud APC’s various creditors and/or were made with APC receiving less than reasonably equivalent (and in most cases, no) value for the transfer and at a time when APC (i) was insolvent or was rendered insolvent by the transfer; or (ii) was engaged in a business for which the debtor’s remaining property was an unreasonably small capital.

http://bankrupt.com/misc/txwb18-1570098tmd-879.pdf

The geologist that is mentioned in the original Torchlight 3.2B barrel oil discovery also seemed to know Jason Hoisager very well.

It was around one in the afternoon on a Wednesday in August, and another bustling lunch hour at the Petroleum Club, in Midland, was under way. “I don’t come here as much as most people,” Jason Hoisager told me as he walked up the marble staircase. “Maybe twice a week.” Hoisager is a dimple-cheeked up-and-comer. He was riding the high from having recently hit a 1,200-barrel-a-day well, which, based on current prices, will make $10 million by next fall. One of his partners on the deal was Rich Masterson, a mellow geologist with wiry, shoulder-length gray hair. The two men, wearing button-down shirts and slacks, were meeting another Petroleum Club member, local oilman David Arrington, for lunch. Arrington, who lives in one of the biggest houses in town, is best known for drilling acreage in the Barnett Shale before most of his associates would even consider it, then selling those interests, in 2006 and 2007, for $855 million.

https://www.texasmonthly.com/articles/meanwhile-in-west-texas/

There have been mentions of Masterson being a famed geologist targeting discoveries of the Wolfborn in the Delaware basin. One article here notes a few other potential deals to put a value on the discoveries:

While the price oil has crumpled under deflationary pressures and employment in the oil patch slashed, the price of land in the Permian Basin has held up. In deals done recently Diamondback Energy paid $23,845 per acre for 11,948 acres in the Midland Basin in May. In early July, LINN Energy sold 6,400 acres in the Wolfcamp district for $16,000 an acre. Wolfcamp is similar to Wolfbone and hopefully for the latest discovery in Orogrande. While energy prices were far higher last September, the price of almost $51,000 an acre paid by Encana Corporation for 140,000 net acres gives you an idea of the potential for these deals.

The Wolfcamp is the formation being targeted in the early mentioned Permian Basin Royalty Trust(PBT) through vertical fracs but more notably is the mention of Linn energy that went on a buying spree of undeveloped acres that resulted in the bankruptcy of the company. The following are snippets from a whistleblower complaint involving multiple parties of Torchlight over the years that was filed in 2019 by an energy analyst with the Twitter handle @EnergyCredit1 and contributor to other fantastic energy content on intersection.io. This is a very lengthy portion quoted out for ease for the reader from the complaint. If you are uninterested in the complaints you can move on to section Working Interest and Recoverable.

In August of 2014, Torchlight paid $3.3 million dollars, or $20/acre to buy the Orogrande leases from Hudspeth and gave McCabe a 10% reversionary back-end interest. Within less than 1 year we are seeing the transfer of assets by double the original price by an executive holding to shareholders and giving McCabe some controlling interest.

In August of 2014, after buying the Orogrande acreage for only $3.3 million, the company immediately began releasing press that it was worth upwards of $9 billion. The timing of this is relevant since Torchlight was currently very low on capital and by November of 2014 did an offering to raise based on these claims.

On October 18, 2018, TRCH announced it had closed on $6 million of 16% unsecured debt financing. $3 million of the proceeds were used to repay a promissory note held by Gregory McCabe, the Company’s chairman. As part of the deal, McCabe Petroleum, owned by Gregory McCabe was required to give a put option to the lender allowing them to receive the principal amount back from him and in addition, if there is a ‘Fundamental Transaction,’ McCabe Petroleum could be forced to pay a $1.5 million fee (25%) to the lender. No interest or principal is due until 2020.

As part of the October 2018 financing, Torchlight claims they formed a special committee of independent directors and engaged an independent financial consulting firm for a fairness opinion deeming the transaction appropriate.

he statement made in its October 18, 2018 8-K filed with the SEC appears to be false and misleading for the following reasons.

o After the recent refinancing, it TRCH has $17.6 million of UNSECURED debt.

o At year-end 2017, TRCH indicated they had total reserves of 9,600 barrels of oil equivalent, with only 2,300 of that oil.

o The reported PV-10 at YE17 was $96,000

o Since its inception as a public company in 2010, TRCH has had cumulative revenue of $11 million ($9.8 million oil revenue); it has only produced 140,349 barrels of oil and has never produced more than 200 barrels of oil per day on a quarterly basis with the daily average being 60 barrels a day.

o Over the same timeframe, TRCH has reported $56 million of cash capital expenditures; it has reported $49 million of general and administrative expense; and it has reported $20 million of stock and warrants issued for “services,” …

Mr. Brda has an interesting background. He was a defendant in a federal RICO case relating to a Ponzi scheme, which was referenced in the Company’s 2012 10-K:

