Come writers and critics - Who prophesize with your pen - And keep your eyes wide -The chance won’t come again - And don’t speak too soon - For the wheel’s still in spin - And there’s no tellin’ who that it’s namin’ - For the loser now will be later to win - For the times they are a-changin’ -- Bob Dylan

Due to a large number of questions hitting our inbox, the following post is meant to clarify a number of concerns and attempt to explain the current landscape of the PBT/Blackbeard situation from a public reporting perspective.

Blackbeard has done a quality job from an engineering perspective of bringing on new production since they became the operator of the Waddell Ranch in early 2020 through new formations and recompletions. The geology under the trust for the Waddell Ranch does carry significant upside where the sections and blocks associated with the minerals for extraction are divided in interest by West Ranch of 1/2 and the East Ranch 3/8.

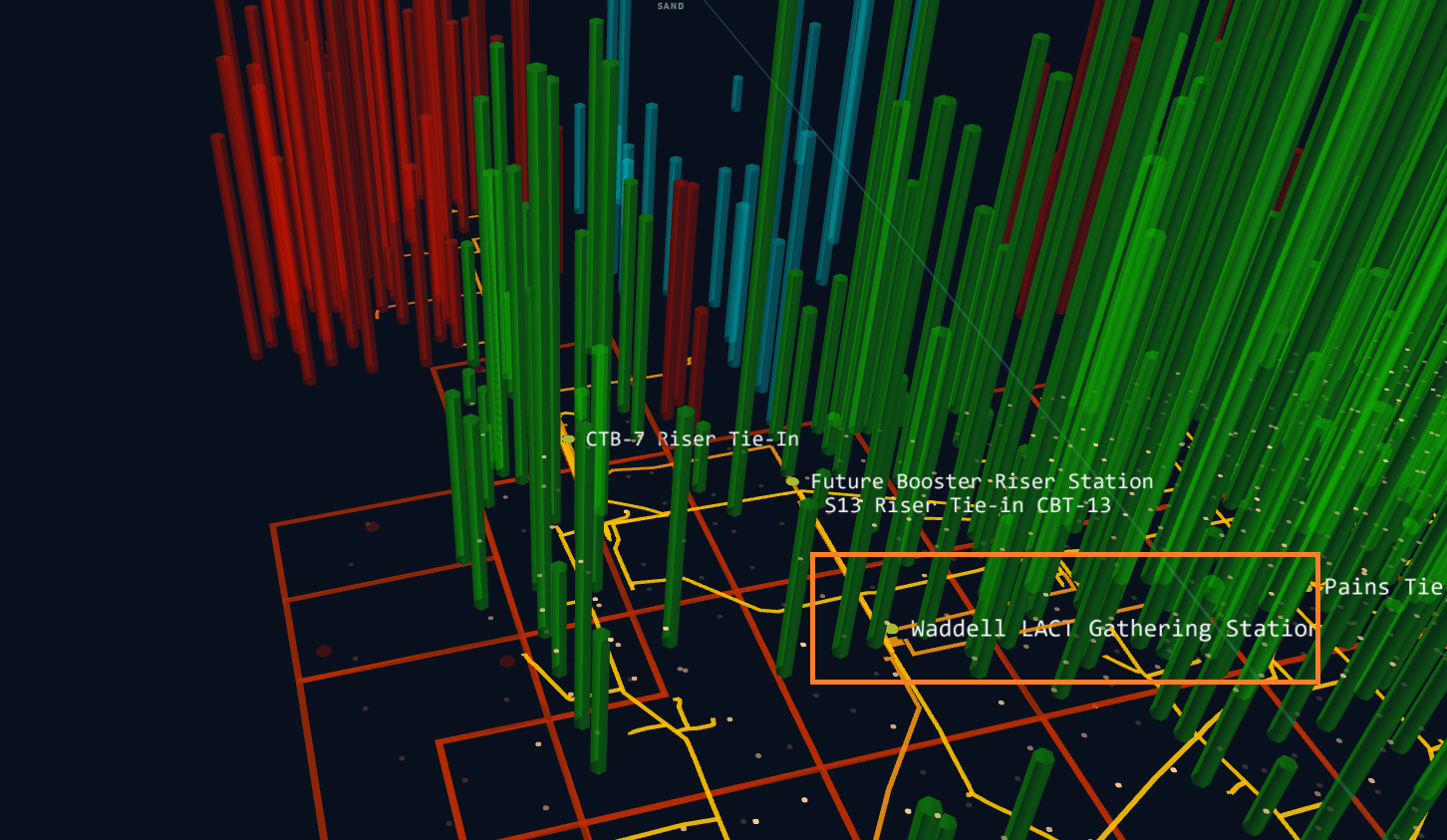

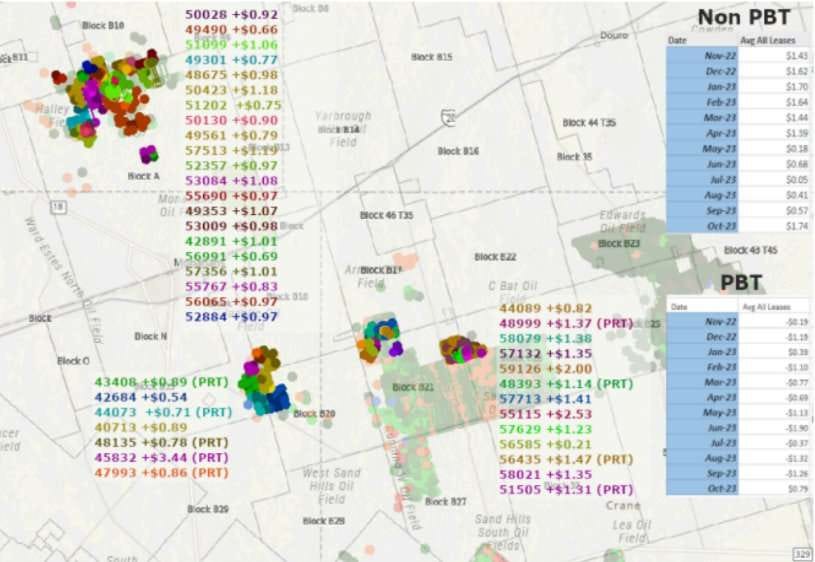

Blackbeard has kept their focus on the West Ranch that carries the 1/2(50%) interest for the trust. Completions seen below show Blackbeard operations both on and off the trust as well as other operators nearby.

The East Ranch also carries important cost saving infrastructure and pipelines for processing and gathering of oil, gas and other liquids, including a central collection point - Waddell LACT Gathering Station - that Blackbeard’s other leases North of the Waddell Ranch utilize.

