This represents the first installment in a comprehensive four-part series examining West Texas's emergence as America's next data center frontier. Part one establishes the foundational case; how the convergence of stranded natural gas resources, massive pipeline infrastructure, and an energy-rich ecosystem positions the Permian Basin to capture overflow demand from capacity-constrained Texas metros. Subsequent installments will explore property tax incentives and workforce development strategies (Part Two), critical infrastructure gaps in fiber connectivity and emergency services (Part Three), and the innovative potential of treating produced water from oil operations for data center cooling (Part Four). Together, these breakdowns reveal both the extraordinary opportunity and the infrastructure investments required to unlock West Texas data center potential.

Texas Electric Demand

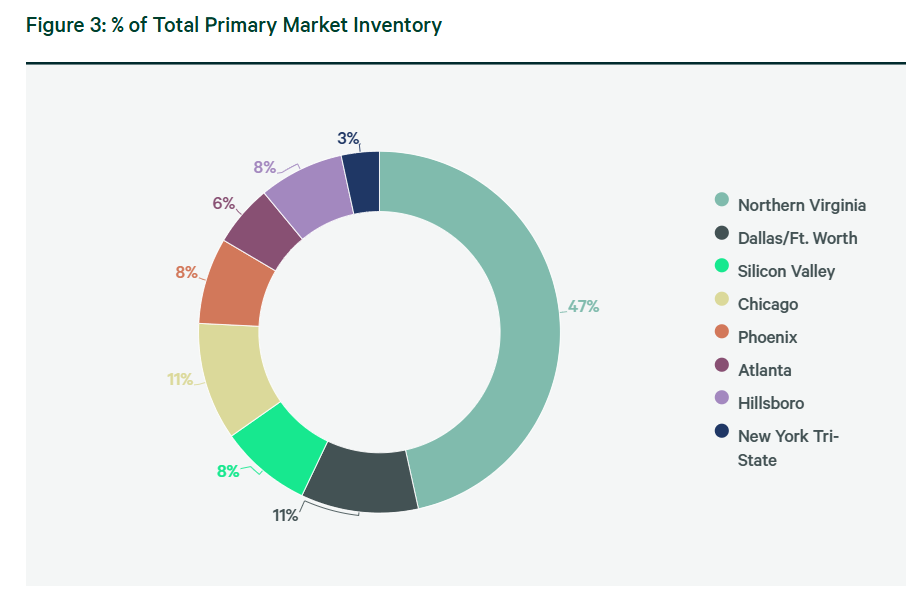

The Electric Reliability Council of Texas (ERCOT) forecasts a staggering near-doubling of electricity demand by 2030, driven by an unprecedented surge in large-scale users seeking grid connections including data centers, cryptocurrency mining operations, hydrogen production facilities, and oil and gas infrastructure. Texas currently hosts 279 data centers, with the Dallas-Fort Worth metroplex commanding 141 of these facilities. This concentration translated into 591 MW of power absorption in Dallas-Fort Worth during the previous year, ranking second nationally, while Austin and San Antonio collectively consumed nearly 190 MW according to CBRE market analysis.