“Involvement in certain legal proceedings. In November 2007, Mr. Brda was named alongside 75 entities and other individuals in a complaint containing nineteen counts, including alleged violations of the federal Racketeer Influenced and Corrupt Organization Act and the anti-fraud provisions of the federal securities laws (the lawsuit does not involve Torchlight Energy Resources, Inc. in any way). Several months later, Mr. Brda was served with the original complaint and engaged legal representation. Based on Mr. Brda’s minimal connection to the investments at issue in the complaint, he instructed his attorney to contact plaintiffs’ counsel and try to negotiate a prompt resolution of the case and dismissal of the claims against him. His attorney contacted plaintiffs’ counsel and thereafter told Mr. Brda that the claims against him had been resolved when – in fact – they had not. Unknown to Mr. Brda, he remained a defendant in the suit, and in part because no answer was filed on his behalf, and in part because he was never served with any of the relevant papers after the original complaint, the court entered a default judgment against him in September 2012. Mr. Brda received no actual notice of any kind regarding the continued existence of any claims against him, any entry of default, any motion or hearing for default judgment, or the default judgment itself, until March 2013. He promptly retained legal counsel who filed a motion to vacate the default judgment on April 11, 2013, which motion is now pending. A motion for leave to file an answer to plaintiffs’ first amended complaint was also filed on that date. Discussions with plaintiffs’ counsel for the possible resolution of this matter are ongoing. Mr. Brda contends that all claims against him in the litigation are without merit, and that the court should dismiss the counts against him.”

The motion to vacate referenced was accepted by the court, which included a settlement. As part of the motion to vacate, Mr. Brda filed an affidavit describing his involvement in the American Pallet Ponzi scheme.

“Mr. Wurtele has served as our Chief Financial Officer since September 2013. He is a versatile, experienced finance executive that has served as Chief Financial Officer for several public and private companies. He has a broad range of experience in public accounting, corporate finance and executive management. Mr. Wurtele previously served as CFO of Xtreme Oil & Gas, Inc. from February 2010 to September 2013. From May 2013 to September 2013 he worked as a financial consultant for us. From November 2007 to January 2010, Mr. Wurtele served as CFO of Lang and Company LLC, a developer of commercial real estate projects. He graduated from the University of Nebraska and has been a Certified Public Accountant for 40 years.”

Mr. Wurtele was previously an insider at Energy & Engine Technology Corp. and subsequently worked at Xtreme Oil & Gas, Inc.

Energy & Engine Technology Corp. was headquartered in Plano, Texas at 5308 West Plano Parkway, while Xtreme Oil & Gas, Inc. was also headquartered in Plano at 5700 West Plano Parkway #3600. Torchlight’s corporate address is 5700 West Plano Parkway #3600. TRCH agreed to buy assets from Xtreme Oil & Gas, Inc. in April 2013 but as part of the deal apparently took over their office space. Indeed despite Mr. Wurtele stating he did not begin working for TRCH until September 2013, the 2013 10Q filed on 8/16/13 indicated TRCH’s corporate address was now that of Xtreme’s.

https://www.sec.gov/cgi-bin/own-disp?action=getowner&CIK=0001177089

Both Xtreme Oil & Gas, Inc. and Energy & Engine Technology Corp. were run by Mr. Wurtele and Willard G. McAndrew III, who was for a short time the COO of TRCH. Mr. McAndrew is now CEO of another apparent oil & gas fraud out of Plano, Texas that trades over-the-counter as Amazing Energy Oil and Gas, Co. (ticker: AMAZ).

Energy & Engine Technology Corp., was shut down by the SEC through cease-and desist proceedings pursuant to Section 8A of the Securities Act. The matters involved “a common abuse found among certain small publicly held companies. In recent years, many such companies have hired stock promoters to tout their shares on stock-picking websites and through mass-mailed e-mail messages (commonly known as "spam"). The promoter is often compensated in the form of purportedly unrestricted shares of the company's common stock, which the promoter sells after its touting has attracted investor interest in the company.”

https://www.sec.gov/litigation/admin/33-8311.htm

“According to the Commission’s Orders, Energy & Engine, which maintains a natural gas gathering system, hired former stock promoter Siembida, of Depew, New York, and his company, Russell Management, to promote Energy & Engine on the Internet.”

Derek K. Gradwell ran TRCH investor relations as an employee of MZ Group:

Mr. Gradwell was previously charged by the SEC for his involvement in an oil & gas related fraud. Per the SEC, Gradwell and his co-conspirators, “fraudulently raised at least $3.8 million from investors, purportedly for investments in oil and gas wells” and “made misrepresentations about the performance of Shoreline's wells, a purported business relationship with El Paso Field Services, and their use of investor funds.” Gradwell concealed the “misappropriation from investors of more than $1.2 million to pay for lavish vacations, a wedding and honeymoon, a vacation home, gambling debts, customized motorcycles and other luxury items.”

https://www.sec.gov/litigation/litreleases/lr18424.htm

Jack M. Johnston was the managing Member of Zenith Petroleum Corp.:

In June 2014, TRCH acquired certain oil and gas assets located in Oklahoma from Zenith Petroleum Corp. In exchange for buying the assets and receiving $1.65 million in cash, TRCH issued 1.35 million restricted shares, valued at $5.9 million ($4.39/share). The managing member of Zenith Petroleum is Jack M. Johnston of Colorado and Texas. This transaction is highly unusual. The buyer of the assets received cash from the seller of the assets. TRCH’s Hunton assets were later sold for $750,000 in 2016.