There is no disputing that Blackbeard has great engineers and what attracted us at Energy Crisis to monitor the Permian Basin Royalty Trust so closely in 2020 after Blackbeard became the operator on lease. Monitoring the drilling and completions in publicly available data from The Texas Railroad Commission and their success in the Wolfcamp to unlock barrels in the area made our entry below a $250M market cap for these assets an easy decision.

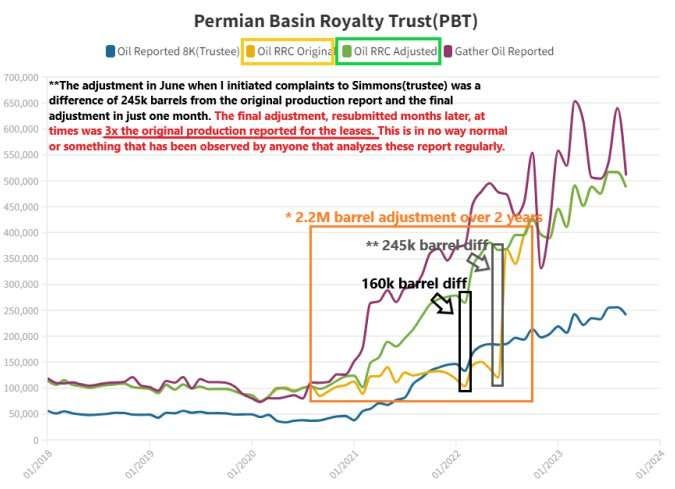

Investors like Murray Stahl of Horizon Kinetics have rightfully gained a lot of respect for his investments over the decades and the Permian Basin Royalty Trust has been one of his top picks, essentially still very early as an investor in PBT based on its total development potential. Unfortunately there is a cloud over the investment through litigation that will need more discovery and litigation before even the savviest of investors know where their returns start and end. And now the questions as they mostly pertain to the ongoing litigation and gaps in data that was previously available to investors.

Fracing and horizontal drilling changed how everything operates in the Permian Basin with new services that didn’t exist decades ago. With the line items that are charged when drilling and completing a well related to fracing, how does PBT define these charges and are they part of the litigation?

