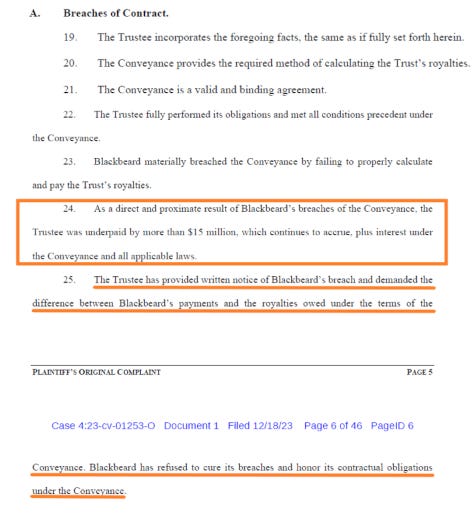

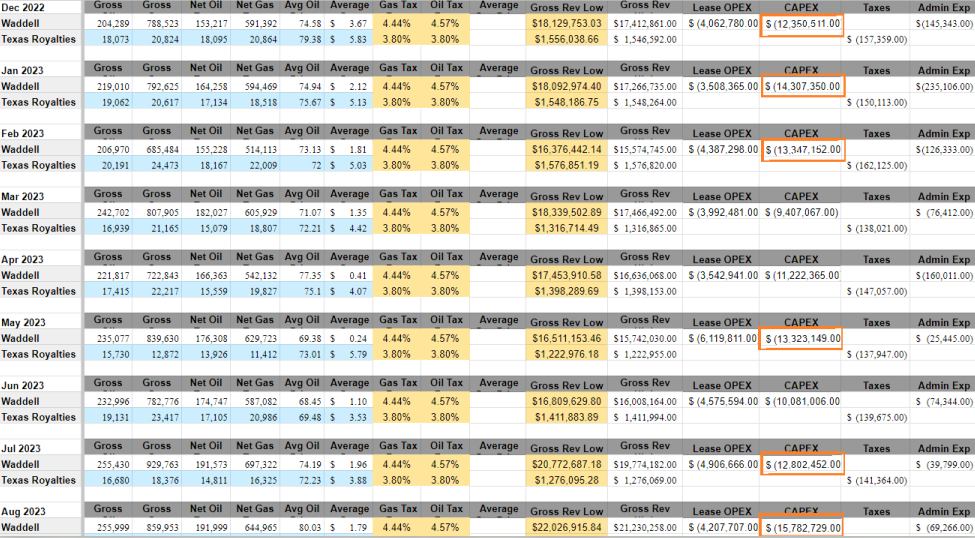

The 2024 budget for the Permian Basin Royalty Trust(PBT) was released last month on February 29th in the annual report for the trust after a small delay. Historically the budget was part of the first cash distribution report in January but was pushed back according to the trustee based on lack of communication from the operator spurred by a recent process audit that found possible overcharges to the trust in capital expenditures(CAPEX) and lease operating expenses(LOE). A lawsuit against the trustee with these claims was filed on December 27, 2023 outlining a few key points of capital misallocation by the operator.

‘Blackbeard has refused to cure its breaches and honor its contractual obligations under the conveyance’ supports the claim by the trustee that the operator of the leases went fully dark on a resolution and put forward an effort to obfuscate how they were processing charges to the trust. However, Argent isn’t without fault in relaying the budget to investors where the language was misleading in the initial announcement where the trustee stated that the 2023 budget was $135M(Gross) and the 2024 budget would be ‘approximately $301M Gross’.

The initial reaction by The Street and many retail investors was shock and a run for the exits as the equity traded down as much as ~21% and causing a loss of roughly $140M in market cap valuation in a very short period.

Energy Crisis contacted the Trustee for clarification because due to the information available where it seemed like the budget was nearly triple the previous year based on the presentation of the language of the upcoming and previous year in the annual report. However on March 19, a few weeks after the annual report was released, the cash distribution press releases had a clarification to the budget on Net versus Gross. The obligation of the trust for the 2024 budget is $106.11M instead of $301M a decrease of ~21% from the pervious years $121.92M, coincidentally the same amount the stock sold off in a single day off the trustee’s error. It’s also important to note that the 2023 budget was originally $135M and later revised down twice to $122M and finally $96.8M but ultimately the total spent ended at the original $135M.

It was communicated to Energy Crisis by the trustee that the budget of $301M had to be included or risk a SEC comment on the proved undeveloped reserves in accordance with the 5 year rule (SEC Ch 210.4-10 Sec 31 .) Trustee also stated that they reached out to Blackbeard multiple times prior to filing and that their auditor advised them to use this number last provided.

