Budget!? Oil is Sub $70, Screw Your Budget!

‘A lie can travel halfway around the world while the truth is still putting on its shoes’ - Mark Twain

A Reuters article came out this morning stating that Saudi Arabia is to abandon $100 crude target to take back market share with 40 days left before the U.S. Presidential elections. The end of August 2022 was the last time Brent Crude was above $100, two years ago, and since it has struggled to maintain anything close to the fictional $100 price target that never seemed based in reality outside of energy expert pundits talking points.

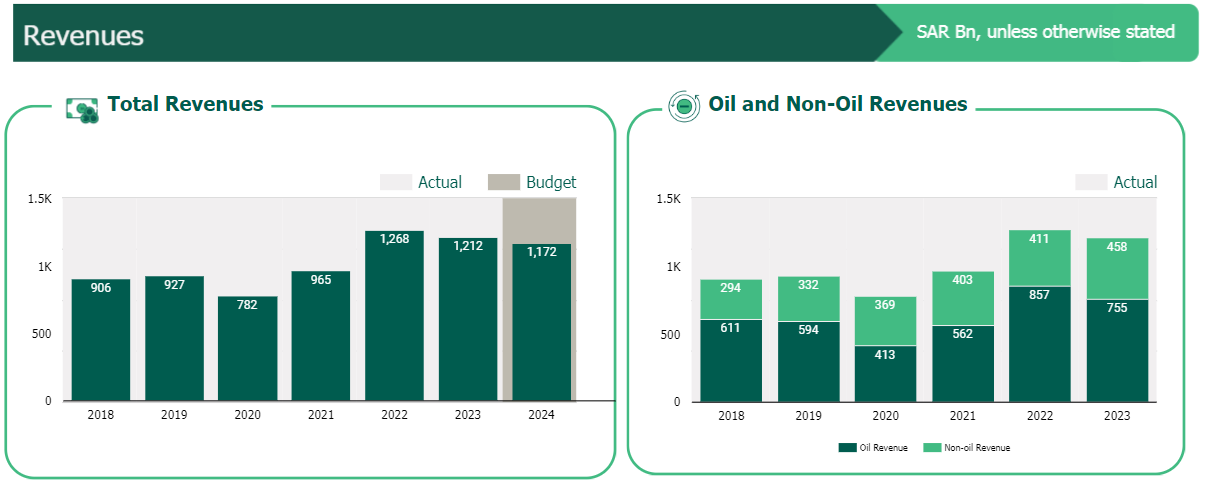

Saudi Arabia's budget for the fiscal year 2024 is roughly 1,251 billion SAR(315 billion USD) with an expected revenue generation of 1,172 billion SAR(337 billion USD) or a $22 billion USD short fall. The budget is heavily driven by Saudi Vision 2030, self described as a strategic framework and comprehensive plan launched by the Kingdom of Saudi Arabia in 2016 on the heals of the last price war of 2014 where the kingdom flooded the market with oil in order to prevent the growth of U.S. Shale producers. In September of 2014 Saudi Arabia saw an opportunity to crush US Shale producers that were over-leveraged and chasing growth and did just that by boosting production to 9.6M barrels per day and discounting all major Asia consumers by 30%. Exactly a decade later to the month, the same narrative is being pushed and prices are feeling the pressure from the headlines.

But Saudi Arabia isn’t done increasing their budget and the next 2 years are projected to grow by 3.91% in 2025 and 5.23% in 2026 year-on-year adding another $31.5 billion USD to the current budget.