JACK JOHNSTON CHARGED IN 25-COUNT INDICTMENT Michael J. Norton, U.S. Attorney for the District of Colorado, and the Securities and Exchange Commission, along with other members of the U.S. Attorney’s Securities Fraud Task Force, jointly announced on August 22, 1991 a Denver federal grand jury 25- count indictment. The indictment charges Jack M. Johnston of Englewood, Colorado and Houston, Texas with conspiracy, securities fraud, mail fraud, wire fraud, money laundering and failure to disclose foreign bank accounts. The British government’s Serious Fraud Office gave substantial assistance regarding Channel Islands corporations and bank accounts, allegedly used to further the conspiracy. The indictment charges that, from about September 1986 to about October 1988, Johnston secretly controlled Duralite Manufacturing Company, Inc., a pre-1933 Act company, and Mamba, Inc., Sable, Inc. and Warowl, Inc., all blind pools. Johnston allegedly caused nominee accounts to be established at various broker-dealer firms and caused sales of the four corporations’ securities. The securities were sold to various customers, including Postel Investment Management, an investment management company in London, England responsible for investing holdings of various pension funds, including the pension funds of British postal workers. Allegedly, nominee bank accounts were opened in the United States and Channel Islands to conceal receipt of proceeds from sale of these securities. According to the indictment, Johnston’s net proceeds from sales of the companies’ stock were about $15,067,267.61. [U.S. v. Jack M. Johnston, Crim. No. 9l-CR-277, U.S.D.C. Colorado) (LR-12971).

David Bromberg, owner of KBK Ventures, Inc., in Houston, Texas:

David Bromberg is a large “investor” and/or shareholder in Torchlight, with many of his shares allegedly being received as compensation for “consulting.” Mr. Bromberg was involved in prior companies alongside John Brda, including iMedia international and Ring Energy (which ultimately became a legitimate oil and gas company).

https://www.chron.com/news/houston-texas/article/Victims-help-expose swindler-s-schemes-2085483.php

Brian Jacobelli, owner of Three Rivers Business Consulting:

A contract between his firm and another company shows his services include “to assist and consult with the Company in matters concerning investor relations and to represent the Company in finance and in investors communications and public relations with existing shareholders, brokers, dealers and other investment professionals as to the Company's current and proposed activities.”

https://www.sec.gov/Archives/edgar/data/81350/000105291807000104/ex107. htm

Roger Overby, broker at Skyway Capital Markets in Florida:

In February 2018, Roger Overby sold a 12% Unsecured Promissory Note on behalf of TRCH to the David A. Straz Jr Revocable Trust of 1986 (billionaire philanthropist from Tampa, FL). The note pays 12% annual interest in monthly installments and also pays a 2.5% annual stock payment. Mr. Overby appears to have a history of high sales pressure tactics.

Given the Company’s stated reserve value of approximately $100,000 and lack of cash flow, no prudent man could sell $4-plus million of unsecured Torchlight debt. Skyway and Overby could not have acted in good faith in selling this note to a client or clients.

https://www.sec.gov/Archives/edgar/data/1431959/000165495418002713/exhi bit_10-19.htm

Umbrella Research – Joe Giamichael and Dmitry Shapiro:

Umbrella receives shares in the name of Catalytic Capital Partners during later issuances, but between both entities, have been paid hundred of thousands of shares for what appears to be fictitious and/or fraudulent research, which can be found online with simple Google searches. Umbrella and Giamichael have been involved in SEC proceedings relating to the nature of their research product in the past.

https://www.sec.gov/litigation/admin/2017/33-10391.pdf

ATLAS Consulting:

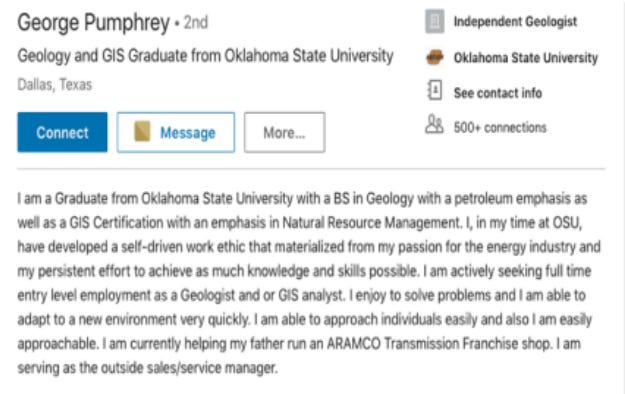

Appear to run a potentially illegal/unregistered paid research site focusing on oil & gas companies. Run by Dallas Salazar who has written a number of articles about Torchlight over the years, some of which disclose that he owns shares. Mr. Salazar, Amit Banerjee, Joe Filberto (a registered representative) and others appear to be part of a group connected with ATLAS that ‘pump’ Torchlight on Twitter, Seeking Alpha, Stocktwits and other sites. Mr. Salazar wrote an article on Seeking Alpha stating that he had hired an independent geologist to review Torchlight’s Orogrande acreage. This was the “geologist.”