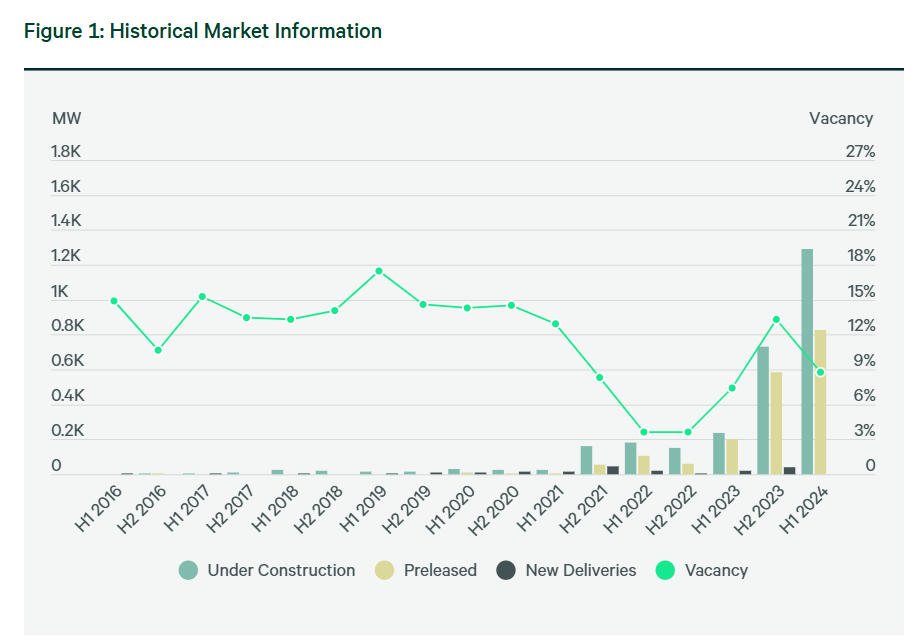

The velocity of development proves even more striking. Austin and San Antonio's construction pipeline exploded from minimal activity to 463.5 MW, a quadrupling that signals the market's insatiable appetite for capacity. Yet availability remains critically constrained, with approximately 80% of the 3,871.8 MW under construction across primary markets already committed through pre-lease agreements. Cloud service providers continue to dominate absorption, though artificial intelligence companies have emerged as formidable competitors for the remaining scraps of available power. A dynamic that pushes developers to seek alternatives in secondary markets where power access, not proximity to population centers, increasingly dictates site selection.

North American data center markets experienced seismic shifts in Q1, with inventory across the four dominant hubs—Northern Virginia, Chicago, Atlanta, and Phoenix—surging 43% year-over-year. Despite this unprecedented 43% inventory expansion across premier markets, vacancy rates remained extraordinarily compressed throughout Q1, underscoring the fundamental supply-demand imbalance gripping the sector. ERCOT's large load interconnection queue reveals the extraordinary velocity of industrial-scale power demand reshaping Texas's energy landscape. The queue expanded from 39,136 MW in October 2023 to a staggering 56,954 MW by September 2024 or a 45% surge in less than twelve months that underscores the unprecedented scramble for grid capacity. Co-located projects, primarily data centers paired with on-site generation, now represent 9,885 MW of pending connections, while standalone facilities account for the remaining 47,069 MW awaiting approval.

The U.S. Energy Information Administration's comprehensive tracking of electric power sector energy consumption reveals the dramatic evolution of America's generation mix over three decades. This comprehensive data underscores a fundamental truth shaping data center location decisions. Natural gas's contribution provides the reliable, dispatchable power that hyperscale facilities demand, explaining why West Texas's stranded gas resources represent such compelling economics for developers willing to bypass traditional grid constraints through behind-the-meter generation.