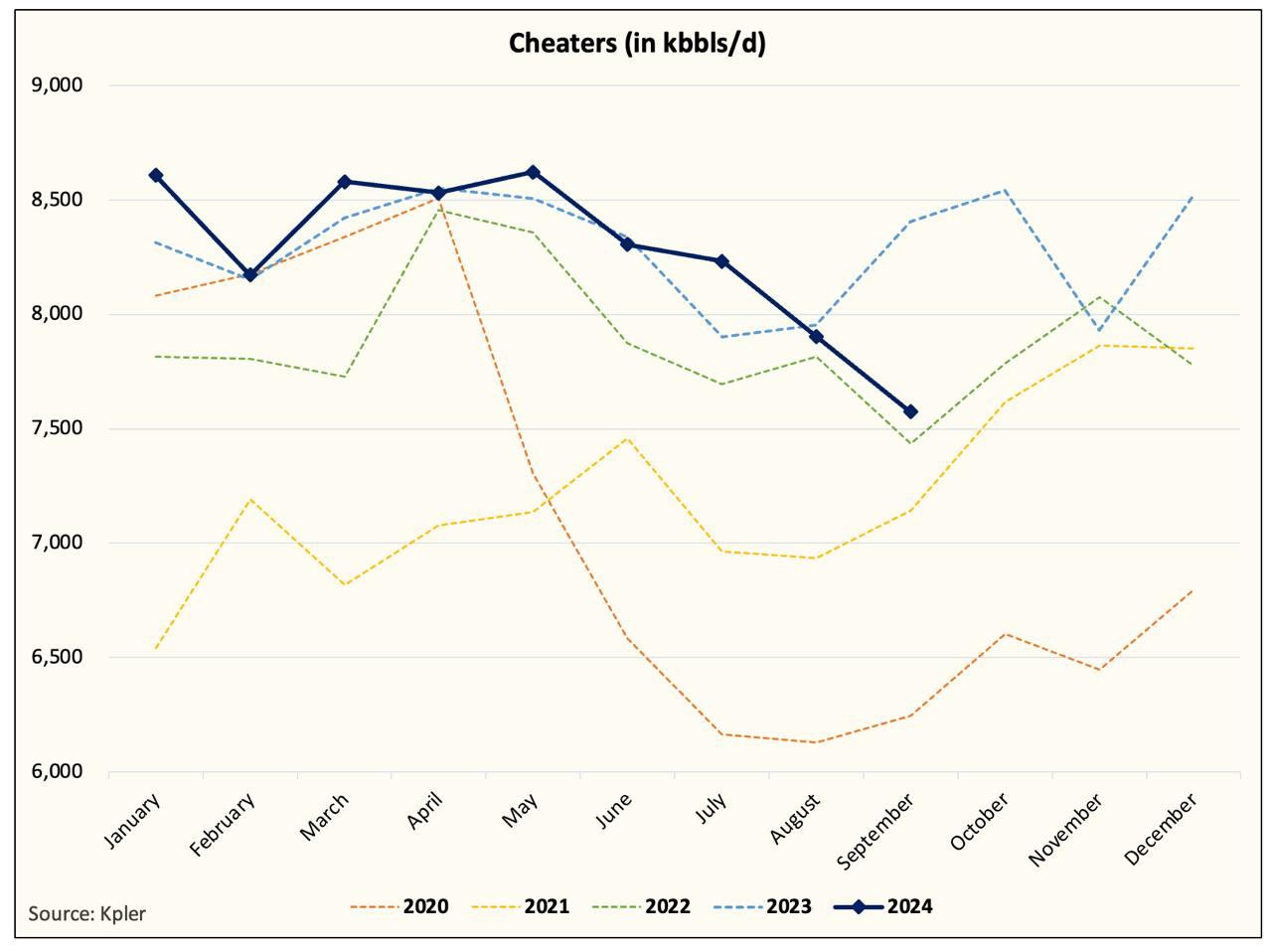

The goal of overproducing in the past was not just a warning shot for U.S. producers but for the whole of OPEC at the time where many past quota cheats were shown what spare capacity the kingdom was capable of deploying.

“Using tactics to over-produce and hide non-compliance have been tried many times in the past, and always end in failure,” Prince Abdulaziz said at the opening session of the OPEC+ committee that monitors the output cuts. “They achieve nothing and bring harm to our reputation and credibility.”

