More Power

Like a fat kid loves cake, the average consumer loves their energy and will seek it out at any cost

News of shortages in energy seems to creep into the headlines daily in this new era. From fuel supplies in Sri Lanka to the power grid in Texas on the brink of failure, the only thing in full abundance these days seems to be the fear of how reliable our supply chains and infrastructure are and if they can meet the demands of modern society. This past week the US Energy Secretary stated in a video:

“Right now, we are witnessing the beginning of one of the most significant events in human history: the clean energy transition. It is long overdue, and it can’t progress fast enough,”

Regardless of your views on the needs of a transition to clean energy and what that really means, the part of the statement that struck me the most was the tacked on at the end, ‘and it can’t progress fast enough’. I’ve been following the space of energy for a very long time and as a resident of Texas my entire life, I have seen the oil and gas industry, wind initiative, and now a huge push for solar to add more capacity to the grid. In the words of the late great James “Scotty” Dooham, “I’m giving her all she’s got captain.” is now the battle cry of ERCOT as the group tries desperately to keep up with Texas energy demand.

Texas Wind

Wind makes up a significant amount of installed capacity in Texas coming in only second to natural gas at 20.79% of the grids mix just slightly above coal power. With an overall capacity of 36GwH wind has been a true savior to the power hungry state but, recently capacity and supply haven’t matched up well, where total output was only 1GwH(2% of installed capacity) on July 14th and the only thing that saved the grid from rolling blackouts were storms pushing in to cool off the state and demand.

What we have come to learn in Texas from recent months’ heatwaves and the freeze in February 2021 is that the wind doesn’t seem to blow in extreme heat or cold. A larger adoption of electric vehicles over the past several years has given some much needed insight into real world case of battery capacity and degradation in these same weather conditions. An important part of the equation to consider since batteries are leaned on heavily for non baseload power to store energy of the renewable power sources. As technology breakthroughs continue in the space of batteries there is still potential for the scales to tip in favor of renewables becoming a reliable source, but at what cost?

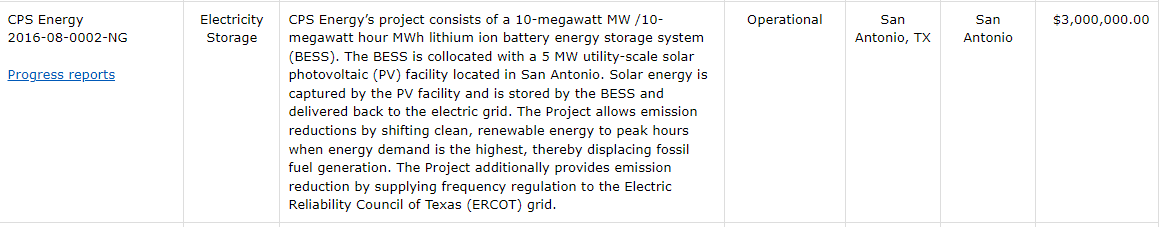

The 100-megawatt battery near Jamestown installed in Australia cost $90 million that was installed in a joint effort by Tesla, a supposed leader in battery technologies. New projects coming to Texas show similar cost to market such as the CPS Energy storage facility near San Antonio that received a $3M grant.

ERCOT data for the past month can be seen below on an hourly variable rate of change of power generation during different times of the day. It seems apparent that wind generation cannot be considered a reliable baseload power without a significant amount of battery storage added to the grid.