In reference to fracing charges there could potentially be an issue here if the acreage did not have continuous interest where horizontal drilling crossed different percentage which complicates applying costs if there is no pooling or utilization agreement. Since the conveyance also states 'in and to oil gas and other minerals in and under' in reference to all formations are attributed to the trust. Therefore the total vertical and lateral drilling costs would be charged to the trust. Unlike a standard Net Overriding Royalty Interest(NORI) the trust is setup as an Net Profit Interest(NPI) where the trust defines costs incurred on an actual basis in operating the underlying properties, including both capital and other expenses. Therefore the operator can and does charge the trust for all drilling and completions and from all indications of the lawsuit claims this is not being disputed by the trustee.

The lawsuit lays out the thesis very clearly about what is being claimed in the first few sentences: ‘For 40 years, the parties to a royalty conveyance understood how royalties were to be calculated and paid. That ended after Blackbeard took over as operator of the wells and began paying royalties.’

Within those 40 years Blackbeard has only been the operator of the trust since early 2020 but horizontal drilling and fracing is not new to the Permian Basin Trust. The first reference directly to fracing was made in 2014 by the trustee, over a decade ago.

The trustee under Simmons Bank began a Joint Venture(JV) audit well before Argent was involved, possibly as early as mid 2022. A JV audit is an examination of the financial records, operations, and cost allocations in oil and gas joint ventures to verify that working interest owners and royalty holders are receiving their correct share of revenues and bearing appropriate costs. For royalty trusts, JV audits are somewhat uncommon because most trusts hold passive royalty interests rather than working or non-operating working interests in joint ventures - they typically receive royalty payments based on production volumes and prices without participating in operational decisions or bearing development costs. However, because of PBT trust is a non-op the trustee would need to occasionally conduct or participate in JV audits to protect the unit holders economic interests.

This JV audit is what sparked the initial claims in the lawsuit of incorrect charges and equipment used on other leases. The trustee, whether is be Simmons Bank or Argent Trust Company, have a fiduciary duty to their shareholders to guarantee that the correct amount of revenue is distributed to unit holders but typically the trustee has no appetite for litigation without cause. Sometimes when you start peeling back layers you find nothing and other times there are varying degrees of issues as seen in the claims to date.

‘Charging the Trust for services performed and equipment installed on property unrelated to the Conveyance’ along with many double or non-existent service charges are outlined in the lawsuit. When looking back at the property of the Waddell Ranch and the nearby leases that Blackbeard operates; it appears many services and costs, including equipment installed, could potentially be charged to the trust incorrectly.

While the trustee has changed over time, including the more recent change to Argent Trust Company, the management of the trust has mostly stayed the same under the same employees that oversaw the monthly and quarterly filings. Horizontal drilling, fracing, same employee oversight; the only major change in the past few years is the operator. Given the excuses that Blackbeard provided over the Railroad Commission(RRC) production reports that were completely incorrect for years as a ‘software glitch’, maybe this will be chalked up as an ‘accounting glitch’ once the dust settles.

Would this litigation have any adverse effects on the entire oil industry? Does the judge know the implications and are they equipped to understand them?

Argent originally filed in Federal court which typically sees more oil and gas litigation and those judges tend to have a better understanding of the issue. However, the lawsuit was pulled and put in Tarrant County later due to what's currently assumed to be by Blackbeard’s request due to an issue not fully understood but possibly in relation to Diversity Jurisdiction. Staying in Federal Court would have benefited Blackbeard if fracing and a revolutionary change in applied costs was coming down the line over this litigation but instead the court change and stalling the court date was the result. The court is still within Texas and the judge seems very capable and prudent to cleaning up their docket but does not see a lot of Oil and Gas cases. If Blackbeard is trying to make the case that this has an adverse effect on the entire oil and gas industry in court, it could be potentially easier to persuade a judge with less consistent exposure to litigation around the industry.

Blackbeard states in their counterclaim that ‘Blackbeard is entitled to passthrough oil and water gathering and transportation charges charged by Blackbeard vendor Nile Midstream’.

Midstream companies can have some correlation to fracing costs, though it's often indirect. Fracing costs are primarily driven by service company pricing, technology, and well design and completion costs (sand, chemicals, equipment) that aren't directly tied to midstream. Essentially Blackbeard is stating to the courts that through Nile Midstream and their service company Post Recompletion, that they should be allowed to charge the trust as they see fit with profit margins that could be well outside industry standard.