(ii) Undrilled locations can be classified as having undeveloped reserves only

if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.

The lawsuit also makes the allegation that Blackbeard was ‘charging the Trust for services performed and equipment installed on property unrelated to the Conveyance.’ The budget ramped up pretty heavily in late 2022 where some months exceeded what was expected. Tracking satellite images for leases nearby that are not part of the conveyance but are operated by Blackbeard shows some heavy development of wells around the same time this spending increased for the trust.

Technical analysis or trading on the pretty lines of the chart is mostly useless but looking back at the chart and knowing the timeline needed for the trustee to work with the operator and when the breakdown in communication would of happened that resulted in a lawsuit would lead most that have experience in these situations to believe that it was at least a few months prior to the lawsuit being filed in December. One thing for certain that has been confirmed by us at Energy Crisis is a process audit had been ongoing for most of 2023 looking into the charges to the trust and would of been near completion before the forth quarter of 2023. PBT is a fairly thinly traded stock historically but volume came in a bit heavy in late October causing a lot of downward pressure, a -42% drawdown in 2 months on no change in news. As the saying goes ‘someone always knows’ but on an equity that is somewhat obscure is more perplexing but it definitely seemed that a large holder wanted out when there were no pauses in the selling pressure to allow for price discovery.

Another change that was made recently by the trustee was how the reporting of natural gas volumes will include plant products moving forward. Finally this makes natural gas volumes line up well with the Texas Comptroller reports by the operator for December 2022 which hasn’t been the case since early 2020 when ConocoPhillips was the operator. However it is a bit frustrating to see the notes on these products with the boilerplate use of '** This pricing includes sales of gas liquid products.' On the Waddell Ranch which has always been included with the amendment of '~ Gas volumes have been corrected to include plant product mcf volume' makes the previous statement that the NGPL were not actually being accounted for prior.

Total value of gas sold has skewed drastically based on marketing Costs in March through June and October through November where some months net out to $0.11. Blackbeard has poor reporting controls across Texas Comptroller & Texas Railroad Commission(RRC) with huge revisions. For example in October 2023 gas volume was reported to the Texas Comptroller at 2,305,951 McF and revised down by half later.

Blackbeard operates their own midstream in the Permian and their largest asset is PBT under operations. This complicates things but was also outlined in the lawsuit as ‘improperly applying certain costs for employee benefits, operator-generated costs, and gathering fees and oil transportation fees’.

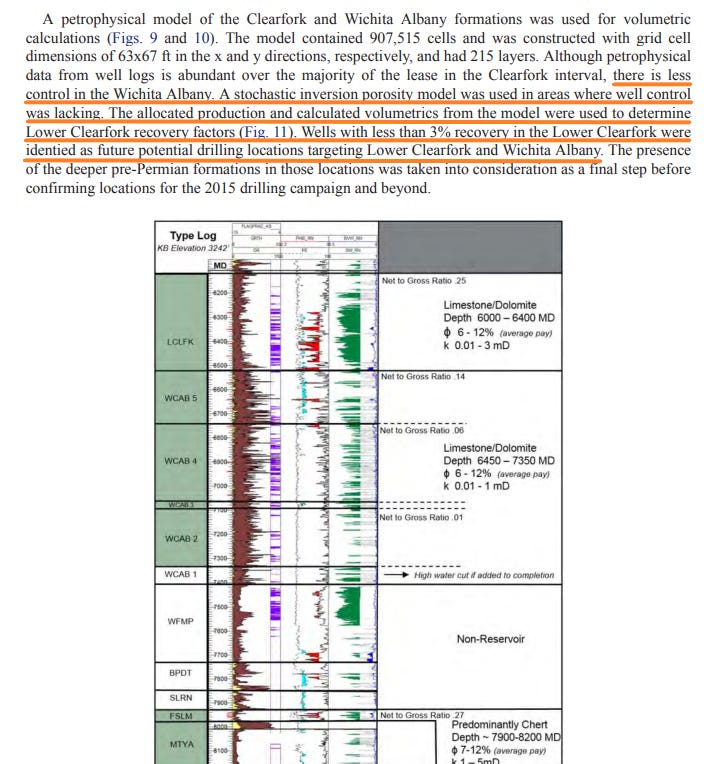

Now its time to explore the positive piece of the 2024 budget after no growth in production in 2023. Blackbeard has changed their approach in their 2024 drilling program to heavy horizontal drilling where current permits show 17 Horizontal wells targeting the WICHITA-ALBANY fields and 25 MCKNIGHT.