National Securities Corporation:

National Securities Corp., and a number of their individual brokers that have been disclosed in S-1 filings appear to have raised a significant amount of equity capital for TRCH over the past 5 years. An analysis of several years worth of S-1 filings, would suggest they were able to scam a number of partners from national consulting firms, including E&Y, PwC and Deloitte as well as doctors and lawyers, among others. NSC received warrants – as well as what appears to be a 10% commission on shares sold. We would speculate that not all of the shareholders disclosed in S-1 filings were accredited investors who were able to participate in unregistered equity offerings; further given the nature of the company and FINRA records of NSC and its brokers, we suspect their compensation was not disclosed.

https://www.sec.gov/Archives/edgar/data/1431959/000107878214000719/s104 1814_ex4z2.htm

https://www.sec.gov/Archives/edgar/data/1431959/000119983514000523/torc hlight-s1a3d_16184.htm

NSC brokers involved in the TRCH offerings had 40 FINRA disclosures among 15 individual brokers:

Roger Monteforte (2 FINRA disclosures), Richard Libretti (1), Joseph Glodek (8), Jonathan C. Rich (2), Andrei Amaritei (0), Joon Rhee (6), Coby Haddad (0), Don Bianco (0), Ray San Pedro (6), Tom Kelly (n/a), Dennis Karjanis (0), Brandon Leon (1), Adam Friedman (0), Greg Lourdin (10), Mike Rosado (4).

Calvetti Ferguson:

TRCH’s former auditors have a checkered past, including recently settling a class action lawsuit related to falsified financials at another company. The current auditor is Briggs & Veselka Co. who also appears to be willfully negligent.

http://www.nobilishealth.com/notice-of-the-proposed-partial-settlement-of-the nobilis-securities-class-action/

Robert Moriarty:

Published a gold newsletter but appears to also pump small-capitalization energy stocks, including Torchlight and Amazing Energy. Mr. Moriarty is either not very smart or is in on the scams. If you consider the latter as an option, then it is also likely he did not buy the shares he owns that have been disclosed in S-1 filings, but they are rather payments for stock promotion. His articles often appear on Streetwise Reports (www.streetwisereports.com), which appears to be a site that is often used to promote fake “research.”

https://www.streetwisereports.com/article/2018/07/31/torchlight-illuminates-a new-texas-oil-basin.html

Robert received shares per S-1 filings.

Robert D. Axelrod:

Former SEC attorney based in Houston, Texas. Was in the commissions Enforcement Division between 1973 and 1976. Seems to have carved out a niche helping register and file documents with the SEC for Nevada corporations, reverse mergers, OTC scams and other shady publicly companies that have a strange tendency to go to $0; and defending defendants that get caught in ponzi schemes and pump-and-dumps.

Mr. Axelrod is involved in the two cases below, among others.

https://www.sec.gov/litigation/litreleases/2018/lr24107.htm

Robert Kenneth Dulin:

Torchlight would have gone the way of the tumbleweed years ago without capital providers and counterparties willing to do transactions that provided enough cash liquidity to survive. Robert Kenneth Dulin appears to live in Longmont, Colorado. He is listed –along with one of the businesses he uses to invest in Torchlight – as a Trustee at the University of Colorado at Boulder.

https://giving.cu.edu/about-us/cu-foundation/trustees

Mr. Dulin has invested in Torchlight individually and through a number of different entities, including Sawtooth Properties, LLLP (managing partner with 90% indirect pecuniary interest), LLLP2 (1/3 pecuniary interest), LLC1 (1/3 pecuniary interest), Black Hills Properties, LLLP (1/3 pecuniary interest), Pine River Ranch, LLC (1/3 pecuniary interest) and Pandora Energy, LP (50% pecuniary interest). It appears Mr. Dulin’s wife and children own the remaining interest in the above corporate entities. By gifting shares to his family members, together with reporting on a pecuniary interest only, Mr. Dulin can sell shares without triggering SEC reporting requirements. Likewise, John Brda has gifted hundred of thousands of shares to his parents. These maneuvers could be consistent with a desire to move shares to accounts where they can be quietly sold. Recall part of the pump-and dump TRCH’s current CFO was involved with included similar illegitimate securities sales. It does not appear to be disclosed other than in his 13D filed in 2013, but Mr. Dulin was a shareholder in Torchlight Energy, Inc. (“TEI”), the private predecessor to TRCH that did a share exchange with Pole Perfect Studios to create the company.

“Sawtooth and LLLP2 (as defined below in Item 5) were TEI Stockholders. At closing of the Exchange Agreement, Sawtooth and LLLP2 exchanged their shares of common stock of TEI for 100,000 and 50,000, respectively, (post-split) restricted shares of the Issuer’s common stock (in December 2010, the Issuer effected a 4-for 1 forward split).”

https://www.sec.gov/Archives/edgar/data/1431959/000107878213001319/sch1 3d070813_sc13d.htm

Said differently, Mr. Dulin has been investing in Torchlight since before it went public. He had partnered with John Brda and others as shareholders in TEI. Mr. Dulin has received an egregious amount of warrants over the years, he has had convertible debt securities issued to him at premiums to par, exchanges appear to always be beneficial. The significant number of Form 4s he has filed with the SEC show common stock, warrant, convertible promissory note and convertible preferred stock investments. If Torchlight has done a deal, he’s usually been the lead investor. TRCH filings, however, indicate a somewhat adversarial relationship where additional shares or warrants are provided to extend maturities, release collateral or exchange into new securities.