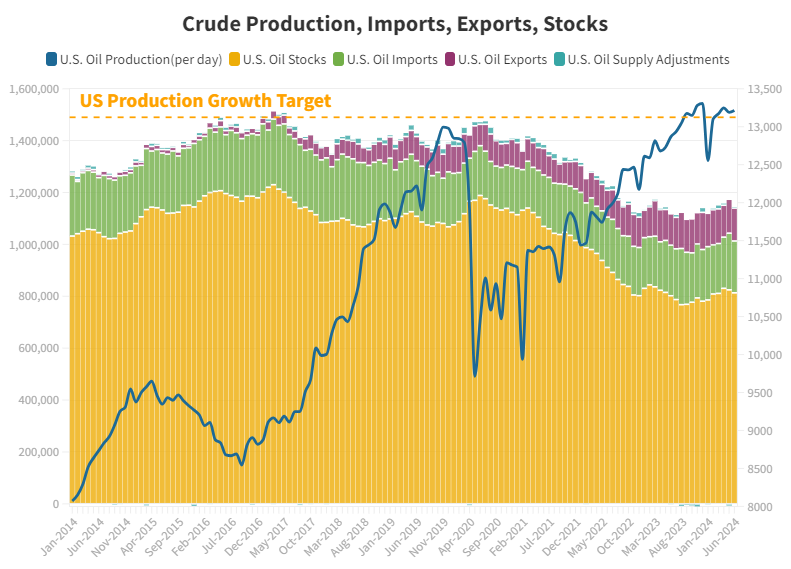

This comes at a time when a large swath of U.S. oil producers are operating in an extremely tight environment of sub $75 WTI oil prices. Inflation adjustments for the patch aren’t a simple thing to measure but by all metrics day rates, casing, surface equipment… everything is priced substantially higher than a decade ago. More importantly, the growth of U.S. shale in the post COVID world of oil production has started to show serious signs of weakening.

Year-on-year production growth for U.S Shale has flattened significantly at 13.3M barrels per day in December 2023 and a slight decrease in production in the past six months of 0.7%.

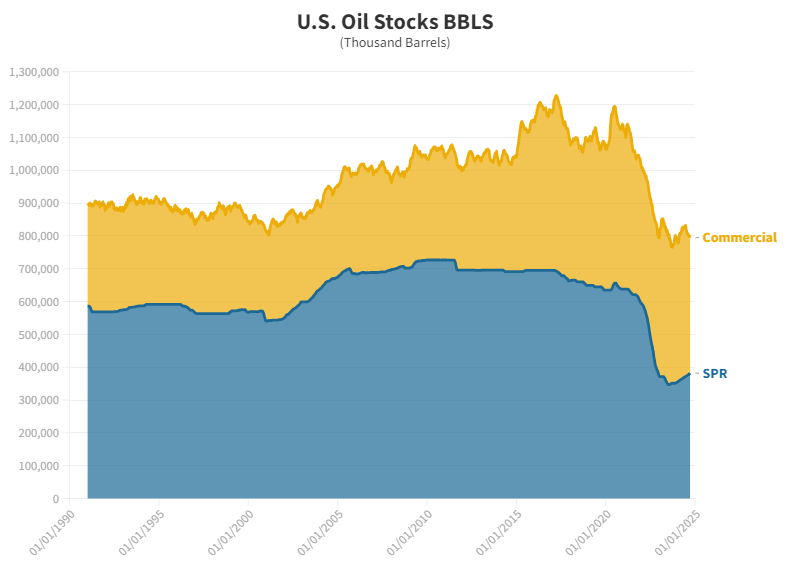

While U.S. oil stocks remain historically low and exports have continued to climb the world is still operating on demand, growth for oil and natural gas at a pace that supply is meting but possibly not for long. OPEC said in its annual long-term outlook that global oil consumption is set to increase between now and 2050 by roughly 18% to reach 120.1 million barrels a day by the middle of the century which fixes the issues of Saudi Arabia and many other OPEC+ members budgets.

Sources of growth will rely heavily on India adding a significant amount of demand.