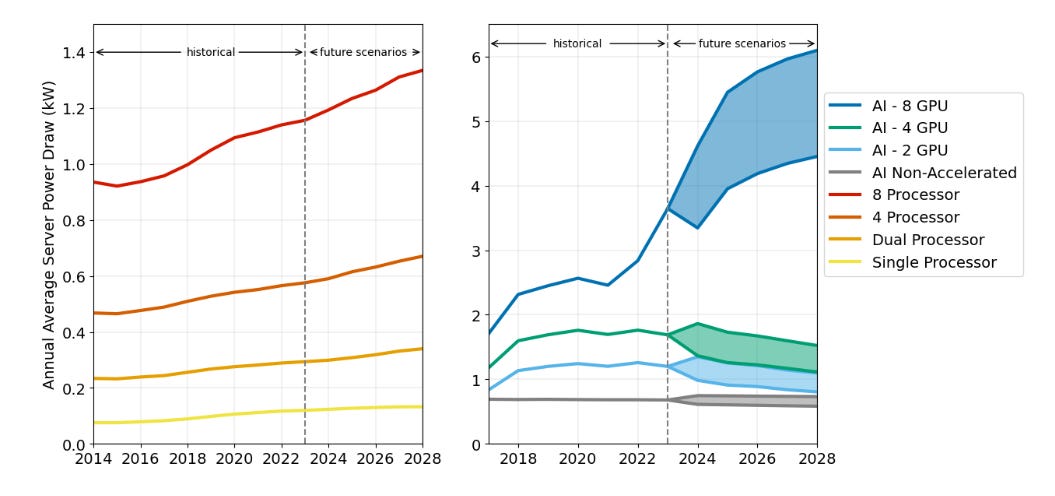

A gold rush into AI and compute has exploded since the second half of 2023. Some are hesitant and feel like they have seen this movie before, sometimes exuberance gets ahead of practicality of implementation and new technological advancements and efficiencies could potentially reduce the need for the projected large footprints being deployed. Essentially, data centers could already be hitting a maximum where they are overbuilt on hardware as software solves scalability restraints.

Cryptocurrency Miners Pioneered Flared Gas Utilization

West Texas data center ecosystem reflects its energy advantages, with cryptocurrency mining operations dominating the current landscape while traditional hyperscale cloud facilities remain entirely absent. This specialized development pattern shows both the region's unique strengths and infrastructure limitations. Cryptocurrency mining leads deployment with major facilities including US Bitcoin Corp's 42MW operation in Pecos County and Cormint's 75MW facility that consumes electricity equivalent to the entire county. These operations leverage West Texas's stranded natural gas resources through innovative flared gas utilization projects by companies like EZ Blockchain, Verde Mining, and Giga Energy Solutions, achieving 99% combustion rates compared to 75-90% for traditional flaring.

The region's cryptocurrency mining expertise has laid crucial groundwork for emerging AI infrastructure solutions, with companies like Crusoe extending their proven bitcoin mining methodologies into modular AI compute. Crusoe Spark™ modular data centers represent this natural evolution, applying the same rapid deployment principles and energy optimization strategies that made West Texas attractive to crypto miners. Like the bitcoin operations that pioneered flared gas utilization in the region, Crusoe's prefabricated units can be deployed in as little as three months to capitalize on stranded energy resources, whether natural gas, solar, or other renewable sources. With over 400 modular units already deployed globally in harsh conditions, Crusoe demonstrates how the operational resilience and energy-first approach developed through cryptocurrency mining translates directly to AI infrastructure, enabling the same type of opportunistic energy monetization that has driven West Texas digital asset economy while expanding into the rapidly growing edge AI market.