This much appears to be true: Mr. Dulin either knows or is willfully ignorant about TRCH’s inability to repay any debt given their lack of cash flow and lack of assets. If you believe that premise, it is a reasonable inference to believe Mr. Dulin is part and parcel of the apparent fraud. If the evidence above isn’t significant enough, consider than Mr. Dulin was making similar “investments” at iMedia International, Inc. – a company where Mr. John Brda claims to have been Director of Business development and David Bromberg/KBK Ventures was a consultant in the mid-to late 2000s.

The playbook at IMedia appears eerily similar to what has transpired at Torchlight. Indeed, here is a $150,000 loan from Sawtooth Properties LLLP to iMedia which provides for warrants. Dulin has done a nearly identical deal with TRCH as will be discussed.

http://getfilings.com/sec-filings/100520/IMEDIA-INTERNATIONAL-INC_8-K/

John Brda is indicated as a shareholder and key consultant in iMedia filings, while KBK Ventures and David Bromberg is identified as a consultant working on investor relations.

While its no crime for business partners to follow each other throughout the years, consider that Dulin and his entities often take adverse positions, requesting more shares or warrants. Understand that no legitimate investor could continue to lend to TRCH on an unsecured basis or look the other way as Mr. Brda and team burned through capital without TRCH ever receiving a return of, let alone a return on capital. It can be no coincidence that three people involved in a CD-ROM penny stock a decade ago are working together at an apparent oil and gas fraud. Indeed, public filings show TEI was formed in 2010, right around the time iMedia was being shut down by the SEC.

Mr. Dulin’s Form 4 filings are a treasure trove of information:

https://www.sec.gov/cgi-bin/own-disp?action=getowner&CIK=0001577874

Gregory McCabe:

Per TRCH website, “Mr. McCabe, from Midland, Texas, is an experienced geologist who brings over 32 years of oil and gas experience to the Company. He is a principal of numerous oil and gas focused entities including McCabe Petroleum Corporation, Manix Royalty, Masterson Royalty Fund, G-Mc Exploration. McCabe has been involved in numerous oil and gas ventures throughout his career and brings a vast experience in technical evaluation, operations and acquisitions and divestitures to the Torchlight Board. McCabe is Torchlight's largest shareholder and provided entry for the Company into its two largest assets, the Hazel Project in the Midland Basin and the Orogrande Project in Hudspeth County, Texas.”

From the McCabe Ventures website, “Greg graduated from Sul Ross State University in 1984, where he earned a B.S. in Geology. Shortly after, he founded McCabe Petroleum Corporation in 1986. For over three decades, Greg has grown McCabe Petroleum Corporation into a successful petroleum company, while investing in a number of non-Oil & Gas ventures. Today, McCabe Petroleum Corporation serves as the cornerstone to the McCabe Ventures portfolio of companies.”

Mr. McCabe appears to have received TRCH’s Hazel acreage as part of a series of transactions with Arabella Exploration, Inc. Similar to deals done with Torchlight, it appears a commission was arranged for his sons through Green Hill Minerals, LLC. In Torchlights case it appears Green Hill is getting equity and warrants for doing nothing - which could potentially be a means to recycle cash back to Greg McCabe.

https://www.sec.gov/Archives/edgar/data/1506374/000121390015006804/f10q0615a1ex10ii_arabellaexp.htm

Arabella is also the source for the Orogrande acreage. “These leases were originally bought by Arabella Petroleum at University Lands’ 123F lease sale in April 2013, LaCoste-Caputo said. It was then sold to McCabe Petroleum in March 2014, and then to Torchlight Energy in July 2014.”

Arabella paid $7/acre for the Orogrande leases in 2013. Torchlight paid 865,000 shares and $100,000 cash for 172,000 acres on August 7, 2014, which worked out to $3.3 million, or approximately $20/acre. Note that approximately 40,000 of the acres expired in December 2014. Soon after closing their deal, TRCH began to ‘pump’ Orogrande as potentially worth $9 billion.

Like Robert Kenneth Dulin, Torchlight likely doesn’t exist without the help from Mr. McCabe in recent years. McCabe appears to be an oilman from Midland, Texas, but there is little online evidence of success.

Based on a conversion feature, allowing the lender to convert into a 6% interest in the Orogrande project, the loan effectively values Orogrande at $100 million ($1mm per 1%). Torchlight has a 72.5% interest in the Orogrande project, thus their acreage is valued at $72.5 million. Recall TRCH paid $3.3 million for all the acreage, including leases that expired. No commercially successful wells have been drilled on the acreage since TRCH acquired it. The large increase in value can primarily be attributed to trading pieces of the acreage back and forth among themselves.