Blackbeard had some success in overall production with some laterals(5000') North of Monahans on the Seally Smith leases they operate. Here are the completion tests for the horizontals where some data on for Waddell is available:

In January 2023 the RRC approved a field rule change for the WICHITA-ALBANY field for Blackbeard shown here including 'Cancellation of accumulated Field overproduction'.

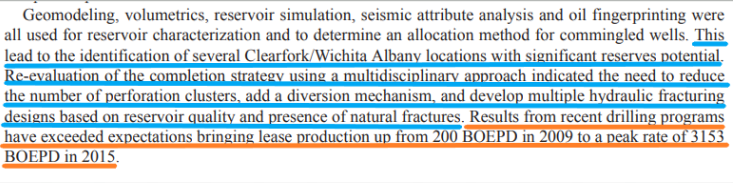

Blackbeard supports their claim to the field change rules including a change to the completion strategy that results in a 'significant reserve potential'. Currently the WITCHITA-ALBANY field has a daily allowable of 300 barrels per day where the potential is raised from 200 BOE/day to 3,153 BOE/day.

Supporting documents explain the completion strategy in more detail and the evolution of targeting the WICHITA-ALBANY field where initial production increased 86% year over year.

Blackbeard references a well log for API 103-36364 which is available for download through RRC. The document explains their findings on changes in strategy.

The 2015 completion strategy ultimately resulted in a previous high-risk WICHITA-ALBANY into a 100% successful placement in the 2015 Embar-B drilling program with a +14,00% increase in production per lease.

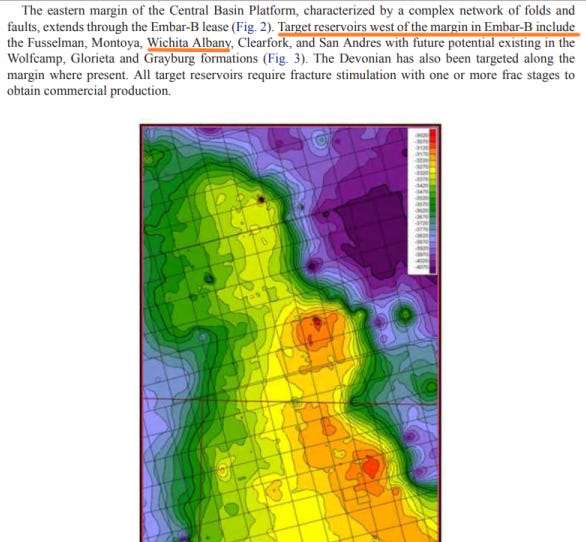

Regardless of the issues in CAPEX allocation by the operator in relation to overcharging the trust the change in strategy to unconventional wells on the Waddell Ranch seem like a quality approach to increase production. ConocoPhillips in their sales deck to investors while divesting from the trust showed a large potential in barrels of oil equivalent(BOE) per day off of horizontal exploration.

A large number of horizontals where permitted through RRC in November 2023 after the stock had already began selling off with volume. Initially there were some assumptions that the change in development may have spoked some investors who follow the permitting closely but the timelines don’t line up well with the filings and it wasn’t overly clear what Blackbeard had planned at this stage in mid November when they permitted 17 horizontal wells.

Conclusion

Though the lawsuit puts an overhang on the trust and Blackbeard has lived up to their chosen name if all allegations prove out to be true, the new development plan based on the proposed field changes and production potential increase for the WICHITA-ALBANY fields from 200 BOE/day to 3,153 BOE/day or a +14,000% on mature fields adds a lot of potential for this rock to prove out to be a long term quality return on the capital deployed by the operator. The trustee should be able to outline the CAPEX and LOE charged to the trust along with any potential discrepancies in marketing costs of gas and production reporting issues for oil by utilizing data though discovery not available publicly such as non operating mineral interest owners join interests billing(JIB). Though it’s hard to judge the full scope of this problem alleged in the lawsuit, it seems evident that the $15M claimed is a baseline when an operator goes dark for such a small amount that is easily proven out.

Thanks for the information.

They have some big investors behind them and you know they did not want to deliver such news to them. It would very damming or they may have already been on board. Who knows either way they think they can beat it or at least come out on top. They hold a lot of cards that are not on the table. Explaining the capital spent and the production obtained I would not want to do so.