Electric Transmission

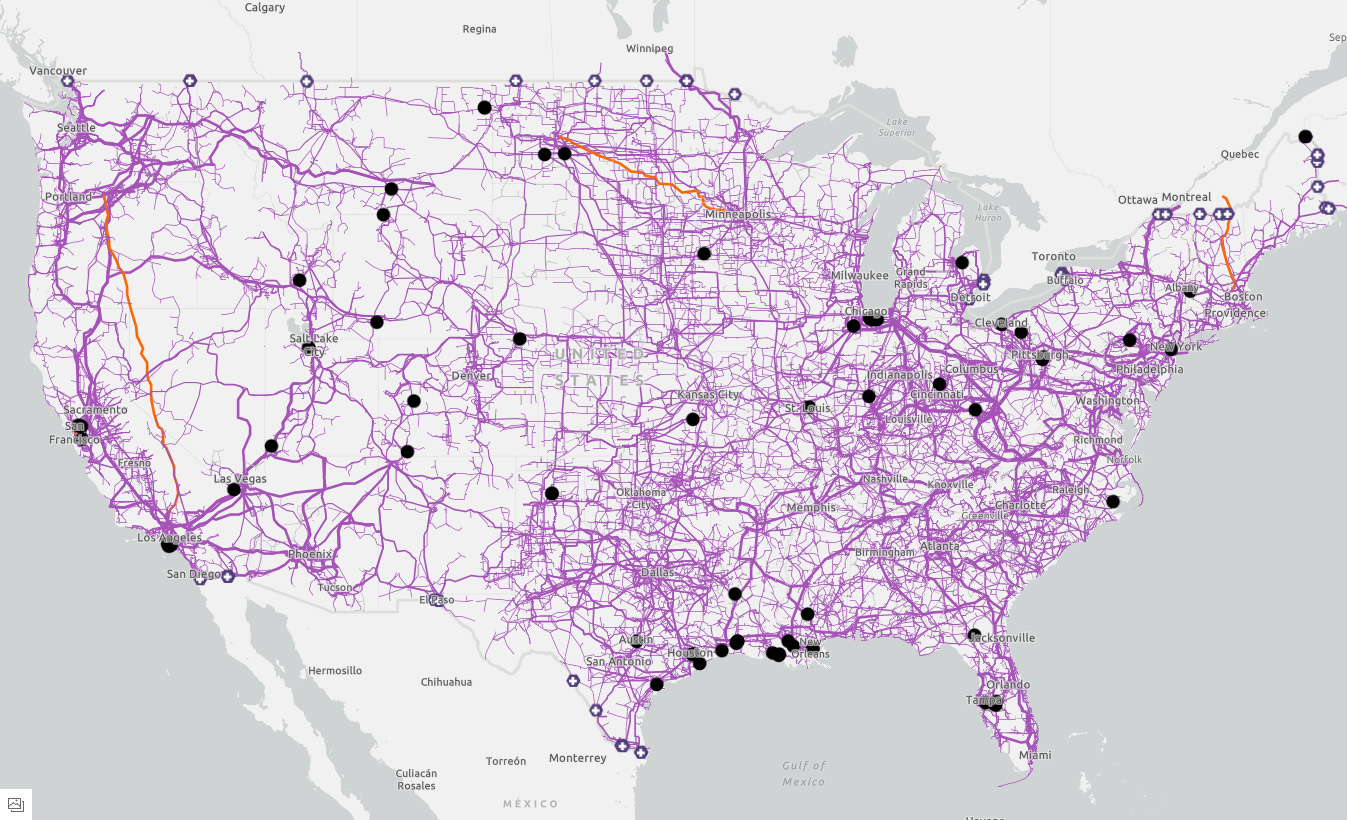

Electrical power transmission lines mapped out by the EIA, the U.S. electric transmission network consists of about 700,000 circuit miles.

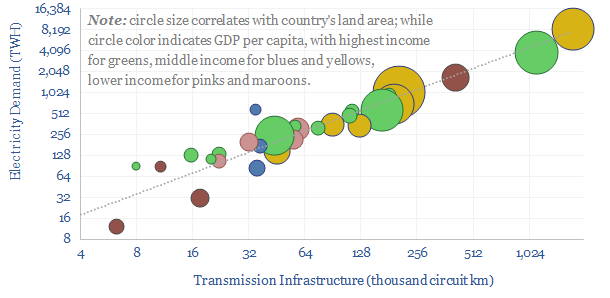

Power transmission infrastructure has emerged as a critical constraint in the global transition to renewable energy and electrification. For every terawatt-hour (TWh) of annual electricity demand worldwide, approximately 170.88 miles (275 km) of transmission lines and 2,485 miles (4,000 km) of distribution lines are required.

Every gigawatt (GW) of newly installed utility-scale energy capacity typically requires about 500 kilometers of new or upgraded transmission lines, along with 8,000 kilometers of distribution infrastructure.

The U.S. alone has approximately 1,300 gigawatts (GW) of generation capacity. Meaning that if 500km of new or upgraded lines are needed for every 1GW currently installed, that would be 650,000 kilometers of transmission lines. To put this into perspective of the sheer size, this is enough transmission lines to wrap around Earth's equator about 16 times. While not all current lines would need to be upgraded, it’s important to understand the sheer size of the current grid in the U.S. and how difficult it will be to extrapolate true demand as technologies change.