Blackbeard and unit holders also share the same liabilities of the NPI including the costs described above. When Nile Midstream invoices the trust for certain services and those same costs should be applied to Blackbeard working interest but it’s clear to see how the charges made to yourself are just taking money from your left pocket to the right for the operator while the unit holders are dinged for a higher cost.

Based on the claims in the lawsuit some disposal costs are also being charged to the trust that may not be associated with PBT leases. This removes costs from their other leases North and puts the burden on the unit holders. Adding in the claim of volumes, if production is also misallocated while costs are moved to the trust - even with a higher royalty on the non-PBT leases it would be beneficial since the cost per barrel would decrease significantly due to Capital Expenditures and Lease Operating Expenses being incorrectly applied to PBT.

In the long-term does the litigation matter? If the assets are quality and Blackbeard has competent engineers, the returns come to fruition regardless.

Just last week Blackbeard was at Super DUG where the focus was on the assets they operate in the Central Platform and the bulk of that drilling is under PBT.

Without opining on the legality of a company preparing for an IPO while possibly providing conflicting(limiting) information to existing public trust investors should raise concerns. Luckily the trustee seems to treat all unit holders of the same class equally with their willingness to answer what questions they can under the current circumstances and restrictions of non-public information.

Situations like this make investors ponder what information they don't have access to through public means that others could potentially be afforded. PBT saw a fairly dramatic pullback in stock price starting only a few months leading into the announcement of the lawsuit with no other public news that would have been considered bad for the investment.

Where is production at this point? There was no growth in 2024 and the most recent quarterly filings didn't show much either.

Production is already increasing dramatically in recent months and is up nearly 40% Gross to Trust since November.

This increase is during the discovery processes where production was named not long before the increase began.

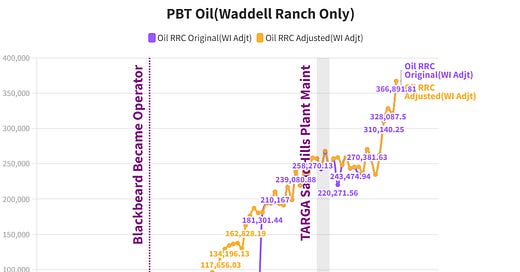

Production reported to date by the trustee in the most recent quarterly filing does not reflect all months of data in the RRC data. Currently May production to be reported to the trust is at 366k BOPM Gross to Trust. The above chart shows the three months of growth not included in the trustee filing due to lag in reporting and an additional gap added of a month by the operator when data was being refused in early 2024.

New completions and tests across the Waddell Ranch are shown below. New Horizontal Drilling has been the focus of the operator for the majority of 2024 and into 2025. Currently the lawsuit does not cover 2024 capital expenditures since there is an ongoing JV audit that takes time to review and verify.

For reference Blackbeard’s other leases and drilling completion results along with production per lease outside of the Permian Basin Trust are shown below.

There are concerns if production volume accountability is an issue with so many new barrels being added as it could potentially help obfuscate the underlying issues if a volumes measurement audit was not correctly performed.

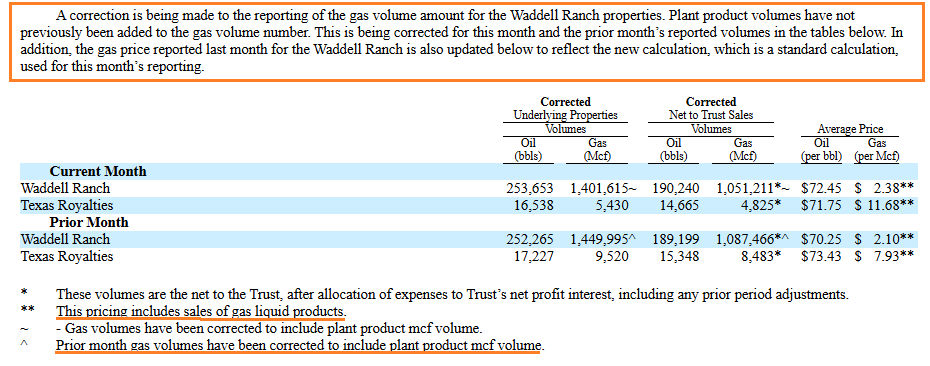

Pricing in relation to if NGLs not being included has been questioned for some time as leases operated by Blackbeard nearby have had a better pricing according to the Texas Comptroller data in part of 2022 and most of 2023.