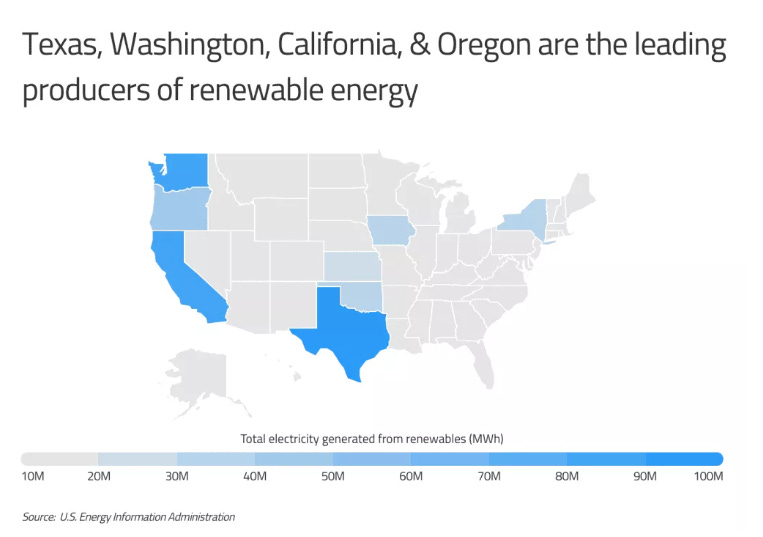

Texas is currently leading the U.S. in renewable power generation but is also the largest producer of energy in the States. This is a new crown for Texas as the state pushes heavily with grants to entice developers to grow their renewable energy presence.

U.S. Power Sources

Estimated U.S energy consumption for 2021 came in at a total of 97.3 Quads but the more interesting metric is two thirds of power generated is lost energy rejected through thermodynamic heat loss in transmission lines and sub generation stations. Currently, the Secretary of Transportation has been quoted many times on his pro-view of electric vehicles but one thing that is never truly answered is what additional capacity the grid needs in order to offset petroleum products for transportation that currently sits at 26.9 Quads of power generation before efficiency loss. With solar and wind making up only 4.83 Quads of energy input, roughly 50 times of renewables will need to be added to the grid to power the electric vehicle revolution and offset the fossil fuel density of power currently being used.

A true cost analysis on the implantation of renewables is still needed according to recent analysis done by Goldman Sachs. Seen below they touch on the three key points of intermittency, hidden costs, and geopolitics which also plague other energy sectors such as oil and gas. One thing I know about the oil and gas sector is that the US Shale sector has spent a lot of time and capital chasing growth off of high decline wells that need to be replaced with new wells constantly. Just like these wells, wind turbines, and solar panels have a lifespan and will need replaced.

A constant theme that I tend to rotate back to in my writings is that the world is a very energy hungry place and as more countries emerge their citizens into a competitive market of comfortable and sustainable living the need for more inputs is evident. Never in the history of the world have we as a species been able to fully reduce our reliance on an energy source by replacing it with another, instead these new energy sources add to our overall capacity to feed this insatiable appetite. Even the dirtiest of inputs such as biofuels is still heavily relied upon by emerging markets to heat homes and a fuel source for cooking.

Final Thoughts

This leaves a lot of open ended questions such as the true cost to keep up with rising demand based on population growth, required battery footprint for reliable baseload renewables, and the willingness of the consumer to continue to pay higher energy prices. For this writer, these questions are not easily answered for the simple fact that technologies tend to evolve rapidly in crisis but the short term concern for many leaders should be the attitudes and willingness to sacrifice burdened onto the poorest of our society. As we have seen in Sri Lanka, Ecuador, Libya, and China just to name a few; the masses are unhappy and willing to revolt once their food and energy are jeopardized.

Great essay thank you for these insightful comments. It is interesting that despite the brief "defaltionary hammer" of FED rate raising and some commodities really declining, black gold only dipped below 100 for a couple of days and bounced back quickly. Again we must focus on the fundamentals as you (Broncho) have astutely noted; for years the chronic underinvestment means that supplies cannot "magically appear". Presuming the voracious appetite from India and China continues (let alone a hopefully resurgent US) demand is only getting stronger. If oil can maintain the 100 plus range (yes it could dip if the FED jacks up rates more than expected but it should not last) Texas Tea will be in the "sweet spot" for at least another year (I am conservative here). I just dont see a better more stable oil play than PBT. Please God let it continue to rise maybe I can make up for my disastrous losses on LL&E.