However, the Biden-Harris administration through the U.S. Department of Transportation recently announced nearly $200 Million to Replace Aging Gas Pipes and the Public Utility Commission of Texas (PUC) said in June 2024 that power developers in the state submitted 125 formal applications under the Texas Energy Fund (TEF) for the development of almost 56 gigawatts of new natural gas power generation in the coming years according to Forbes. This is off the backs of the Texas Legislature that appropriated $5 billion to fund the TEF for Fiscal Years 2025-2026.

According to Bloomberg’s New Energy Outlook (NEO) the energy transition scenario requires 46,000 terawatt-hours of power generation in 2050, nearly double today’s amount. The Net Zero Scenario, however, requires more than 80,000 terawatt-hours of generation, more than triple today’s amount.

A large portion of this demand will come in unrealized potential of Artificial Intelligence (AI) and the Large Language models (LLM) being fed. These monsters are extremely hungry for new energy not currently available on the grid to meet the demand needs.

West Texas Opportunity

Hyperscale cloud providers remain absent from Ector, Midland Winkler, Ward, Reeves, and Crane counties, with AWS, Microsoft Azure, Google Cloud, and Meta maintaining no facilities in the region. The closest major presence exists in Dallas (650+ MW capacity by end of 2025 across 150+ data centers) and San Antonio, where Microsoft operates its Azure South Central US region. This absence stems from hyperscalers' requirements for proximity to major population centers, dense fiber networks, and established Internet Exchange Points—infrastructure West Texas currently lacks. However, AI and High-Performance Computing(HPC) facilities show emerging potential with Texas Critical Data Centers'(New Era Helium and Sharon AI) planned 250MW net-zero facility in Ector County representing the region's first major non-cryptocurrency data center.

Project Details 50/50 Joint Venture

Location - 235 acres in Ector County, Texas (Odessa/Penwell TX area)

Capacity - 250MW net-zero AI/HPC data center

Power Generation - Under the terms of the Memorandum of Understanding(MOU), signed on April 23 2025, PowerForward Energy Solutions(PFES) has agreed to manufacture, install, and operate 250MW of generation assets at the Texas Critical Data Center(TCDC) site, with the first 100MW targeted for delivery within 12 months of funding and full deployment expected within 18 months.

New Era Helium Inc(NEHC) is a next-gen exploration and production platform unlocking the full value of its Permian Basin assets. The Company controls over 137,000 acres in Southeast New Mexico, with more than 1.5 Bcf of proved and probable helium reserves sourced alongside natural gas production. Positioned to capture rising demand in high-tech growth markets like semiconductors and aerospace from America's energy-rich corridor, while generating three revenue streams—helium, natural gas, and natural gas liquids—supported by multi-million dollar long-term offtake agreements. New Era Helium revenue diversification extends beyond traditional commodity sales through Methane Performance Certificates from responsibly sourced gas and ‘behind the meter’ power generation for energy transition opportunities, creating operational synergies and strategic advantages across our integrated platform.

‘Our vision is to power the next era of AI infrastructure from the heart of America’s energy backyard, the Permian Basin. Interest in Texas Critical Data Center validates the value of our location and our strategy. We’re committed to building out a scalable, resilient platform to meet the rising energy demands of AI. - Will Gray II, CEO of New Era Helium, Inc.

Sharon AI brings proven AI infrastructure expertise to the partnership through its hybrid operational approach, deploying both within Tier IV co-location facilities and purpose-built data centers. The company's GPU-as-a-Service platform encompasses current-generation processors including NVIDIA L40S, H100, and AMD MI300X, with plans to expand to NVIDIA H200 systems in 2025—providing the computational muscle necessary to transform West Texas's stranded gas resources into high-value AI compute capacity.