In TRCH’s Form 10-Q filed for the first quarter of 2015, TRCH discloses that “on April 1, 2015, a major shareholder lent us $150,000 pursuant to a 12% promissory note due September 30, 2015, convertible at $0.25 per share. In addition, the major shareholder received 150,000 warrants, with a term of three years at an exercise price of $0.50 per share.

Greg McCabe isn’t a stranger to being a party to odd transactions with TRCH. In its 2017 10-K, TRCH disclosed that “on December 1, 2017, the transactions contemplated by the Purchase Agreement that our wholly-owned subsidiary, Torchlight Energy, Inc., a Nevada corporation (“TEI”), entered into with MPC closed. Under the Purchase Agreement, which was entered into on November 14, 2017, TEI acquired beneficial ownership of certain of MPC’s assets, including acreage and wellbores located in Ward County, Texas (the “Ward County Assets”). As consideration under the Purchase Agreement, at closing TEI issued to MPC an unsecured promissory note in the principal amount of $3,250,000, payable in monthly installments of interest only beginning on January 1, 2018, at the rate of 5% per annum, with the entire principal amount together with all accrued interest due and payable on December 31, 2020. In connection with TEI’s acquisition of beneficial ownership in the Ward County Assets, MPC sold those same assets, on behalf of TEI, to MECO at closing of the MECO PSA, and accordingly, TEI received $3,250,000 in cash for its beneficial interest in the Ward County Assets. Additionally, at closing of the MECO PSA, MPC paid TEI a performance fee of $2,781,500 in cash as compensation for TEI’s marketing and selling the Winkler County assets of MPC and the Ward County Assets as a package to MECO. “

This transaction highlights TRCH’s need to do deals to generate cash. Torchlight bought assets from Greg McCabe, and in exchange he took a $3.25 million seller note, which was recently repaid with proceeds of the new $6 million note. McCabe then sold those same assets on behalf of TRCH. For reasons that aren’t explained, TRCH effectively passed assets through its corporate structure and in exchange for doing so, received a $2.8 million performance fee.

Beyond appearing fraudulent given the company received $2.8 million cash for a wash transaction, the accounting of the transaction appears improper. Indeed, the note is disclosed on the cash flow statement, but no sale of assets is disclosed on the fourth quarter 2017 statement of cash flows. Indeed, TRCH ran the $2.8 million fee through operations as a consulting fee. The press release disclosing the transaction discusses giving McCabe the $3.25 million promissory note and 2.5 million shares as consideration and provided entry into a new region (Winkler County). It is worth noting that MECO IV, LLC, Torchlight’s new partner as a result of this transaction appears to have offices in the same area where Mr. Dulin lives in Colorado.

In yet another transaction which provided TRCH with a cash injection, Jack M. Johnston (recall, charged fraudster) and the Company did a deal in 2014.

“On June 6, 2014, our wholly-owned subsidiary, Torchlight Energy, Inc. (“TEI”) entered into and closed a Purchase and Sale Agreement with Zenith Petroleum Corporation. Under the agreement, TEI purchased from Zenith certain oil and gas properties located in Oklahoma and received from Zenith $1,650,000 cash. As consideration for the properties and cash, Zenith received 1,350,000 restricted shares of common stock of Torchlight Energy Resources, Inc. The Purchase and Sale Agreement is included as Exhibit 10.1 to this current report, and a press release describing the acquisition is included as Exhibit 99.1.

Prior to the acquisition described above, in September 2013 we purchased from Zenith a 15.3% working interest in 5,101 net mineral acres in Kingfisher County, Oklahoma, for which Zenith received 558,356 restricted shares of common stock.” In exchange for the assets and cash, TRCH gave Johnston $5.9 million of restricted shares. In the press release from June 14, 2014, TRCH reiterated Q214 production guidance of 500 barrels of oil equivalent per day. The Company never produced more than 200/day.

Reading through the whole whistleblower complaint is a bit of a task but the gist of the complaint is that Torchlight misrepresented the potential of the projects that they were promoting through different entities while padding the pockets of many individuals on a false basis of value. Greg McCabe continued to sell assets to Torchlight and then participate in Series C Preferred to fund the projects. This allowed McCabe to convert the preferred shares back into working interest of the wells which currently MMTLP holders have to buyout from McCabe in order to close a deal. A way to rinse and repeat the sell of the same assets that presumably are worthless in order to allow McCabe to garner money from investors while maintaining an interest that could be leveraged as a personal piggy bank.

It also seems McCabe will be made another offer and be able to exit his position in the overstated valued assets in the Orogrande using MMTLP holders as exit liquidity. The only positive thing that can be said is at least this will be the final wash and repeat sell by McCabe to enrich himself.