The above represents the average cost per lease for PBT and non-PBT leases operated in the area visualized by height of the hexagon bar. Notably 2023 pricing decreases against the other leases in the area to near zero. The assumption is that higher priced NGLs are not being included in the pricing for the wet gas on the West Ranch but are being accounted for on Blackbeard leases slightly North of the Ranch. Below shows the volumes of leases that have a zero net after marking costs for natural gas where the height of the hexagon bar represents the volume for the entire lease normalized across all other leases.

This adds to the concern of Blackbeard operating in a prudent manner. Just shortly before Blackbeard stopped reporting production volumes to the trustee there was an amendment to Natural Gas Liquids(NGL) and pricing for the previous and current month that were never explained fully. It appears that the trust has not been receiving pricing for the correct total amounts across all products.

The most recently updated claim of volumes or the measurements of oil, gas and other liquids was added to those claims. Energy Crisis reached out to a volumes measurement firm over a year ago to understand this process better and the costs associated with it. Typically a sampling is done of 10 to 15% of wells along with a visual inspection of all infrastructure and metering to determine if the correct processes and equipment are in place. This first step is cost-effective and typically gives the auditor an indication on whether more wells need to be evaluated or if the operator is conducting themselves in good standards. Unfortunately, if there is an issue with the sampling wells, the cost could rise significantly but those costs would most likely have a recoverable attached to them due to their being an issue with the measurements. In the case of PBT, a full audit being performed due to initial issues discovered could result in millions of dollars spent but looking at the claims on the capital expenditures by the trustee and the lawsuit, it would be safe to assume that if something was found in the initial sampling that total cost would be recovered and possibly much more. This would also add process and controls that would give peace of mind to investors with the overhang of issues claimed within the lawsuit, including 'failure to pay royalties to the trust for volumes produced'. The other side of this is nothing is found and investors have a clear path to future returns which allows for the attorneys to go back to their corners and billable hours to no longer haunt both Blackbeard and Argent/Unit Holders.

Does Blackbeard have a plan to IPO and go public?

According to a roundtable discussion by Horizon Kinetics Murray Stahl said the following ‘From the point of view from the investment, it doesn’t matter anyway. The reason it doesn’t matter is because Blackbeard wants to be public. So right now if you are going to spend money, you are a private company, now is the time to spend the money. However this lawsuit is, spend the money and be in a position to increase production. If you increase your production today you don’t get any valuation credit for it.’ According to Stahl Blackbeard has every intention of becoming a public company but that may be difficult with the current lawsuit still active, a related lawsuit to the trust with Crane County Appraisal District, and a number of other smaller lawsuits with claims varying on volumes and charges.

This is also where we differ in opinion heavily from Murray Stahl on the matter where he seems to be implying that Blackbeard has a plan to go public so they should be allowed to choke back production to hold it under the reserves of the trust while applying costs to the trust, including their owned midstream services(Nile), in order to build up value for their own personal gain and private equity investors while harming unit holders of the publicly traded Permian Basin Trust? Blackbeard would also be doing this while out promoting themselves and those reserves that they are constantly being put at risk of not being booked by the trust due to Blackbeard’s refusal to provide a drilling plan and budget in accordance with SEC guidelines for reserves. In these pitches are they also sharing their drilling plans with investors that they are refusing to the trust?

Site audit, surface, volumes measurements audit - regardless of the name the process and goal remains the same where all volumes of oil and gas including NGLSs are accounted for and measured for their accuracy to guarantee all revenue is being attributed to the net profit interest calculations. While the Permian Basin Trust has operated more than 40 years with the understanding that all costs associated with the drilling and completion of wells including the costs related to transpiration of those products can be charged to the trust, double charging or arm's length transaction are not defined within the trust documents and what is being claimed here. That, along with volumes of production which should be questioned with the other issues alleged - a bit of transparency would be nice in order to finally put this to bed and allow Blackbeard to continue to operate quality wells, instead of continue stalling, and the unit holders of the Permian Basin Royalty Trust know if there is revenue owed after true and correct costs to produce the hydrocarbons are applied.

Ok, I do not get Horizon's comments at all unless they are one of those investors in the public company to be. However that would be considered I think double-dealing. Second, at some point the holding back of production will be released and must flow as well to PBT. Seems a backward investment approach and I also fail to see how this helps Blackbeard be transparent in their public offering. Chickens as I know them come home. This seems to me to be one lie repeated leads to more unless coming clean. Blackbeard has not done that and it is leaving a mark that will take time the heal. All seems crazy to me and the interest in going public will be the sunlight needed to disinfect this wound.

Thank you for this.

Do you mind sharing if you have an update on SJT? Maybe the previous post is current?