‘With the launch of the Sharon AI Cloud we are now offering both NVIDIA GPU hardware and cloud infrastructure together with software and tools that enable developers, researchers and corporates to build and train with efficiency and speed. We are excited to offer this differentiated service to our AI/HPC customers.’ - Wolf Schubert, CEO of Sharon AI Inc.

This location has access to Interstate 20 plus needed pipeline infrastructure through a 26” Kinder Morgan CO2 pipeline, 20” ONEOK Westex natural gas pipeline, and a 24” and 30” Enterprise Products natural gas pipeline. This joint venture between New Era Helium and Sharon AI will utilize natural gas with carbon capture technology, targeting operational status by December 2026.

‘There are currently more than $8B in total investments for data centers[TCDC] being considered in Ector County alone.’ - Ector County Judge Dustin Fawcett

Ector County sits far from most major data center locations in Texas and its difficult for many to understand just how big Texas is. With major populated areas of Midland and Odessa being in the heart of the Permian Basin, they sit on an island of their own with drives to Dallas or San Antonio taking more than five hours and a distance of more than three hundred thirty miles. This adds pressure to the local workforce requirements that will be covered in the next part of this series.

Natural Gas Infrastructure

Geographic concentration patterns reveal highest density in Reeves and Ector counties, driven by proximity to renewable energy transmission lines and natural gas resources. Current saturation remains low to moderate, with significant expansion capacity available given the region's 25 Bcfd stranded gas potential by 2025. This ‘stranded’ designation reflects severe pipeline constraints that created negative pricing at the Waha Hub for 46% of trading days in 2024, with prices dropping as low as negative $6.41 per million BTU. Associated gas from oil drilling has nearly tripled since 2018, overwhelming existing infrastructure despite recent additions like the 2.5 Bcfd Matterhorn Express Pipeline.

The broader regional context extends beyond the immediate Permian Basin boundaries, with major AI infrastructure developments positioned strategically within Texas's energy corridor. The $500 billion Stargate project's placement in Abilene, approximately 150 miles northeast of Midland County, demonstrates how hyperscale AI facilities are leveraging Texas's comprehensive energy infrastructure network while maintaining proximity to the Permian's abundant resources. The Abilene location serves as a strategic bridge between the Permian Basin's energy abundance and Texas's broader electrical grid infrastructure, enabling massive AI compute deployments that can scale from the modular edge solutions addressing local stranded gas resources to the hyperscale facilities requiring gigawatt-level power capacity and grid-scale transmission access.

Conclusion

High quality data centers demand a complex set of resources in order to scale to today’s demanding needs for AI and Large Language Models(LLMs). West Texas must overcome significant gaps to attract diverse data center operators beyond cryptocurrency miners. This multi part series plans to cover many of these needs starting with part 2 that looks into workforce development programs that must transition oil and gas skills to data center operations and how counties are attracting these large footprints to the Permian Basin through property tax abatements. Strategic investments in telecommunications and supporting infrastructure could unlock West Texas's potential as enterprises seek alternatives to increasingly constrained primary markets. Part three will explore fiber network infrastructure needs and what major upgrades are required match redundancy levels in established markets along with essential services such as fire suppression and response times. In the fourth and final part of this series water management and purification of brackish and produced water in the Permian Basin is considered for the large cooling needs that data centers carry, resource that is lacking on the surface but abundant from fracing throughout the Delaware Basin. The convergence of massive energy resources, available land, and planned pipeline capacity creates a unique window for establishing West Texas as America's next major data center frontier.

Thank you for this wonderful and timely post. I look forward to the next one on tax abatements, since I worked on a bill to remove them. Passed the senate but never got a look in at the house.

Also about to be run over here with transmission lines - the Permian Basin Reliability Plan... with the premise that the Permian needs more power... at least that's the story they are giving - somewhat of a joke I think since they have all the natural assets they need.

Do you think that they will move more in the direction of microgrids rather than these massive projects? Or do they need both? I believe this project was driven years ago by wind and solar - much like the CREZ line.

Thanks for all your work on this.