Working Interest and Recoverable

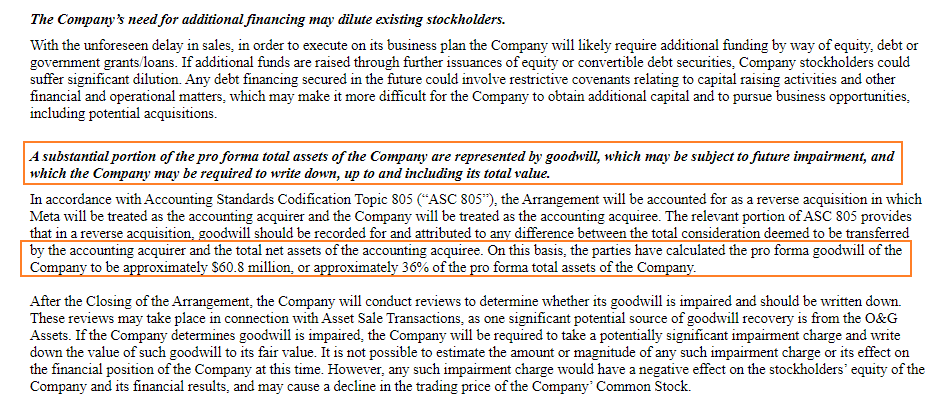

The recent S1 does a good job of describing what working interest is and how that translates to equity for the shareholders. However, the filing doesn’t break down what the proposed working interest will actually be for the assets once private.

With McCabe’s current working interest and a number of liens against his holdings, it looks to be inevitable that shareholders will be diluted after closing with no way to hold the private co accountable.

Dilution of Shares or a Squeeze

Short and sweet:

McCabe and others seeking their exit liquidity are most likely hoping investors will ignore the potential dilution and focus on key terms such as ‘short squeeze’ in the filing.

Additionally, it’s important to note how Metamaterials valued the assets in the reverse merger and how that valuation does not match up with the promised Dividend by the CEO of MMAT.

There have been a number of claims on how large the short position is but a common number equates to a value of $500M at close of the TRCH reverse merger by Metamaterials.

MMAT(TRCH) is down 82% from the infamous George tweet about burning the shorts. PBT has an accumulative dividend payment of $0.92/share in 2022, while I still believe MMTLP will never pay out a dividend but if it does I suspect it to be around a few pennies and not the promised $10-20 George proclaimed while trying to ‘burn the shorts’.

Audio Link: https://drive.google.com/file/d/1udZ6IS85NrNU8H6h9HsMABIxynsZvpDb/view

Audio 3:45 - ‘There are many examples like this, for example SPAC deals that have been made recently with startups that have no revenue and sometimes one customer valued at 1.5 billion or more has been the case. In our case it is much more real’

Based on my findings of the filings of Metamaterials financial situation, George Palikaris was describing Metamaterials, in 2019 Metamaterials had $1.1M in 2019 revenue and reached a market capitalization of +$2B pre merger.

Audio 5:55 - ‘There is one more element to add here, lets call it the X Factor. If you notice the Torchlight stock is massively shorted. There are not only American short positions but international and naked short positions. This deal is setup not to give a past dividend of closing. So in order for the short positions to cover they have to have the stock on their hand because the dividend will be paid out as a preferred share not cash. As a result there is no physical way for the shorts to cover this stock when the time to close. We believe or at least we expect the market conditions allow the potential jump towards the close. We dont know by how much or if its going to happen but we have seen other stocks that have experienced a massive increase towards such an event where the shorts have to, you know, its called a short squeeze.’

Though the above tweet from the CEO does not specifically call out for a ‘short squeeze’ the audio from the CEO clearly says that this is the goal of the company and under my interpretation of the Securities Exchange Act of 1933 rules and guidelines, this is manipulation of a stock price and should be considered as fraud. With the intended goal of the Securities Exchange to prohibit deceit, misrepresentations, and other fraud in the sale of securities, I believe that this statement and others by the CEO of the acquirer company Metamaterials should be considered and action be taken.

Audio 13:00 - ‘As you know when Torchlight decided to sell the business to change 180 degrees there business model and find a company like us. They look at many different companies, they selected us and we selected them. Today the price of oil from one twelve month period the price of oil went from negative to lets say more momentum and lets say the more time that goes by over the next 6 months, I can tell you that Torchlight is speaking to the right potential buyers and that they are top tier and frankly no one can predict where this will be a $1 or $20 dividend… depending on where we are in the market’

‘Very exciting for the Torchlight shareholders and frankly no one in the Oil and Gas industry and that makes assets or the assets of the Torchlight has even more valuable. So if you announce a dividend today, you are shooting yourself in the foot as they say. I believe the dividend will be very exciting for the Torchlight shareholders and they will do with it whatever they like and maybe buy some additional MMAT stock on the future on the Nasdaq. Thats my hope and why we did not want to touch the dividend because we on the Meta side could not even predict the price of oil 6 months ago or where this Biden Administration would create additional reasons for these assets to be more valuable. And for you its a preferred share for a reason and that's not priced and in order for the shorts to deliver this they have to own the stock. They cannot borrow the stock, they cannot short the stock, they have to own the stock to participate in the dividend and so does any other normal investor. As a result because of the potential is, if you look at the statistics, it could be a dollar($1) to more than twenty dollars($20) according to the analysis. It's difficult to predict where it will end up.

At the time of this audio and prior, Torchlight had put out many warnings to its investors about the health and longevity of the company moving forward. This in theory should be obvious to more seasoned investors because a reverse merger does not typically spell out quality for the shell being used to list the new entity onto an exchange.

Torchlight also outlined for investors in 2021 that they are not an operator of the leases and this same scenario should be assumed moving forward into a privately held company. The new entity will need to give up operations to a third party in order to develop the land since all indications show this property will not sell for a high valuation.