Though down from its peak in 2004 of 450.83M, India has a long way to go before it can meet the needs of its poorest population. India is in a similar situation to China in the 1990’s where a move from farm to city by the population is creating opportunity for people to bring themselves out of the extreme poverty threshold and prosper through working in the cities and having access to healthcare, utilities, and jobs. Instead of exerting all ones energy on the farm of work-to-eat the government is attempting to provide access for people to work-to-live and one of the key points to this effort is energy security.

China and India currently purchase two thirds of the crude seaborn from Russia and at a heavy discount thanks to the price caps implemented by Western countries for Russian oil in response to the conflict with Ukraine. "Unless we survive the present, we will not be able to go into the world of clean and green energy," Oil Minister Hardeep Singh Puri said at India Energy Week. "While affordable traditional energy resources are essential for meeting the base load requirements, new sources of energy which are cleaner, sustainable, and innovative, are critical for combating the menace of climate change." If India plans to mimic the move China made for its people to add industry jobs for manufacturing where China and India now have almost identical population size, it will need a lot of crude, coal, and LNG.

In recent weeks every headline that is neutral or negative has taken a serious toll on the price of oil leading into election season but a more important season is upon U.S. Shale with next year’s drilling programs being planned in what is currently a sub $70 WTI oil market and a lot of producers struggle to justify capital expenditure growth due to break evens from rising costs of doing business. Initial planning usually begins 4-6 months before the fiscal year starts and while the exact timing can vary based on company size and structure, we are already seeing global layoffs in some major oil and gas providers where Shell recently announced plans for 20% cut in their workforce and many smaller producers are slashing budgets. Sensational headlines with ghost sources are the markets favorite when deciding to overreact because they carry little to no repercussions for the source that probably never existed in the first place. This doesn’t change the fact that U.S. Shale needs to take a hard look inwards on their past years promises of capital discipline in the face of moderate oil prices.

Return of capital and return on capital are two important financial concepts that investors and business owners should understand, unfortunately many U.S shale companies usually don't. The key difference is that return of capital is simply getting your original investment back, while return on capital is the profit you make on top of your original investment. While oil prices remain artificially low and capital has continued to be deployed by exploration companies, those with high decline rates and a lack of sustainable drilling could see their growth decline and free cash flow get hammered. For producers that added marginal barrels and have low declines should consider cutting their 2025 capital expenditures by a minimum of 15% and allow production to decline 3-5%. This allows for inventory to be reserved and a return on investment for past drilling to come to full fruition.

‘Russia does not want to flood the market with oil if there is no need’ - Deputy Energy Minister Pavel Sorokin(September 2024)

‘All OPEC+ deal participants in full compliance with the deal’ - Russia’s Novak(September 2024)

‘We are waiting for interest rates to come down and a better trajectory when it comes to economic growth ... not pockets of growth here and there,’ - Saudi Energy Minister Prince Abdulaziz bin Salman(June 2024)

“Those who are also taking a very pessimistic view on demand.” He flagged that the OPEC+ group is approaching supply-demand considerations with prudence and precaution, saying of the prospect of impending market tightness, “I will believe it when I see it.” - Saudi Energy Minister Prince Abdulaziz bin Salman(June 2024)

OPEC+ continues to walk the walk with makeup cuts such as Iraq announcement in July where they acknowledged it produced 184,000 b/d over its OPEC+ quota the previous month, based on secondary sources estimates, and pledged to compensate for its excess output by a September 2025 deadline under the latest OPEC+ agreement by making additional cuts of equivalent volume. The sources above can be verified and tell a different story than the price action of crude futures in recent weeks but a strong narrative tends to over-saturate temporary thinking versus the actual data driven fundamentals of the market.

Much like the quote that began this article, ‘A lie can travel halfway around the world while the truth is still putting on its shoes’, that is often attributed to Mark Twain; the source is a ghost because that particular quote was never written by Twain and has been recycled in many variations and incorrectly attributed to others such as Winston Churchill and Oscar Wilde. Markets/algos will believe what they want until proven otherwise and that proof will have to come in the form of continued market tightness and a willingness of U.S. Shale producers to return to capital discipline.