The CEO of Metamaterials seems to find himself on Twitter a lot explaining the dynamics of the Short Squeeze and dividend.

Pumpers tend to push unrealistic but hard to debunk catalysts for their stock promotions and the CEO’s and others’ involved in the Torchlight/Metamaterials merger are no different. It’s also notable that the CEO of the Acquirer Metamaterials is aware of false allegations tying him to Tesla and Elon Musk as he responds to a Tweet by Musk. If your gonna try to fraud investors you might as well tie yourself to the biggest scam artist running the most overvalued bubble of all time.

This writer does wonder with much hesitance, how a large group of investors can both be for the Oil and Gas assets based on fundamentals while also hoping for manipulation in the stock with a short squeeze but at this point its written off as “hopium”. Like Bitcoin of Tesla stock everything is bullish and bears just don’t seem to understand how no one could see the endless free money in these securities, yes Bitcoin should be considered a security, though never really producing much of any real value. It reminds me of one of my favorite quotes from the CEO of Sun Microsystems during the 2000s dot com bubble:

‘At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?’— Scott McNealy, Business Week, 2002

Debt

Even though Torchlight couldn’t produce Oil and Gas on their leases and had attempted to start looking for buyers of the Orogrande and other projects in 2018, one thing they were exceptional at producing was debt while incinerating cash. At the time of the merger many debts were yet to be paid and relied on the reverse merger to close in order to clear.

After digesting this unhealthy debt, readers may want to look back at the section that notes how McCabe was able to extract capital from shareholders rinsing and repeating the same working interest through preferred shares and how this debt is being translated onto the private company. The same McCabe that will get paid before any other common shareholder does on assets that he most likely knew had been worthless this whole time.

Those newer to the MMTLP position that was originally Torchlight assets, may not remember the Metamaterials CEO tweets discussing what would be much more healthy capital and turning it down to do an offering right before the reverse merger.

5 days later Torchlight increased their offering to $250M after the CEO of Metamaterials was publicly stating the dilution at $100M offering. This seems to clearly be manipulation on their part to hold the price up for more dilution.

The CEO also seemed to give some false information about the holding period in order to receive the preferred shares that were promoted as a dividend that most likely will never exist, especially in the form originally promoted.

The CEO of Metamaterials outlined dates for the dividend that leads the investors to believe that they must hold till that closing day of 6/24. The way he wrote the Tweet may be intended to confuse Torchlight investors to hold longer than they needed. As we see here, Mr. Zyngier sold all his TRCH shares on 6/22.

Total Proven Oil

Nearing the reverse merger, while being pumped by a number of Fintwit and Discord groups, Torchlight had been in the process of selling their Winkler and Hazel assets that were the only producing and proved oil under Torchlight. Torchlights annual report for the physical year of 2020 had some key takeaways.

It would be curious to see what famed geologist helped with the revisions of the estimates of reserves so far down.

All producing wells which were at least partially developed and producing were sold off prior to the reverse merger. As mentioned prior most buyers are looking for barrels now and have abandoned the practice of wildcatting after decades of poor capital destruction. The overall production of the assets was lacking but were located in the Permian Basin and made it much easier to get a deal closed.

It could be argued that Torchlight was attempting to prove out these leases for a larger sale but they were not drilling and testing with much success in the Orogrande even after the ‘large discovery’. On January 30, 2017 Torchlight entered into and closed an Agreement and Plan of Reorganization and a Plan of Merger with Line Drive Energy, LLC and was required to drill one well every six months to hold the entire 12,000 acre block for eighteen months, and thereafter two wells every six month starting June 2018. Line Drive, which was wholly-owned by Mr. McCabe, owned certain assets and securities, including approximately 40.66% of 12,000 gross acres, 9,600 net acres, in the Hazel Project and 521,739 warrants to purchase shares of common stock. On November 11, 2020, Torchlight and MPC sold their entire interest in a project in Winkler County, Texas. In connection with this sell, MPC allocated its cash consideration of $100,000 to Torchlight in return for 313,480 shares of common stock of Torchlight, essentially removing the only valuable Oil and Gas assets that were controlled by Torchlight prior to the reverse merger and leaving a shell of a company and leaving no proven oil for the asset sale. With George Palikaras running the show in the Orogrande as the ‘experts’ that ran Torchlight into the ground exit, the future outlook is best represented in meme form.

Conclusion

Having no position in MMTLP, MMAT, or TRCH currently or in the past year and not representing anyone or having any connection to those that I know are short these equities, I do want to say that I hope this ‘squeeze’ works out for those retail investors that have been trapped in this play for a while. Regardless of the amount of negative viewpoints presented here, the key to investing requires constant monitoring of downside risks and capital preservation when things look grim. To see the old Torchlight Oil and Gas assets being taken private with no proven or producing barrels to the market should give pause to investors because the shareholders will have no course to scrape back equity from the investment. If these leases were producing some sort of sustainable production investors would at least have some light at the end of the tunnel with a small dividend. However, the structure of this in my opinion, looks to be intentionally designed for retail to hold the bag until an inevitable default.